Form 8915 D 2022

What is the Form 8915 D

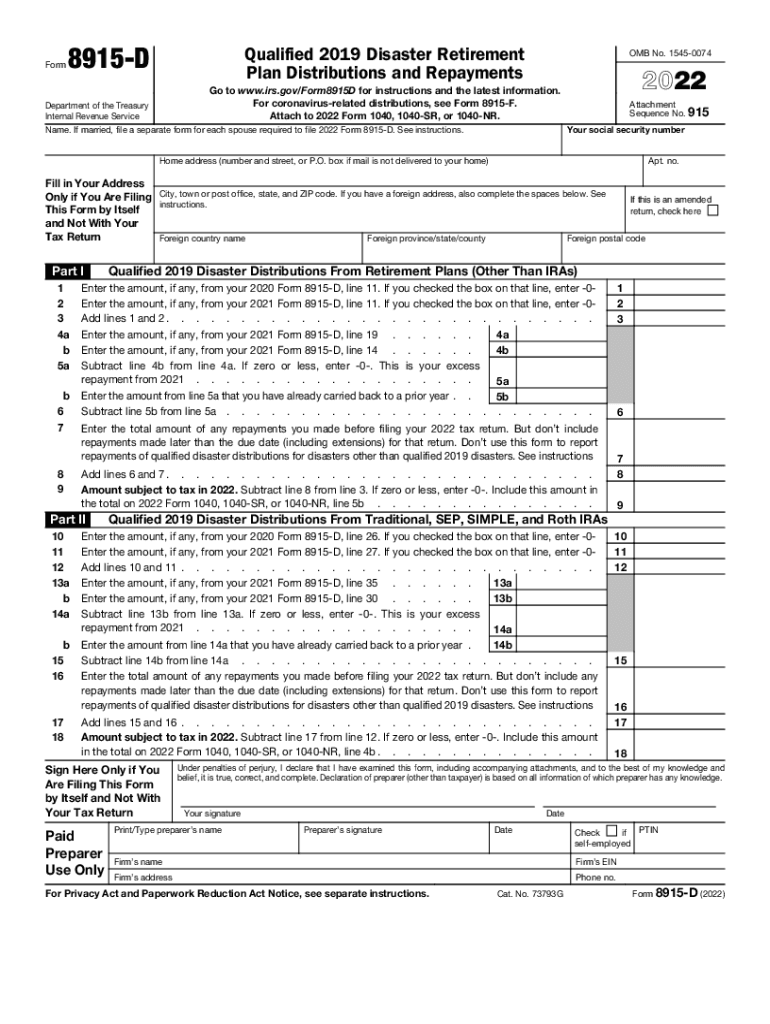

The Form 8915 D is a tax form used by individuals to report disaster distributions from retirement accounts. Specifically, it relates to distributions made under the provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This form allows taxpayers to account for distributions taken in response to qualifying disasters, including the COVID-19 pandemic. By using this form, individuals can spread the tax liability of their distributions over three years, providing financial relief during challenging times.

How to use the Form 8915 D

To effectively use the Form 8915 D, individuals must first determine their eligibility for disaster distributions. Eligible distributions can include amounts withdrawn from qualified retirement plans such as 401(k)s and IRAs. Once eligibility is established, the taxpayer can fill out the form by entering the amount of the distribution, the reason for the withdrawal, and any repayments made. It is essential to follow the instructions provided with the form to ensure accurate reporting and compliance with IRS regulations.

Steps to complete the Form 8915 D

Completing the Form 8915 D involves several key steps:

- Gather necessary documentation, including details of the distribution and any qualifying events.

- Indicate the total amount of disaster distributions received during the tax year.

- Provide information on any repayments made towards the distributions.

- Calculate the taxable amount and enter it on the form.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 8915 D

The legal use of the Form 8915 D is governed by IRS regulations regarding disaster distributions. To ensure compliance, taxpayers must adhere to the guidelines set forth in the CARES Act and subsequent IRS publications. This includes understanding the eligibility criteria for disaster distributions and accurately reporting any distributions taken. Failure to comply with these regulations can result in penalties or additional tax liabilities.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 8915 D, which include eligibility requirements, reporting procedures, and deadlines. Taxpayers are encouraged to review IRS publications related to disaster distributions to ensure they meet all necessary criteria. Understanding these guidelines is crucial for accurate tax reporting and to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8915 D align with the general tax return deadlines. Typically, individuals must file their forms by April 15 of the following year. However, extensions may be available. It is important to stay informed about any changes to these deadlines, especially in light of disaster-related provisions, which may affect filing dates.

Eligibility Criteria

Eligibility for disaster distributions reported on the Form 8915 D is primarily based on the occurrence of qualifying disasters as defined by the IRS. Taxpayers must have experienced a financial impact due to these disasters, which can include loss of income or increased expenses. Additionally, the distributions must be made from eligible retirement accounts. Understanding these criteria is essential for determining whether to use this form when filing taxes.

Quick guide on how to complete form 8915 d 624654109

Complete Form 8915 D effortlessly on any device

Online document management has become widely embraced by businesses and individuals. It offers an excellent eco-friendly option to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form 8915 D on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 8915 D with ease

- Obtain Form 8915 D and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from a device of your choice. Modify and eSign Form 8915 D and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8915 d 624654109

Create this form in 5 minutes!

People also ask

-

What are d disaster distributions and how can airSlate SignNow help?

D disaster distributions refer to specific financial distributions made in response to disaster-related events. airSlate SignNow streamlines the process of generating and signing documents related to these distributions, ensuring compliance and efficiency in a critical time.

-

How does airSlate SignNow ensure the security of d disaster distributions?

The security of d disaster distributions is paramount, and airSlate SignNow employs advanced encryption and secure sign-in protocols to protect sensitive information. With comprehensive compliance standards, you can trust that your documents and distributions are well-guarded.

-

What features does airSlate SignNow offer for managing d disaster distributions?

airSlate SignNow includes features such as customizable templates, automated reminders, and tracking capabilities specifically designed for d disaster distributions. These features simplify the signing process and enhance overall efficiency.

-

Is airSlate SignNow affordable for small businesses handling d disaster distributions?

Absolutely! airSlate SignNow provides a cost-effective solution for small businesses managing d disaster distributions. With flexible pricing plans, you can choose the option that fits your budget while still accessing powerful eSignature tools.

-

Can I integrate airSlate SignNow with other tools for d disaster distributions?

Yes, airSlate SignNow offers seamless integrations with a variety of third-party platforms, enhancing your workflow for d disaster distributions. Whether it's CRM, cloud storage, or document management systems, integrations are designed to complement your existing processes.

-

What benefits does airSlate SignNow provide for remote teams managing d disaster distributions?

For remote teams handling d disaster distributions, airSlate SignNow offers real-time collaboration and document sharing capabilities. This ensures that all team members can access, edit, and sign documents from anywhere, facilitating quicker responses during critical times.

-

How easy is it to get started with airSlate SignNow for d disaster distributions?

Getting started with airSlate SignNow for d disaster distributions is incredibly easy. Create an account and follow the user-friendly interface to upload documents, set up templates, and start sending out eSignatures in just a few minutes.

Get more for Form 8915 D

- Quitclaim deed from husband and wife to husband and wife illinois form

- Illinois husband wife 497306033 form

- Illinois postnuptial form

- Postnuptial property agreement form

- Illinois property agreement form

- Agreement between parties living together but remaining unmarried with regard to sale of residence illinois form

- Illinois owner llc form

- Illinois claim form 497306039

Find out other Form 8915 D

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement