Publication 5427 KO 6 Tax Scam Alert Korean Version Form

What is the Publication 5427 KO 6 Tax Scam Alert Korean Version

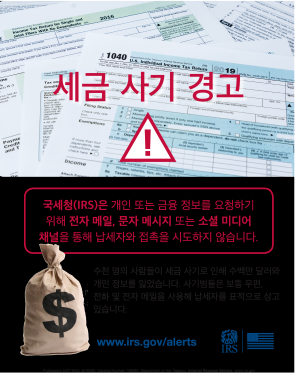

The Publication 5427 KO 6 Tax Scam Alert Korean Version is an informational document released by the IRS to educate the public about various tax scams targeting individuals and businesses. This publication outlines common fraudulent schemes, including phishing attempts, identity theft, and deceptive tax preparation services. It aims to raise awareness, helping taxpayers recognize and avoid these scams, ensuring that they can protect their financial information effectively.

How to use the Publication 5427 KO 6 Tax Scam Alert Korean Version

Using the Publication 5427 KO 6 Tax Scam Alert Korean Version involves reviewing the information provided to understand the types of scams that may affect you. Taxpayers should familiarize themselves with the warning signs of fraud, such as unsolicited communications from the IRS or requests for personal information. By being informed, individuals can take proactive steps to safeguard their sensitive data and report any suspicious activity to the appropriate authorities.

Steps to complete the Publication 5427 KO 6 Tax Scam Alert Korean Version

Completing the Publication 5427 KO 6 Tax Scam Alert Korean Version does not require a formal submission process, as it serves as a guide rather than a form to be filled out. However, taxpayers should follow these steps:

- Read through the publication carefully to understand the different types of scams.

- Identify any potential risks based on your personal or business tax situation.

- Implement recommended practices to protect your information.

- Report any encountered scams to the IRS or local authorities.

Legal use of the Publication 5427 KO 6 Tax Scam Alert Korean Version

The legal use of the Publication 5427 KO 6 Tax Scam Alert Korean Version is primarily centered around education and awareness. It is not a legal document but serves as a resource for taxpayers to understand their rights and responsibilities regarding tax-related scams. By adhering to the guidelines and recommendations in the publication, individuals can ensure they are compliant with tax laws while protecting themselves from fraud.

Key elements of the Publication 5427 KO 6 Tax Scam Alert Korean Version

Key elements of the Publication 5427 KO 6 Tax Scam Alert Korean Version include:

- Descriptions of prevalent tax scams and how they operate.

- Advice on recognizing phishing emails and phone calls.

- Guidelines for safeguarding personal information.

- Instructions on reporting scams to the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the handling of tax scams, which are detailed in the Publication 5427 KO 6 Tax Scam Alert Korean Version. Taxpayers are encouraged to follow these guidelines to ensure they are not victims of fraud. This includes verifying the legitimacy of any communication received, particularly those requesting sensitive information or payments.

Quick guide on how to complete publication 5427 ko 6 2020 tax scam alert korean version

Complete Publication 5427 KO 6 Tax Scam Alert Korean Version effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle Publication 5427 KO 6 Tax Scam Alert Korean Version on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Publication 5427 KO 6 Tax Scam Alert Korean Version with ease

- Locate Publication 5427 KO 6 Tax Scam Alert Korean Version and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for those tasks.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Publication 5427 KO 6 Tax Scam Alert Korean Version and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 5427 ko 6 2020 tax scam alert korean version

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

The 'Publication 5427 KO 6 Tax Scam Alert Korean Version' is a vital resource designed to inform users about prevalent tax scams targeting the Korean-speaking community. It outlines common fraudulent schemes and provides guidance on how to recognize and avoid them. Understanding this publication is crucial for safeguarding your financial information.

-

How can airSlate SignNow help with managing the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

airSlate SignNow allows businesses to easily send and eSign documents related to the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'. With our user-friendly interface, you can securely manage and distribute this important alert among your clients or employees. This ensures that everyone is informed and vigilant against potential scams.

-

Is there a cost associated with accessing the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

Accessing the information contained in the 'Publication 5427 KO 6 Tax Scam Alert Korean Version' is typically free; however, using airSlate SignNow for document management and eSigning may incur costs based on your subscription plan. We offer various pricing options that cater to different business sizes and requirements, ensuring affordable solutions for all users.

-

What features does airSlate SignNow offer for handling tax-related documents like 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for tax-related documents, including the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'. These features enhance your document management process, making it efficient and compliant with legal standards.

-

Can airSlate SignNow integrate with other platforms for better management of the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

Yes, airSlate SignNow offers integrations with various platforms, allowing seamless management of documents like the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'. This means you can connect your existing tools, such as CRM systems and cloud storage, to streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

Using airSlate SignNow for the 'Publication 5427 KO 6 Tax Scam Alert Korean Version' offers numerous benefits, including enhanced security, time-saving eSigning capabilities, and easy document sharing. Additionally, it helps ensure that your clients receive important tax information swiftly and securely, fostering trust and credibility.

-

How does airSlate SignNow ensure the security of documents related to the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'?

Security is a top priority at airSlate SignNow. We implement advanced encryption methods and secure storage practices to protect documents like the 'Publication 5427 KO 6 Tax Scam Alert Korean Version'. This ensures that sensitive information remains confidential and is accessible only to authorized users.

Get more for Publication 5427 KO 6 Tax Scam Alert Korean Version

Find out other Publication 5427 KO 6 Tax Scam Alert Korean Version

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe