Form 8915 D Qualified Disaster Retirement Plan Distributions and Repayments 2024-2026

Understanding Form 8915 D for Qualified Disaster Retirement Plan Distributions and Repayments

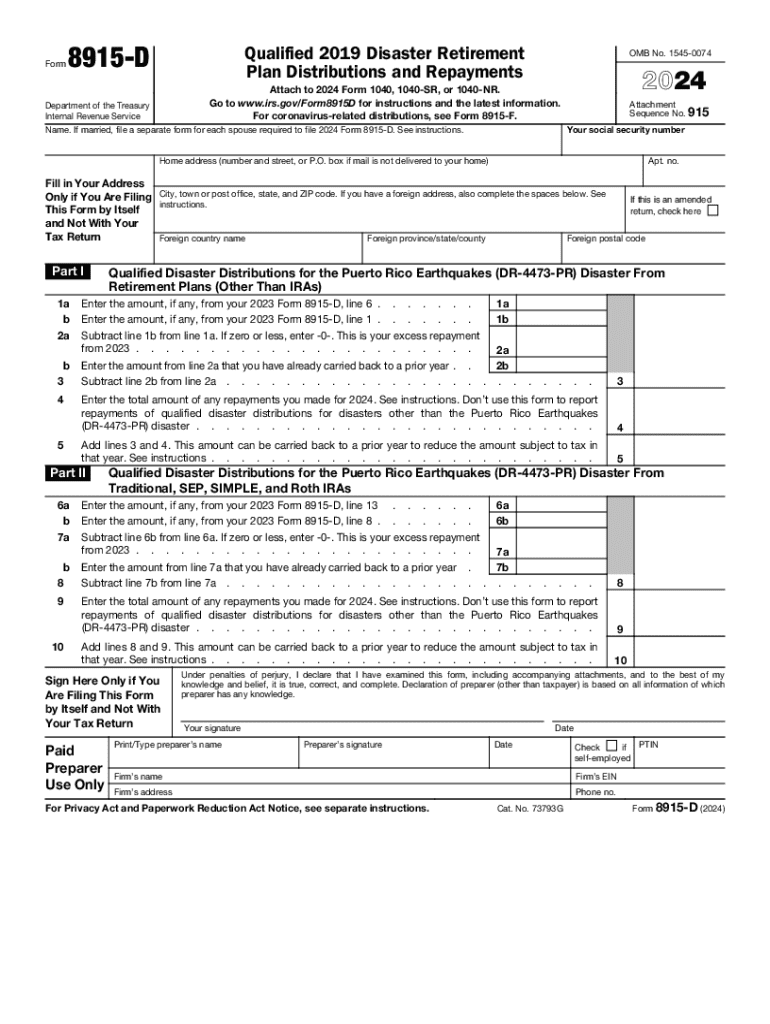

Form 8915 D is a tax form used by individuals who have taken distributions from their retirement plans due to qualified disasters. This form allows taxpayers to report these distributions and, if applicable, to repay them. The purpose of the form is to provide a structured way to account for the tax implications of these distributions, ensuring that taxpayers can manage their retirement funds appropriately in the wake of a disaster. It is crucial for individuals who qualify under the IRS guidelines to use this form correctly to avoid potential penalties.

Steps to Complete Form 8915 D

Completing Form 8915 D involves several key steps:

- Gather necessary information, including details about the disaster and the retirement plan from which distributions were taken.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report the amount of the distribution in the appropriate section of the form.

- If you are repaying any amounts, indicate the repayment details as required.

- Review the form for accuracy before submission.

It is advisable to consult IRS guidelines or a tax professional if you have questions while completing the form.

Obtaining Form 8915 D

Form 8915 D can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure you are using the most current version of the form, as updates may occur annually. You can also request a paper copy by contacting the IRS directly if you prefer to fill it out manually.

Legal Use of Form 8915 D

The legal use of Form 8915 D is primarily for reporting retirement plan distributions made due to qualified disasters. Taxpayers must adhere to IRS regulations regarding eligibility and the proper use of the form. Misuse or failure to file the form correctly can result in penalties, so understanding the legal implications is essential for compliance.

Eligibility Criteria for Form 8915 D

To qualify for using Form 8915 D, taxpayers must have taken distributions from their retirement plans due to specific disasters declared by the federal government. Eligibility often includes individuals affected by natural disasters such as hurricanes, floods, or wildfires. It is important to review the IRS guidelines to confirm that your situation meets the criteria for using this form.

Filing Deadlines for Form 8915 D

Filing deadlines for Form 8915 D typically align with the annual tax filing deadlines. Taxpayers should be aware of the specific dates for the tax year they are filing for, as extensions may not apply to this form. Keeping track of these deadlines is crucial to avoid late penalties.

Examples of Using Form 8915 D

Examples of situations where Form 8915 D would be applicable include:

- A homeowner who withdrew funds from their 401(k) to repair their home after a hurricane.

- An individual who took a distribution to cover living expenses after being displaced by a wildfire.

- A business owner who accessed retirement funds to sustain operations following a natural disaster.

These examples illustrate how the form can be utilized in various scenarios related to disaster recovery.

Create this form in 5 minutes or less

Find and fill out the correct form 8915 d qualified disaster retirement plan distributions and repayments

Create this form in 5 minutes!

How to create an eSignature for the form 8915 d qualified disaster retirement plan distributions and repayments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments?

Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments is a tax form used by individuals who have taken distributions from their retirement plans due to qualified disasters. This form allows taxpayers to report these distributions and any repayments they make, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments?

airSlate SignNow provides a streamlined solution for businesses to send and eSign documents related to Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments. Our platform simplifies the process, making it easy to manage and track these important documents securely.

-

What are the pricing options for using airSlate SignNow for Form 8915 D?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the management of Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 8915 D?

With airSlate SignNow, you can easily create, send, and eSign documents related to Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments. Key features include customizable templates, real-time tracking, and secure cloud storage, all designed to enhance your document management experience.

-

Are there any benefits to using airSlate SignNow for Form 8915 D?

Using airSlate SignNow for Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on what matters most.

-

Can I integrate airSlate SignNow with other software for Form 8915 D?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments alongside your existing tools. This flexibility allows for a seamless workflow and improved productivity.

-

Is airSlate SignNow user-friendly for handling Form 8915 D?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and manage Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments. Our intuitive interface ensures that you can quickly learn how to use the platform effectively.

Get more for Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

Find out other Form 8915 D Qualified Disaster Retirement Plan Distributions And Repayments

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy