Corporations Telephone Number Form

Understanding the AK AR1103 Form

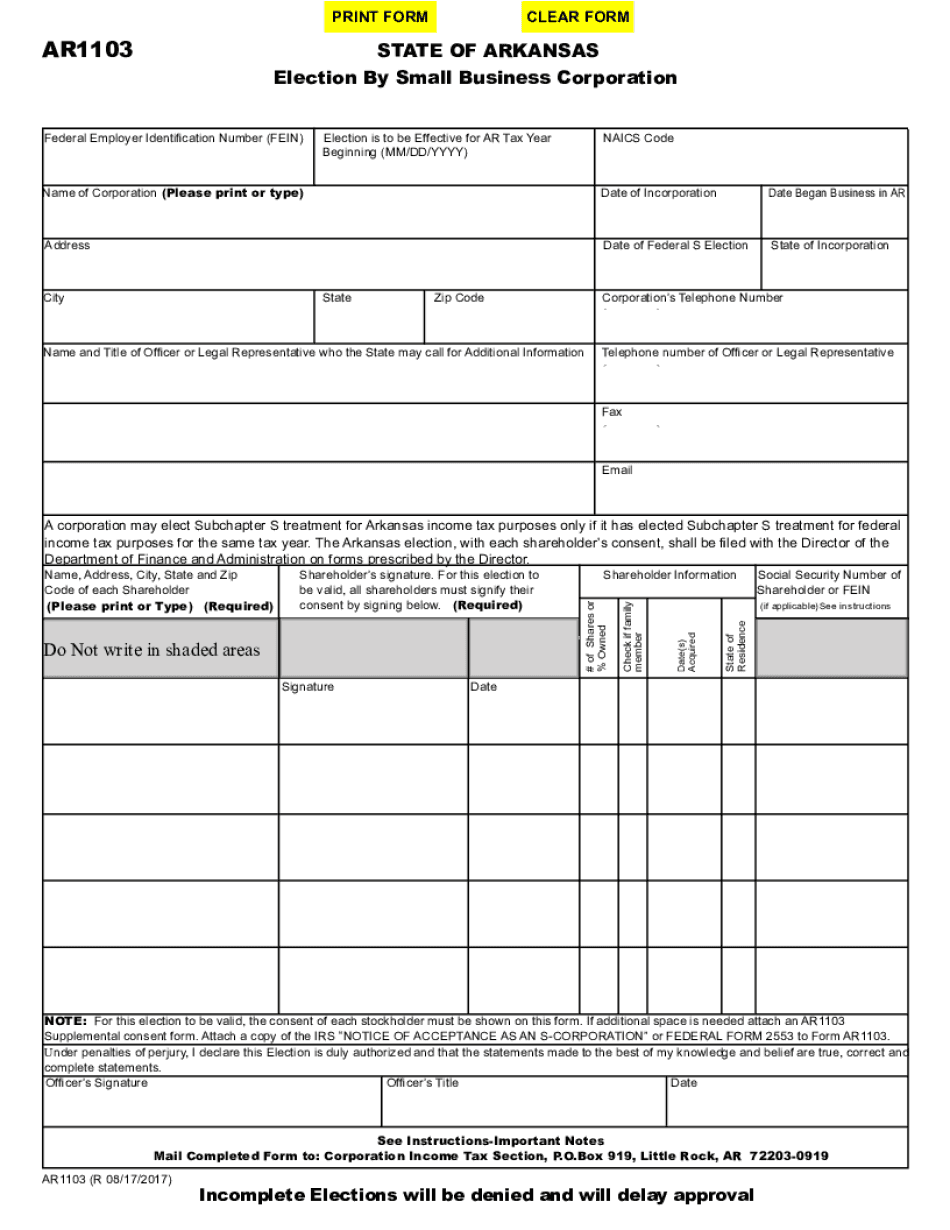

The AK AR1103 form is essential for Arkansas small business corporations electing to be taxed as S corporations. This form allows businesses to inform the state of their decision and ensures compliance with state tax regulations. It is crucial for ensuring that shareholders can benefit from pass-through taxation, avoiding double taxation on corporate income.

Key Elements of the AK AR1103 Form

When filling out the AK AR1103 form, several key elements must be included:

- Corporation Name: The official name of the corporation as registered with the state.

- Employer Identification Number (EIN): This unique number is assigned by the IRS to identify the business entity.

- Shareholder Information: Names, addresses, and Social Security numbers of all shareholders must be provided.

- Election Statement: A clear statement indicating the corporation's intention to elect S corporation status.

Steps to Complete the AK AR1103 Form

Completing the AK AR1103 form involves several straightforward steps:

- Gather necessary information, including the corporation's name, EIN, and shareholder details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the appropriate state tax authority, either online or by mail.

Filing Deadlines for the AK AR1103 Form

Timely filing of the AK AR1103 form is crucial to avoid penalties. Generally, the form must be filed by the 15th day of the third month after the end of the corporation's tax year. For most corporations operating on a calendar year, this means the deadline is March 15. It is advisable to check for any updates or changes to these deadlines annually.

Legal Use of the AK AR1103 Form

The AK AR1103 form is legally binding once it is properly completed and submitted. It serves as a formal declaration of the corporation's choice to be taxed as an S corporation, which can significantly impact tax liabilities and shareholder distributions. Compliance with all state and federal regulations is essential to maintain the validity of this election.

Who Issues the AK AR1103 Form

The AK AR1103 form is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for overseeing tax compliance and ensuring that businesses adhere to Arkansas tax laws. It is important for corporations to obtain the most current version of the form to ensure compliance with any recent changes in legislation.

Quick guide on how to complete corporations telephone number

Complete Corporations Telephone Number effortlessly on any gadget

Online document management has become widely embraced by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Corporations Telephone Number on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Corporations Telephone Number effortlessly

- Obtain Corporations Telephone Number and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes requiring new paper copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Corporations Telephone Number and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporations telephone number

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 's tax arkansas'?

airSlate SignNow is an electronic signature platform that streamlines document management for businesses, including handling 's tax arkansas'. With its user-friendly interface, users can easily create, send, and eSign documents related to tax filings, ensuring compliance and efficiency.

-

How can airSlate SignNow help with filing 's tax arkansas' documents?

With airSlate SignNow, you can securely send and eSign 's tax arkansas' documents, making the process faster and more reliable. The platform allows for easy collaboration, ensuring all parties can sign necessary paperwork promptly, which helps in meeting tax deadlines.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those needing services for 's tax arkansas'. Whether you're a solo entrepreneur or part of a large organization, there are affordable options available to enhance your document signing processes.

-

Does airSlate SignNow integrate with other tax software for 's tax arkansas'?

Yes, airSlate SignNow offers integrations with various popular tax software, allowing for seamless management of 's tax arkansas' documents. This flexibility ensures your tax data flows smoothly between platforms, enhancing your overall efficiency.

-

What features does airSlate SignNow offer for 's tax arkansas' document management?

airSlate SignNow offers features like customizable templates, audit trails, and reminders that help manage 's tax arkansas' documents effectively. These tools simplify the signing process and provide assurance that all necessary steps are completed for compliance.

-

Is airSlate SignNow secure for handling 's tax arkansas' documents?

Absolutely! airSlate SignNow is designed with security in mind. It employs advanced encryption and complies with industry standards to ensure that all 's tax arkansas' documents are stored and transmitted securely.

-

What are the benefits of using airSlate SignNow for 's tax arkansas'?

The key benefits include increased efficiency, reduced turnaround time, and digital tracking for 's tax arkansas' documents. By automating the signing process, businesses can focus more on their core operations and worry less about document management.

Get more for Corporations Telephone Number

- Uob credit card dispute form

- W 1 ree form

- Texas standard possession form

- Replacement cost estimator form

- Affidavit of eligibility form

- Antrag auf arbeitserlaubnis formular pdf

- Wave review worksheet answer key pdf form

- Form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 924

Find out other Corporations Telephone Number

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile