About Form 8915 F, Qualified Disaster Retirement Plan 2023

What is the About Form 8915 F, Qualified Disaster Retirement Plan

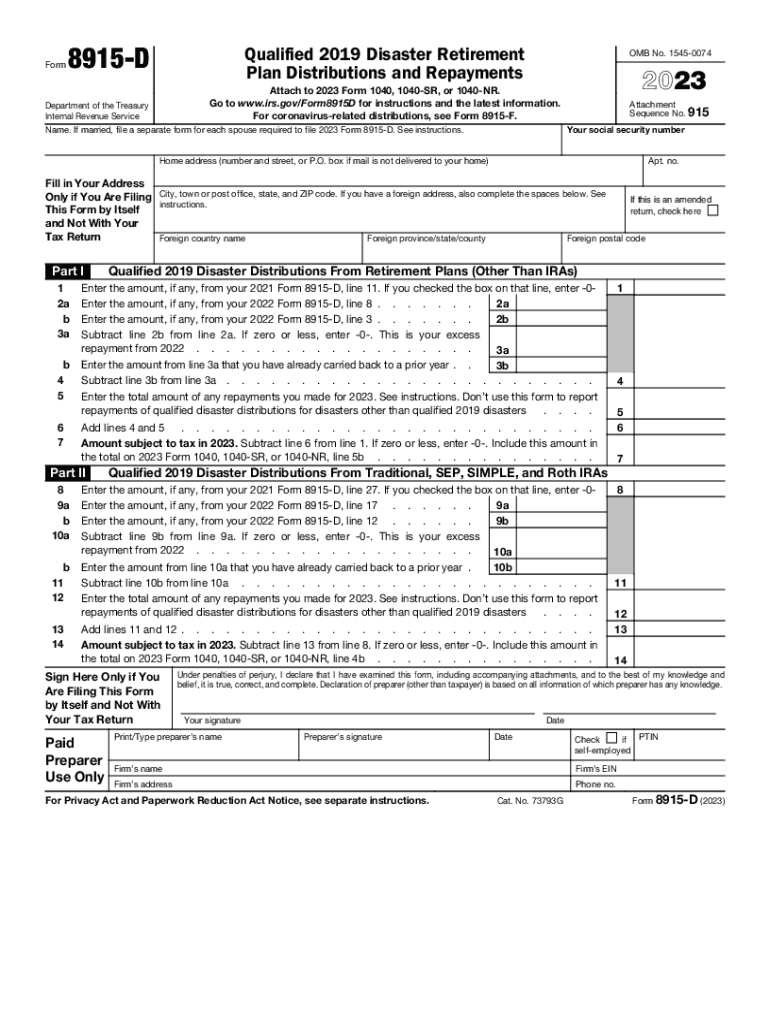

The About Form 8915 F, Qualified Disaster Retirement Plan is a tax form used by individuals who have taken distributions from their retirement plans due to a qualified disaster. This form allows taxpayers to report these distributions and potentially spread the tax liability over three years. It is specifically designed for those affected by federally declared disasters, enabling them to access their retirement funds without incurring immediate tax penalties.

How to use the About Form 8915 F, Qualified Disaster Retirement Plan

To use Form 8915 F, individuals must first determine if they qualify for the provisions associated with disaster-related distributions. If eligible, they will need to fill out the form to report the amount withdrawn from their retirement accounts. The form guides users in calculating the taxable portion of the distribution and how to allocate the tax liability over the specified years. It is essential to keep records of the disaster and the distributions taken for accurate reporting.

Steps to complete the About Form 8915 F, Qualified Disaster Retirement Plan

Completing Form 8915 F involves several key steps:

- Gather necessary information, including details about the disaster and the retirement accounts involved.

- Fill out the personal information section, including your name, address, and Social Security number.

- Enter the total amount of distributions received due to the disaster.

- Calculate the taxable amount and how it will be reported over the next three years.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To be eligible to use Form 8915 F, taxpayers must have taken distributions from their retirement plans due to a qualified disaster as declared by the federal government. The form is applicable to individuals who meet specific criteria, including being a resident in the affected area and having suffered financial loss due to the disaster. It is important to verify that the disaster meets IRS guidelines for qualification.

Filing Deadlines / Important Dates

Filing deadlines for Form 8915 F coincide with the standard tax return deadlines. Taxpayers must ensure that the form is submitted by the due date of their tax return for the year in which the distributions were taken. Extensions may be available, but it is crucial to check the IRS guidelines for the specific year to avoid penalties for late filing.

Required Documents

When completing Form 8915 F, individuals should have the following documents on hand:

- Records of the retirement account distributions taken due to the disaster.

- Documentation of the disaster declaration from the federal government.

- Previous tax returns, if applicable, to assist in reporting and calculations.

Form Submission Methods (Online / Mail / In-Person)

Form 8915 F can be submitted in several ways. Taxpayers can file it electronically through tax software that supports IRS forms or by mailing a paper copy to the appropriate IRS address. In-person submission is generally not available for this form, as it is primarily processed through electronic or postal methods. It is advisable to check the IRS website for the latest submission guidelines and addresses.

Quick guide on how to complete about form 8915 f qualified disaster retirement plan

Manage About Form 8915 F, Qualified Disaster Retirement Plan seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle About Form 8915 F, Qualified Disaster Retirement Plan on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign About Form 8915 F, Qualified Disaster Retirement Plan effortlessly

- Obtain About Form 8915 F, Qualified Disaster Retirement Plan and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to confirm your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign About Form 8915 F, Qualified Disaster Retirement Plan and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8915 f qualified disaster retirement plan

Create this form in 5 minutes!

How to create an eSignature for the about form 8915 f qualified disaster retirement plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8915 F, Qualified Disaster Retirement Plan?

Form 8915 F, Qualified Disaster Retirement Plan, allows you to report distributions and repay loans taken from your retirement accounts due to qualifying disasters. It is specifically designed to help individuals and businesses manage their retirement funds in the wake of a disaster.

-

How can airSlate SignNow assist with Form 8915 F?

airSlate SignNow provides an efficient platform to electronically sign and manage Form 8915 F, Qualified Disaster Retirement Plan documents. With its user-friendly interface, you can seamlessly send and track your forms, ensuring compliance and reducing paperwork hassle.

-

What are the benefits of using airSlate SignNow for Form 8915 F?

Using airSlate SignNow for Form 8915 F offers several benefits, including quick document turnaround, enhanced security for sensitive information, and easy accessibility from anywhere. Our solution streamlines the signing process, making it convenient to address your retirement plan needs.

-

Is there a cost associated with using airSlate SignNow for Form 8915 F?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for users dealing with Form 8915 F, Qualified Disaster Retirement Plan documents. You can choose a plan that fits your budget while enjoying our premium features.

-

Can airSlate SignNow integrate with other financial software for Form 8915 F?

Yes, airSlate SignNow supports various integrations with leading financial software to help you manage Form 8915 F, Qualified Disaster Retirement Plan documentation more effectively. This allows for a seamless workflow, enhancing productivity while ensuring all your processes are synchronized.

-

What features does airSlate SignNow provide for handling Form 8915 F?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure storage specifically for Form 8915 F, Qualified Disaster Retirement Plan documents. These tools help simplify the signing and submission process, ensuring that you stay organized.

-

How does airSlate SignNow ensure the security of Form 8915 F?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication measures for Form 8915 F, Qualified Disaster Retirement Plan documents. Your data is protected throughout the signing process, giving you peace of mind while managing sensitive information.

Get more for About Form 8915 F, Qualified Disaster Retirement Plan

Find out other About Form 8915 F, Qualified Disaster Retirement Plan

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free