Form 8915 D 2019

What is the Form 8915 D

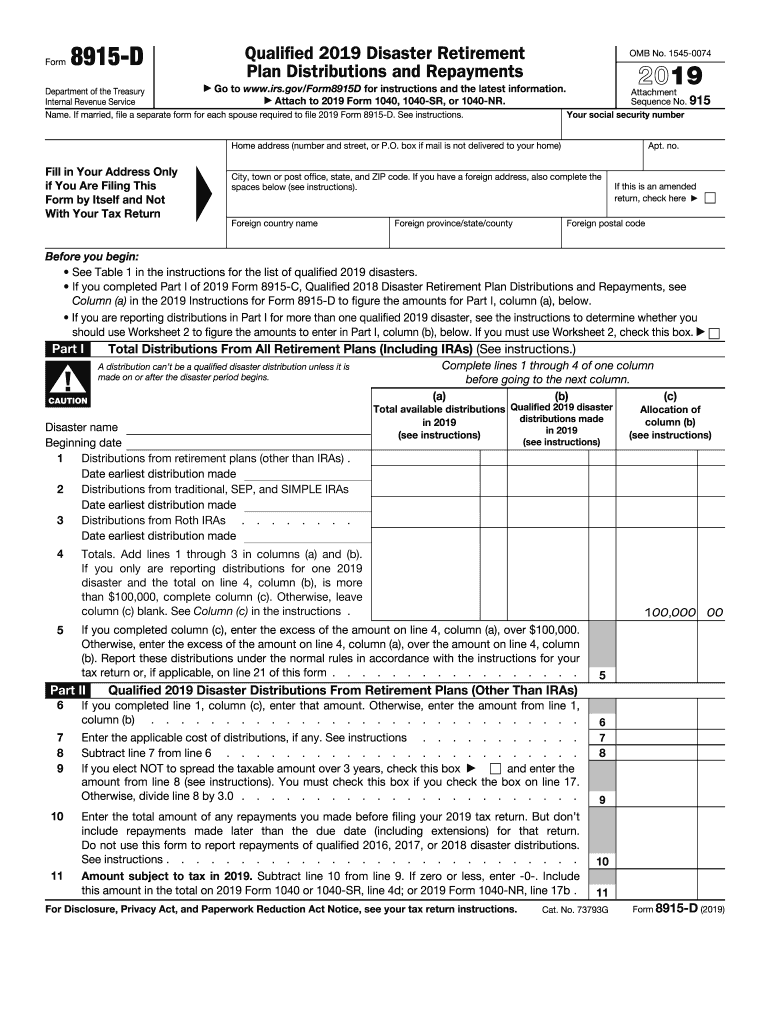

The Form 8915 D is an IRS document used to report distributions from retirement plans due to a qualified disaster. This form allows taxpayers to spread the tax impact of these distributions over three years, providing financial relief to those affected by disasters. It is essential for individuals who have withdrawn funds from their retirement accounts in response to specific disasters declared by the federal government.

How to use the Form 8915 D

To use the Form 8915 D, taxpayers must first determine if they qualify for disaster-related distributions. Once eligibility is confirmed, the form must be filled out accurately to report the amount of distribution received. Taxpayers will need to include details such as the type of retirement account from which the funds were withdrawn, the total distribution amount, and the specific disaster that prompted the withdrawal. Proper completion ensures that the tax benefits associated with the form are applied correctly.

Steps to complete the Form 8915 D

Completing the Form 8915 D involves several key steps:

- Gather necessary information about your retirement accounts and the disaster declaration.

- Indicate the total amount of distributions received due to the disaster.

- Provide details about the specific disaster that qualifies for the distribution.

- Calculate the taxable amount for the current year and the amounts to be reported in the following two years.

- Review the completed form for accuracy before submission.

Legal use of the Form 8915 D

The legal use of the Form 8915 D is grounded in IRS regulations that allow taxpayers to claim favorable tax treatment for disaster-related distributions. To ensure compliance, it is crucial that the form is used only for qualified disasters as recognized by the IRS. Incorrect use of the form can lead to penalties or disallowed claims, making it essential for taxpayers to understand the legal framework surrounding its use.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 8915 D. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, filing deadlines, and the necessary documentation to accompany the form. Staying informed about these guidelines helps ensure that taxpayers meet all requirements and avoid potential issues with their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8915 D align with the general tax filing deadlines set by the IRS. Typically, the form must be submitted by the same date as your annual tax return, which is usually April fifteenth. However, if you file for an extension, the deadline may be extended. It is important to stay updated on any changes to these dates, especially in the context of disaster relief provisions.

Quick guide on how to complete form 8915 d

Complete Form 8915 D effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can acquire the right format and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 8915 D on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form 8915 D without any hassle

- Obtain Form 8915 D and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Modify and eSign Form 8915 D and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8915 d

Create this form in 5 minutes!

How to create an eSignature for the form 8915 d

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is 8915 d and how does it relate to airSlate SignNow?

8915 d refers to the specific designation of a digital signing standard that airSlate SignNow utilizes to ensure secure and efficient electronic signatures. This feature allows users to sign documents electronically with confidence, streamlining their business processes.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the plan you choose, with options designed to fit different budgets. All plans integrate the powerful functionality of 8915 d, making it a cost-effective solution for signing and managing documents.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features including document templates, real-time tracking, and multi-party signing. With 8915 d, users benefit from enhanced security and compliance, ensuring that document transactions are both smooth and reliable.

-

How can 8915 d benefit my business?

Implementing 8915 d through airSlate SignNow enhances operational efficiency by reducing paperwork and accelerating document workflows. This means quicker transactions and improved collaboration between teams and clients, leading to greater productivity.

-

What integrations are available with airSlate SignNow?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems, making it flexible for any business environment. With the implementation of 8915 d, these integrations allow for a smoother document signing process across different platforms.

-

Is airSlate SignNow compliant with legal regulations?

Yes, airSlate SignNow complies with various legal standards, including those associated with 8915 d. This compliance ensures that your electronically signed documents are valid and enforceable in legal contexts, providing peace of mind for businesses.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing users to send and sign documents on the go. This mobile compatibility includes the benefits of 8915 d, ensuring secure and efficient signing from anywhere.

Get more for Form 8915 D

Find out other Form 8915 D

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now