5136 Form

What is the 5136

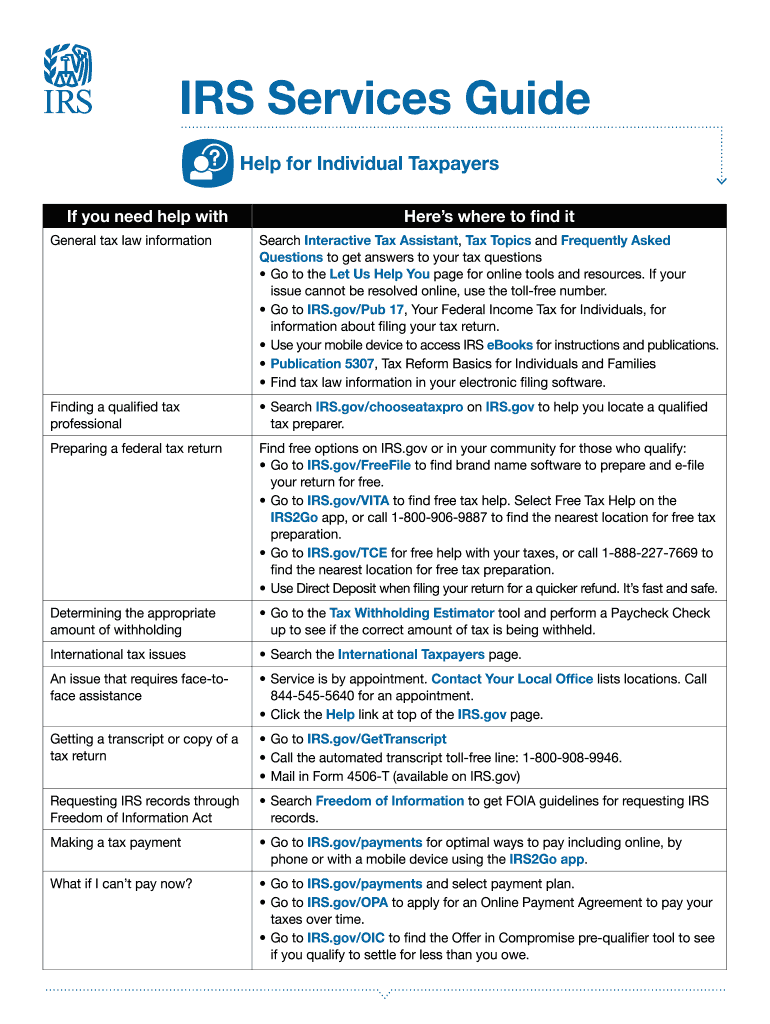

The 5136 form, also known as the IRS Publication 5136, serves as a comprehensive guide for taxpayers regarding various tax-related topics. It is designed to assist individuals and businesses in understanding their tax obligations and rights. This publication includes critical information about tax credits, deductions, and filing requirements, making it an essential resource for navigating the complexities of the U.S. tax system.

How to use the 5136

Using the 5136 form effectively involves understanding its structure and the information it provides. Taxpayers should start by reviewing the table of contents to locate the specific sections relevant to their needs. Each section is organized to address different topics, such as eligibility criteria for tax credits or detailed instructions on filing procedures. By following the guidelines outlined in the 5136, individuals can ensure they are compliant with IRS regulations and maximize their potential tax benefits.

Steps to complete the 5136

Completing the 5136 form requires several key steps to ensure accuracy and compliance. First, gather all necessary documentation, such as income statements and previous tax returns. Next, carefully read through the sections of the 5136 that pertain to your specific situation. Fill out the required information accurately, ensuring that all entries are clear and legible. Finally, review the completed form for any errors before submission to avoid delays or penalties.

Legal use of the 5136

The legal use of the 5136 form is critical for ensuring that taxpayers adhere to IRS regulations. This publication is recognized as an authoritative source of information on tax matters, and following its guidelines helps prevent legal issues related to tax compliance. It is important to understand that the information provided in the 5136 must be applied in accordance with current tax laws, and any updates or changes in legislation should be taken into account when preparing tax documents.

IRS Guidelines

IRS guidelines outlined in the 5136 provide essential information on various tax-related processes, including filing deadlines, required documentation, and eligibility criteria for deductions and credits. Taxpayers should familiarize themselves with these guidelines to ensure they meet all necessary requirements. Adhering to IRS guidelines not only facilitates a smoother filing process but also helps in avoiding potential audits or penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines and important dates is crucial for taxpayers using the 5136. The IRS typically sets specific dates for tax filings, which can vary based on the type of taxpayer (individual, business, etc.). It is important to mark these dates on your calendar to ensure timely submission of your tax documents. Missing deadlines can result in penalties, interest, or other complications, so staying informed is key.

Required Documents

When completing the 5136 form, certain documents are required to support the information provided. These may include W-2 forms, 1099 forms, and receipts for deductible expenses. Having these documents on hand ensures that taxpayers can accurately fill out the form and substantiate their claims. It is advisable to keep copies of all submitted documents for personal records and future reference.

Quick guide on how to complete 5136

Prepare 5136 seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage 5136 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign 5136 effortlessly

- Obtain 5136 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 5136 and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5136

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the IRS publication guide and how can it help businesses?

The IRS publication guide provides essential information on tax-related regulations and compliance. Utilizing this guide can help businesses understand their tax obligations and streamline their document management processes. airSlate SignNow integrates seamlessly with the IRS publication guide to simplify eSigning tax documents.

-

How does airSlate SignNow support compliance with the IRS publication guide?

airSlate SignNow ensures compliance with the IRS publication guide by offering tools that maintain the integrity and security of signed documents. Our platform utilizes advanced encryption to protect sensitive information, ensuring that your compliance with IRS regulations is met effectively.

-

Are there any costs associated with accessing the IRS publication guide through airSlate SignNow?

Accessing the IRS publication guide itself is free, but using airSlate SignNow does involve a subscription fee. Our pricing plans are designed to be cost-effective, offering advanced features that enhance your ability to manage documents in accordance with IRS guidelines. Evaluate our pricing to find the perfect plan for your needs.

-

What features does airSlate SignNow offer related to the IRS publication guide?

airSlate SignNow offers features such as customizable templates, automated workflows, and robust tracking capabilities, all geared toward enhancing compliance with the IRS publication guide. These tools allow users to streamline the eSigning process and maintain organized records needed for tax submissions.

-

Can airSlate SignNow integrate with other tools to help utilize the IRS publication guide?

Yes, airSlate SignNow integrates with various popular business applications, allowing you to utilize the IRS publication guide effectively. This integration ensures that your workflow remains seamless, linking eSigning tasks with accounting and CRM systems for enhanced productivity.

-

How can I ensure my documents meet IRS publication guide standards using airSlate SignNow?

To ensure your documents meet IRS publication guide standards, you can use airSlate SignNow’s templating and auditing features. The platform allows you to set specific compliance requirements and review processes, which helps maintain adherence to guidelines while improving document workflow.

-

Is it easy to eSign documents related to the IRS publication guide using airSlate SignNow?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to eSign documents associated with the IRS publication guide. The straightforward interface and guided setup allow users to complete their signing tasks quickly and efficiently.

Get more for 5136

- Online applications assistance form

- Standardized recipe template 390658383 form

- Family group record familysearch org familysearch form

- Jm climate pro coverage chart form

- Nevada section 8 waiting list form

- Pageant biography examples form

- Church of god exhorter study guide form

- Shipping instructions request sir 2 0 form

Find out other 5136

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form