Mississippi Partnership Form

What is the Mississippi Partnership

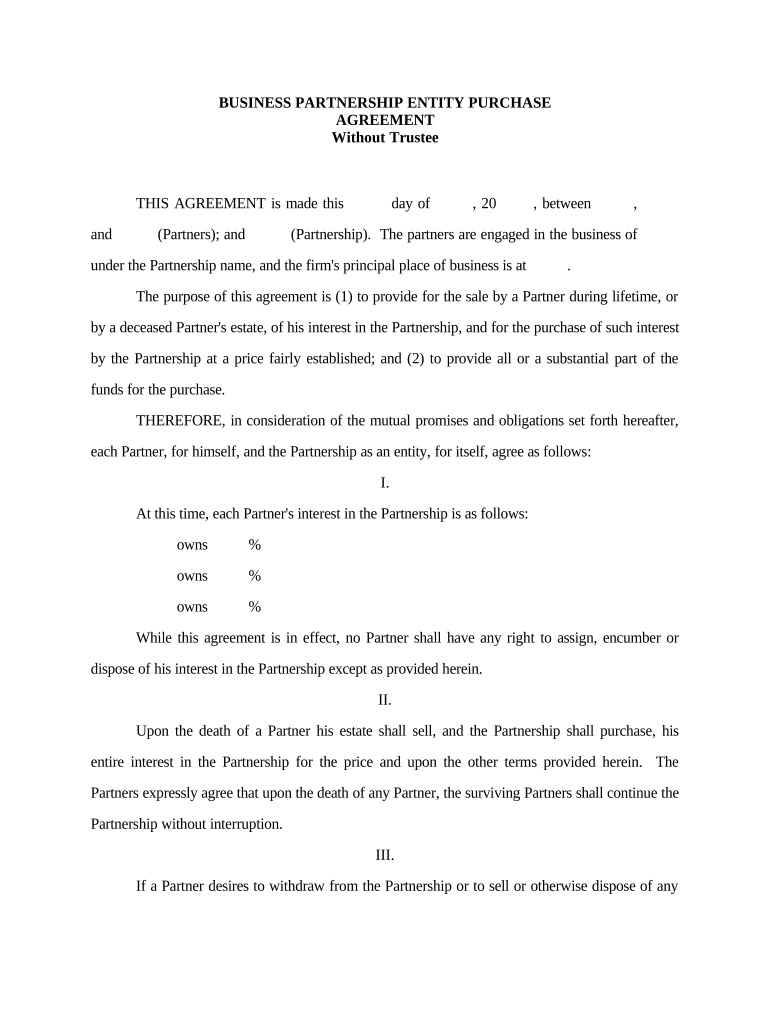

The Mississippi Partnership is a legal entity formed by two or more individuals or entities to conduct business in the state of Mississippi. This structure allows partners to share profits, losses, and management responsibilities. Unlike corporations, partnerships are generally easier to establish and maintain, requiring fewer formalities. Partners in a Mississippi Partnership can be individuals, corporations, or other partnerships, providing flexibility in business arrangements.

Steps to complete the Mississippi Partnership

Completing the Mississippi Partnership involves several key steps to ensure compliance with state regulations:

- Choose a partnership name: The name must be unique and not already in use by another business entity in Mississippi.

- Draft a partnership agreement: This document outlines the roles, responsibilities, and profit-sharing arrangements among partners.

- Register the partnership: File the necessary documents with the Mississippi Secretary of State, which may include a Certificate of Partnership.

- Obtain necessary licenses and permits: Depending on the nature of the business, additional permits may be required at the local or state level.

- Apply for an Employer Identification Number (EIN): This is necessary for tax purposes and can be obtained from the IRS.

Legal use of the Mississippi Partnership

To ensure the legal validity of a Mississippi Partnership, partners must adhere to state laws governing business entities. This includes maintaining proper records, filing required documents, and complying with tax obligations. The partnership agreement should clearly define each partner's rights and obligations, which can help prevent disputes. Additionally, partners may need to register their business name and obtain any necessary licenses to operate legally within the state.

Key elements of the Mississippi Partnership

Several key elements define a Mississippi Partnership:

- Partnership Agreement: A crucial document that outlines the terms of the partnership, including profit-sharing, responsibilities, and decision-making processes.

- Liability: In a general partnership, all partners share personal liability for business debts and obligations, which can impact personal assets.

- Taxation: Partnerships typically enjoy pass-through taxation, meaning profits and losses are reported on the partners' individual tax returns.

- Management Structure: Partnerships can be managed by all partners or designated individuals, depending on the agreement.

Required Documents

To establish a Mississippi Partnership, several documents are typically required:

- Partnership Agreement: This should detail the terms and conditions agreed upon by the partners.

- Certificate of Partnership: This may need to be filed with the Secretary of State, depending on the partnership type.

- Employer Identification Number (EIN): Essential for tax reporting and employee identification.

- Business Licenses: Depending on the industry, specific licenses may be required to operate legally.

Examples of using the Mississippi Partnership

Mississippi Partnerships can be utilized in various business scenarios, including:

- Professional Services: Lawyers, accountants, and consultants often form partnerships to combine expertise and share resources.

- Retail Ventures: Two or more individuals can establish a partnership to open a retail store, sharing responsibilities and profits.

- Real Estate Investments: Partners may collaborate to invest in properties, pooling resources for larger investments.

Quick guide on how to complete mississippi partnership 497314617

Complete Mississippi Partnership effortlessly on any gadget

Digital document management has gained traction among firms and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Mississippi Partnership from any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Mississippi Partnership with ease

- Find Mississippi Partnership and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your selecting. Edit and eSign Mississippi Partnership and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mississippi partnership?

A Mississippi partnership is a business structure where two or more individuals share ownership and profits. This type of partnership allows for flexibility in management and operations, making it an attractive option for businesses in Mississippi looking to collaborate effectively.

-

How can airSlate SignNow assist with forming a Mississippi partnership?

airSlate SignNow simplifies the process of forming a Mississippi partnership by providing digital document signing and sharing features. You can easily create, send, and sign partnership agreements online, ensuring that all parties are on the same page and legally protected.

-

What features does airSlate SignNow offer for Mississippi partnerships?

airSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures tailored for Mississippi partnerships. These tools streamline the documentation process, making it easier for partners to manage their agreements and communications.

-

Is airSlate SignNow cost-effective for Mississippi partnerships?

Yes, airSlate SignNow is designed to be cost-effective for businesses, including Mississippi partnerships. With flexible pricing plans, it caters to various budget levels, ensuring that you get the essential features for document management without overspending.

-

Can airSlate SignNow integrate with other tools for Mississippi partnerships?

Absolutely! airSlate SignNow offers integrations with various applications that Mississippi partnerships might already be using. This ensures a seamless workflow by connecting eSignature processes with popular business tools and platforms.

-

What are the benefits of using airSlate SignNow for a Mississippi partnership?

Using airSlate SignNow for a Mississippi partnership provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy in document handling. It allows partners to focus more on growing their business instead of being bogged down by administrative tasks.

-

Are electronic signatures legally binding for Mississippi partnerships?

Yes, electronic signatures facilitated by airSlate SignNow are legally binding in Mississippi. The platform complies with eSignature laws, ensuring that all signed documents hold the same legal weight as traditional signatures in the context of a Mississippi partnership.

Get more for Mississippi Partnership

Find out other Mississippi Partnership

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document