VAT264 Second Hand Goods Melwescor Melwescor Co 2004

What is the VAT264 Second Hand Goods Melwescor Melwescor Co

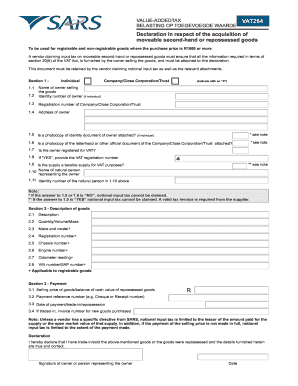

The VAT264 Second Hand Goods form is a tax document specifically designed for businesses dealing with the sale of second-hand goods. This form is used to report transactions and ensure compliance with tax regulations. Melwescor Co, a company involved in this sector, utilizes the VAT264 to accurately track sales and manage tax obligations. The form helps businesses maintain transparency in their operations and provides a structured way to report sales of used items, which may have different tax implications compared to new goods.

How to use the VAT264 Second Hand Goods Melwescor Melwescor Co

Using the VAT264 form involves several steps to ensure accurate reporting of second-hand goods transactions. Businesses must first gather all relevant sales data, including the sale price and details of the items sold. Once the data is collected, the VAT264 can be filled out, detailing each transaction. It is essential to keep thorough records, as these will support the information reported on the form. After completing the form, businesses must submit it to the appropriate tax authority to fulfill their tax obligations.

Steps to complete the VAT264 Second Hand Goods Melwescor Melwescor Co

Completing the VAT264 form requires careful attention to detail. The steps include:

- Collect sales data for all second-hand goods sold during the reporting period.

- Fill in the VAT264 form with accurate transaction details, including item descriptions and sale prices.

- Review the completed form for accuracy and completeness.

- Submit the form to the relevant tax authority by the specified deadline.

Each step is crucial to ensure compliance and avoid potential penalties.

Legal use of the VAT264 Second Hand Goods Melwescor Melwescor Co

The legal use of the VAT264 form is essential for businesses to meet tax obligations related to the sale of second-hand goods. This form ensures that companies report their sales accurately and comply with tax laws. Failure to use the VAT264 correctly can result in legal repercussions, including fines and audits. Businesses must adhere to local and federal regulations when using this form to avoid complications.

Key elements of the VAT264 Second Hand Goods Melwescor Melwescor Co

Key elements of the VAT264 form include:

- Identification of the seller and buyer.

- Detailed descriptions of the second-hand goods sold.

- The sale price of each item.

- Total sales for the reporting period.

These elements are vital for ensuring that the form is filled out correctly and provides the necessary information for tax reporting.

Examples of using the VAT264 Second Hand Goods Melwescor Melwescor Co

Examples of using the VAT264 form include:

- A retail store selling used electronics must report each sale on the VAT264.

- A consignment shop that sells second-hand clothing needs to document sales accurately.

- A furniture store specializing in pre-owned items must track sales for tax purposes.

These scenarios illustrate the importance of the VAT264 in various business contexts involving second-hand goods.

Create this form in 5 minutes or less

Find and fill out the correct vat264 second hand goods melwescor melwescor co

Create this form in 5 minutes!

How to create an eSignature for the vat264 second hand goods melwescor melwescor co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are VAT264 Second Hand Goods Melwescor Melwescor Co.?

VAT264 Second Hand Goods Melwescor Melwescor Co. refers to a specific category of second-hand items that are compliant with VAT regulations. These goods are sourced from various suppliers and are available for businesses looking to purchase quality items at reduced prices. Understanding these goods can help businesses save money while remaining compliant with tax laws.

-

How can I purchase VAT264 Second Hand Goods Melwescor Melwescor Co.?

Purchasing VAT264 Second Hand Goods Melwescor Melwescor Co. is straightforward. You can browse our online catalog, select the items you need, and proceed to checkout. Our platform ensures a seamless purchasing experience, allowing you to acquire quality second-hand goods efficiently.

-

What are the benefits of buying VAT264 Second Hand Goods Melwescor Melwescor Co.?

Buying VAT264 Second Hand Goods Melwescor Melwescor Co. offers several benefits, including cost savings and sustainability. These goods are often priced lower than new items, allowing businesses to stretch their budgets further. Additionally, purchasing second-hand items contributes to environmental sustainability by reducing waste.

-

Are VAT264 Second Hand Goods Melwescor Melwescor Co. guaranteed?

Yes, VAT264 Second Hand Goods Melwescor Melwescor Co. come with a satisfaction guarantee. We ensure that all items meet our quality standards before they are listed for sale. If you encounter any issues with your purchase, our customer service team is ready to assist you.

-

What types of products are included in VAT264 Second Hand Goods Melwescor Melwescor Co.?

VAT264 Second Hand Goods Melwescor Melwescor Co. includes a wide range of products, from electronics to furniture and more. Each item is carefully inspected to ensure it meets quality standards. This variety allows businesses to find exactly what they need at competitive prices.

-

How does VAT264 affect the pricing of second-hand goods?

VAT264 plays a crucial role in determining the pricing of second-hand goods. It ensures that all transactions are compliant with tax regulations, which can affect the final price. Understanding VAT264 can help businesses make informed purchasing decisions and budget accordingly.

-

Can VAT264 Second Hand Goods Melwescor Melwescor Co. be integrated with my existing systems?

Yes, VAT264 Second Hand Goods Melwescor Melwescor Co. can be integrated with various business systems. Our platform is designed to work seamlessly with popular accounting and inventory management software, making it easy to track purchases and manage your assets efficiently.

Get more for VAT264 Second Hand Goods Melwescor Melwescor Co

- Security deposit demand letter texas form

- Lra form 7 11 312466469

- Az me application pdf form

- Sellers disclosure form 100095803

- Pulaski county arkansas commercial personal property rendition form

- Waiver of lien to date 100116639 form

- Fifth grade assessments and scoring checklists common core form

- Massachusetts department of revenue form 63 29a ocean marine

Find out other VAT264 Second Hand Goods Melwescor Melwescor Co

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template