Form 8915 D Qualified Disaster Retirement Plan Distributions and Repayments 2020

What is the Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

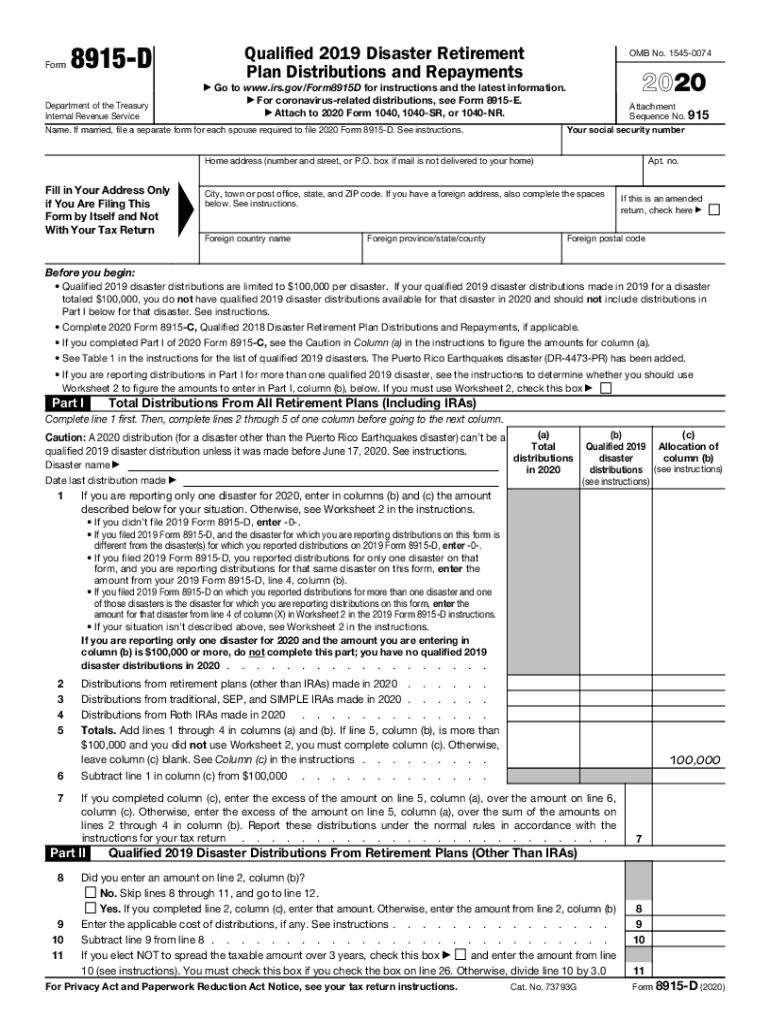

The Form 8915 D is a tax form used by individuals to report qualified disaster retirement plan distributions and repayments. This form is particularly relevant for taxpayers who have taken distributions from their retirement plans due to federally declared disasters. The IRS allows these individuals to spread the tax liability of such distributions over three years, providing financial relief during challenging times. The form captures essential information regarding the amount distributed, the reason for the distribution, and any repayments made to the retirement plan.

How to use the Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

Using the Form 8915 D involves several steps to ensure accurate reporting of disaster-related distributions. Taxpayers must first complete the form by providing personal information, including their name, Social Security number, and the year of the distribution. Next, they must report the total amount of qualified distributions received and any repayments made to the retirement account. It is crucial to follow the IRS instructions carefully to ensure compliance and to avoid potential penalties. After completing the form, taxpayers should attach it to their federal income tax return for the applicable tax year.

Steps to complete the Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

Completing the Form 8915 D requires a systematic approach. Here are the steps to follow:

- Gather necessary documents, including your retirement account statements and any relevant disaster declarations.

- Fill in your personal information, such as your name and Social Security number.

- Report the total amount of distributions taken from your retirement plan due to a qualified disaster.

- Indicate any repayments made to the retirement account within the specified timeframe.

- Double-check all entries for accuracy before submitting the form.

Legal use of the Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

The legal use of the Form 8915 D is governed by IRS regulations concerning disaster-related distributions. To qualify, the distribution must be made due to a federally declared disaster, and the taxpayer must adhere to the specific guidelines set forth by the IRS. Proper completion of the form ensures that taxpayers can take advantage of the tax benefits associated with these distributions, including the ability to repay the amount over three years without incurring penalties. Compliance with these legal requirements is essential to avoid any issues during tax filing.

Eligibility Criteria

To be eligible to use the Form 8915 D, taxpayers must meet specific criteria set by the IRS. These criteria include:

- The individual must have taken a distribution from a qualified retirement plan due to a federally declared disaster.

- The distribution must meet the definition of a qualified disaster distribution as outlined by the IRS.

- The taxpayer must intend to repay the distribution to the retirement plan within the allowed timeframe.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8915 D align with the general tax return deadlines. Taxpayers must submit the form along with their federal income tax return for the year in which the distribution was taken. It is essential to be aware of any extensions that may apply, especially for those affected by disasters. Keeping track of these important dates ensures compliance and helps avoid penalties associated with late submissions.

Quick guide on how to complete 2019 form 8915 d qualified 2019 disaster retirement plan distributions and repayments

Effortlessly Prepare Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to receive the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly and without interruptions. Manage Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Edit and Electronically Sign Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments with Ease

- Locate Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using the specific tools available in airSlate SignNow.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download to your PC.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments to guarantee outstanding communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 8915 d qualified 2019 disaster retirement plan distributions and repayments

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8915 d qualified 2019 disaster retirement plan distributions and repayments

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is form 8915 d?

Form 8915 D is a tax form used by taxpayers to report distributions from retirement plans that were used to pay for qualified expenses. It helps individuals declare certain withdrawals for tax purposes, especially during disaster recovery. Understanding how to fill out form 8915 d is crucial for compliant tax filing.

-

How can airSlate SignNow assist with form 8915 d?

airSlate SignNow allows users to easily prepare and electronically sign document forms, including form 8915 d. With its intuitive interface, you can quickly input the required information and send it securely for eSignature. This simplifies the process and ensures accuracy in your tax reporting.

-

Is there a cost associated with using airSlate SignNow for form 8915 d?

Yes, airSlate SignNow offers various pricing plans tailored to differing needs and budgets. You can explore our flexible pricing options that suit both individuals and businesses. Investing in airSlate SignNow can save you time and increase your productivity when working with forms like 8915 d.

-

What are the key features of airSlate SignNow for handling form 8915 d?

Key features of airSlate SignNow include customizable templates, real-time tracking of document status, and unlimited eSignature requests. These features streamline the process of submitting form 8915 d, ensuring that your signed documents are managed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for working on form 8915 d?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software, enhancing your workflow when dealing with form 8915 d. Popular integrations include CRM systems, document storage solutions, and collaboration tools, making it easier to handle your paperwork.

-

What are the benefits of using airSlate SignNow for form 8915 d?

Using airSlate SignNow for form 8915 d offers numerous benefits, including increased compliance, reduced paper usage, and faster transaction times. The platform ensures that your documents are signed and returned promptly, which is especially crucial around tax season. Plus, with eSigning, you can ensure your forms are legally binding.

-

Is airSlate SignNow secure for submitting sensitive forms like 8915 d?

Yes, airSlate SignNow is highly secure and compliant with industry standards. We use advanced encryption and security measures to protect your documents, including sensitive forms like form 8915 d. Your privacy and security are our top priorities.

Get more for Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

Find out other Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer