Application and Update Form

What is the Application and Update Form?

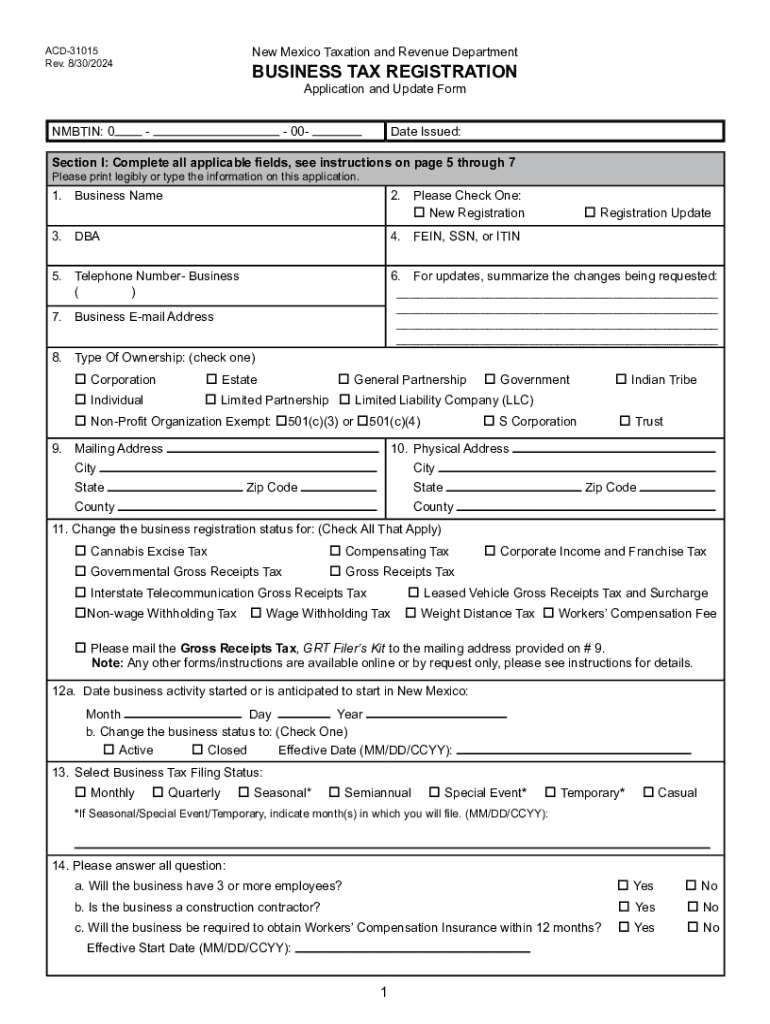

The nm form acd 31015, also known as the New Mexico Application and Update Form, is a crucial document used for tax identification purposes in the state of New Mexico. This form allows businesses to register for a tax identification number, update their existing information, or apply for specific tax programs. It is essential for compliance with state tax regulations and facilitates various business activities, including tax reporting and eligibility for state benefits.

How to Use the Application and Update Form

To effectively use the New Mexico form acd 31015, first ensure that you have all necessary information at hand, including your business details and any previous tax identification numbers. Carefully fill out each section of the form, providing accurate and up-to-date information. Once completed, you can submit the form through the appropriate channels, which may include online submission, mail, or in-person delivery to designated state offices.

Steps to Complete the Application and Update Form

Completing the nm form acd 31015 involves several key steps:

- Gather necessary documentation, such as your business license and identification numbers.

- Fill in the required fields, including your business name, address, and type of business entity.

- Review the form for accuracy to prevent delays in processing.

- Submit the form through your chosen method: online, by mail, or in person.

Required Documents

When submitting the New Mexico form acd 31015, you may need to provide supporting documents to verify your business identity and status. Commonly required documents include:

- Your business license or registration.

- Identification numbers, such as your Social Security Number or Employer Identification Number (EIN).

- Any prior tax identification documentation, if applicable.

Form Submission Methods

The nm form acd 31015 can be submitted through various methods to accommodate different preferences and needs. You can choose to:

- Submit the form online through the New Mexico taxation website, if available.

- Mail the completed form to the designated state tax office address.

- Deliver the form in person to a local tax office for immediate processing.

Eligibility Criteria

To be eligible for submitting the New Mexico form acd 31015, applicants must meet specific criteria. Generally, this includes:

- Being a business entity operating within New Mexico.

- Having a valid business license or registration.

- Providing accurate and truthful information on the application.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application and update form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nm form acd 31015?

The nm form acd 31015 is a specific document used for various administrative purposes in New Mexico. It is essential for businesses and individuals to understand its requirements to ensure compliance. airSlate SignNow simplifies the process of filling out and eSigning this form, making it accessible and efficient.

-

How can airSlate SignNow help with the nm form acd 31015?

airSlate SignNow provides an intuitive platform for completing the nm form acd 31015. Users can easily fill out the form, add electronic signatures, and send it securely. This streamlines the process, saving time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the nm form acd 31015?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value considering the features available for managing documents like the nm form acd 31015. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the nm form acd 31015?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the nm form acd 31015. These features enhance the user experience and ensure that all necessary steps are completed efficiently. Additionally, users can collaborate in real-time, making the process even smoother.

-

Can I integrate airSlate SignNow with other applications for the nm form acd 31015?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the nm form acd 31015 alongside your existing tools. This flexibility ensures that you can streamline your workflow and maintain productivity without switching between platforms.

-

What are the benefits of using airSlate SignNow for the nm form acd 31015?

Using airSlate SignNow for the nm form acd 31015 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick access to documents and ensures that all signatures are legally binding. This makes it an ideal solution for businesses looking to modernize their document management.

-

Is airSlate SignNow user-friendly for completing the nm form acd 31015?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the nm form acd 31015. The interface is intuitive, and users can quickly navigate through the steps required to fill out and eSign the document. This accessibility is crucial for users of all technical skill levels.

Get more for Application And Update Form

Find out other Application And Update Form

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy