Income Tax Bureau of Internal Revenue Taxation in the Form

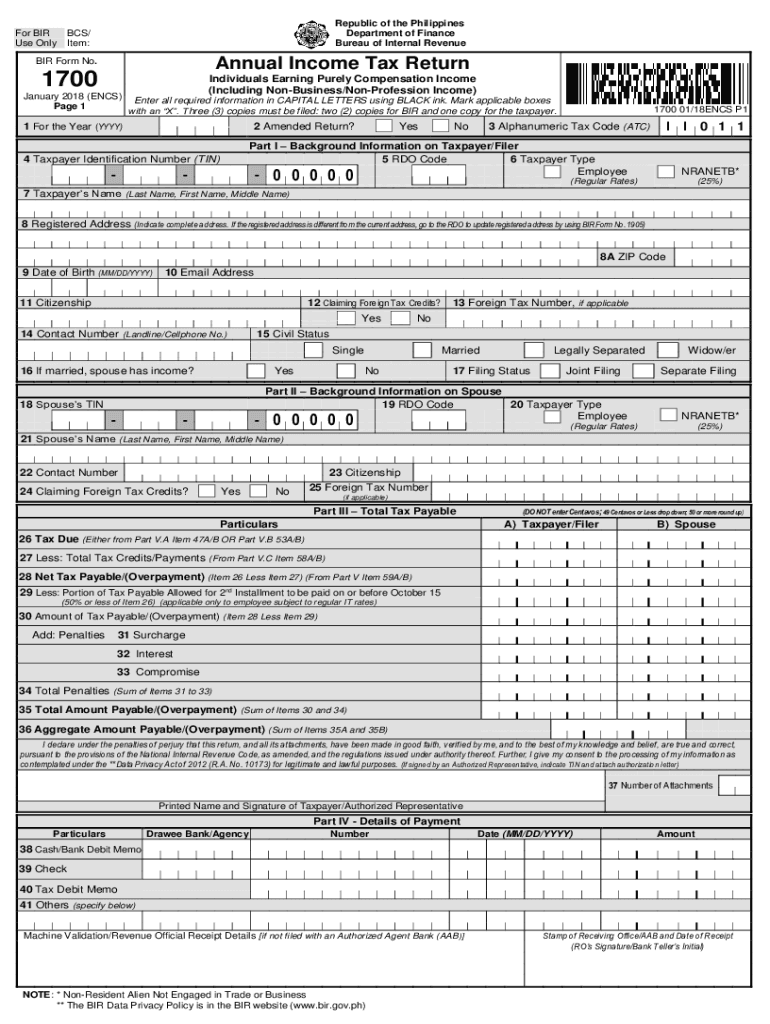

What is the bir form 1700?

The bir form 1700, also known as the Income Tax Return for Individuals, is a document required by the Bureau of Internal Revenue in the Philippines for individuals who are earning income. This form is essential for reporting annual income and determining tax liabilities. It serves as a comprehensive declaration of an individual's earnings from various sources, including salaries, business income, and other taxable income. Understanding its purpose is crucial for compliance with tax regulations.

Steps to complete the bir form 1700

Completing the bir form 1700 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including proof of income, deductions, and credits. Next, accurately fill out the form by entering personal information, income details, and applicable deductions. It is important to double-check all entries for accuracy. Once completed, the form can be submitted either online or through traditional mail, depending on the preferred method. Keeping a copy for personal records is advisable.

Filing Deadlines / Important Dates

Filing deadlines for the bir form 1700 are crucial for avoiding penalties. Typically, the deadline for submission is on or before April 15 of the following year after the income was earned. It is important to stay informed about any changes to this date, as extensions may be granted under certain circumstances. Taxpayers should mark their calendars to ensure timely filing and compliance with the Bureau of Internal Revenue's requirements.

Required Documents

To successfully complete the bir form 1700, several documents are necessary. These include:

- Proof of income, such as payslips or income statements.

- Certificates of withholding tax, if applicable.

- Receipts for deductible expenses, such as medical expenses or educational costs.

- Any other documentation that supports claims for deductions or credits.

Having these documents readily available will streamline the completion process and help ensure accurate reporting.

Who Issues the Form

The bir form 1700 is issued by the Bureau of Internal Revenue (BIR) in the Philippines. This government agency is responsible for the collection of taxes and enforcement of tax laws. The BIR provides guidelines and resources to assist taxpayers in completing their forms and understanding their tax obligations. It is essential for individuals to refer to the official BIR website or local offices for the most up-to-date information regarding the form and its requirements.

Penalties for Non-Compliance

Failing to file the bir form 1700 by the deadline can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, and even legal action in severe cases. The BIR is strict about compliance, and individuals should be aware of the consequences of late filing or inaccuracies in their submissions. To avoid these penalties, it is advisable to file on time and ensure that all information is correct and complete.

Quick guide on how to complete income tax bureau of internal revenue taxation in the

Effortlessly Prepare Income Tax Bureau Of Internal Revenue Taxation In The on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and eSign your documents promptly without delays. Manage Income Tax Bureau Of Internal Revenue Taxation In The across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The easiest way to edit and eSign Income Tax Bureau Of Internal Revenue Taxation In The without hassle

- Find Income Tax Bureau Of Internal Revenue Taxation In The and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign Income Tax Bureau Of Internal Revenue Taxation In The while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax bureau of internal revenue taxation in the

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is a BIR Form 1700, and why is it important?

A BIR Form 1700 is an income tax return form used by individuals in the Philippines. It is essential as it helps taxpayers summarize their income and calculate their tax liability accurately, ensuring compliance with tax regulations. Completing this form is crucial for maintaining good standing with the Bureau of Internal Revenue.

-

How can airSlate SignNow help with BIR Form 1700?

airSlate SignNow simplifies the process of completing and eSigning your BIR Form 1700. With our user-friendly interface, you can fill out the form electronically, ensuring accuracy and efficiency. This eliminates the hassle of paper forms and allows you to submit your tax returns promptly.

-

What features does airSlate SignNow offer for eSigning BIR Form 1700?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and real-time tracking for your BIR Form 1700. Additionally, you can easily collaborate with others by sending documents for review and approval. These features ensure a streamlined and efficient signing process.

-

Is airSlate SignNow a cost-effective solution for managing BIR Form 1700?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing your BIR Form 1700. With various pricing plans tailored to meet different business needs, you can choose an option that fits your budget while enjoying full access to our robust eSigning features. This affordability helps businesses save time and money.

-

Can I integrate airSlate SignNow with other applications for BIR Form 1700?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. This allows you to pull documents directly into the airSlate SignNow platform for easier completion and eSigning of your BIR Form 1700, enhancing your workflow.

-

What are the legal benefits of using airSlate SignNow for BIR Form 1700?

Using airSlate SignNow for your BIR Form 1700 ensures that your electronic signatures comply with legal standards set forth in the Electronic Transactions Act. This gives you peace of mind, knowing that your signed documents are legally enforceable and secure. Furthermore, our platform maintains a detailed audit trail for added legal protection.

-

How secure is airSlate SignNow when handling BIR Form 1700?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your BIR Form 1700 and other sensitive documents. Our platform also features secure user authentication processes, ensuring that only authorized individuals can access your documents. This commitment to security helps safeguard your personal and financial information.

Get more for Income Tax Bureau Of Internal Revenue Taxation In The

Find out other Income Tax Bureau Of Internal Revenue Taxation In The

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast