Fillable W4 Form

What is the fillable W-4?

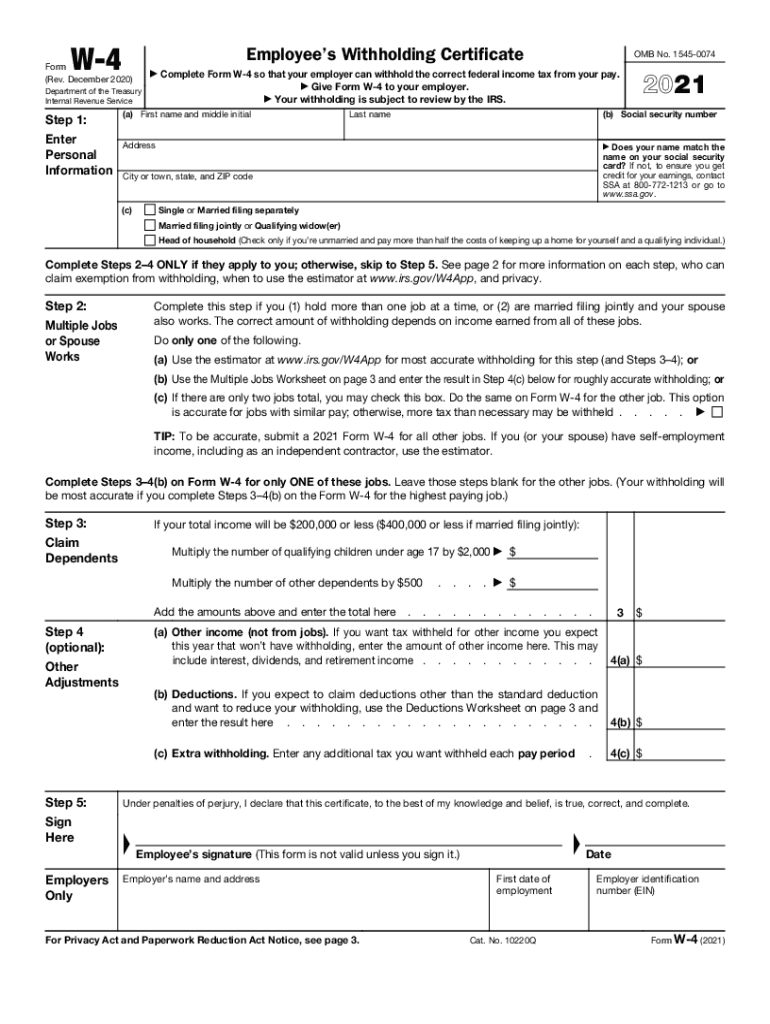

The fillable W-4 is a tax form used by employees in the United States to indicate their tax withholding preferences to their employer. This form helps determine the amount of federal income tax to withhold from an employee's paycheck. The W-4 form allows individuals to adjust their withholding based on personal circumstances, such as marital status, number of dependents, and additional income. By accurately completing the fillable W-4, employees can ensure that they neither owe a large tax bill nor receive a significant refund at tax time.

Steps to complete the fillable W-4

Completing the fillable W-4 involves several straightforward steps:

- Personal Information: Enter your name, address, Social Security number, and filing status (single, married, etc.).

- Multiple Jobs or Spouse Works: If applicable, follow the instructions for adjusting your withholding based on additional jobs or a working spouse.

- Claim Dependents: If you have dependents, provide their information to claim the Child Tax Credit or other credits.

- Other Adjustments: Indicate any other adjustments you wish to make, such as additional withholding or deductions.

- Signature: Sign and date the form to validate your submission.

Once completed, the form should be submitted to your employer, who will use it to adjust your paycheck withholding.

How to obtain the fillable W-4

The fillable W-4 form can be easily obtained through the Internal Revenue Service (IRS) website. The IRS provides a downloadable PDF version of the form that can be filled out electronically or printed for manual completion. Additionally, many employers provide the W-4 form to new employees as part of the onboarding process. If you need a new form, you can also request it from your human resources department.

IRS guidelines for the fillable W-4

The IRS has established specific guidelines for completing the fillable W-4 form. It is essential to follow these guidelines to ensure compliance and accurate tax withholding. Some key points include:

- Ensure that all information is current and accurate to avoid issues with tax withholding.

- Review the form annually or whenever there is a significant change in your financial situation, such as marriage, divorce, or the birth of a child.

- Use the IRS Tax Withholding Estimator tool for guidance on how much to withhold based on your individual circumstances.

Legal use of the fillable W-4

The fillable W-4 is a legally binding document that employees must complete to inform their employers of their tax withholding preferences. It is important to provide truthful and accurate information, as discrepancies can lead to penalties or legal issues. Employers are required to keep the W-4 forms on file and use them to calculate the appropriate amount of federal income tax to withhold from employees' paychecks. Misrepresentation on the W-4 can result in tax liabilities for both the employee and the employer.

Form submission methods for the fillable W-4

The fillable W-4 can be submitted to your employer in several ways:

- Online Submission: If your employer has an electronic system in place, you may be able to submit the form digitally.

- Mail: Print the completed form and mail it directly to your employer's human resources department.

- In-Person: Hand-deliver the completed form to your employer or HR representative.

It is advisable to confirm with your employer the preferred submission method to ensure timely processing of your W-4 form.

Quick guide on how to complete fillable 2021 w4

Effortlessly prepare Fillable W4 on any device

Web-based document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Fillable W4 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Fillable W4 with ease

- Obtain Fillable W4 and then click Get Form to commence.

- Utilize the tools available to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Fillable W4 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable 2021 w4

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the form W-4 2025, and why is it important?

The form W-4 2025 is a critical tax form used by employees to determine the amount of federal income tax withholding from their paychecks. It is important because accurate withholding helps ensure that you don’t owe taxes at the end of the year, preventing under- or over-withholding. Using airSlate SignNow makes it easy to fill out and eSign the form W-4 2025 efficiently.

-

How can airSlate SignNow help with the form W-4 2025?

airSlate SignNow offers user-friendly features that simplify the completion and signing of the form W-4 2025. You can easily fill out the form online, request signatures, and store your documents securely. This streamlined process saves time and enhances compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the form W-4 2025?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including subscription plans for individuals and businesses. These plans provide access to essential features for eSigning and managing forms like the W-4 2025. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for electronic signatures on the form W-4 2025?

airSlate SignNow provides secure electronic signature options, templates, and an easy-to-use interface for managing the form W-4 2025. Signature requests can be sent directly via email, and users receive notifications to ensure timely completion. This convenience accelerates the workflow for both employers and employees.

-

Can I integrate airSlate SignNow with other software for the form W-4 2025?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easier to manage the form W-4 2025 and other documents. You can connect with popular tools like Google Drive, Salesforce, and more, enhancing your operational efficiency.

-

How secure is the airSlate SignNow platform for handling the form W-4 2025?

Security is a top priority for airSlate SignNow. The platform complies with industry standards, including encryption and secure data storage, to protect sensitive information on forms like the W-4 2025. You can trust that your documents are kept safe throughout the entire signing process.

-

What benefits do businesses gain by using airSlate SignNow for the form W-4 2025?

By using airSlate SignNow for the form W-4 2025, businesses benefit from reduced processing time, improved accuracy, and streamlined compliance. The ease of eSigning and document management can lead to increased productivity for HR departments and employees alike.

Get more for Fillable W4

- Car authorization letter form

- City of santa fe form

- Reinforcement evolution worksheet answers form

- Optumrx prior authorization fax form

- Ovals must be filled in completely example go to form

- Rtt coo realty transfer tax declaration for certif form

- Form 75 fuels use report idaho state tax commission

- Oregon parenting plan eforms

Find out other Fillable W4

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy