Family Limited Partnership Agreement Template Form

What is the Family Limited Partnership Agreement Template

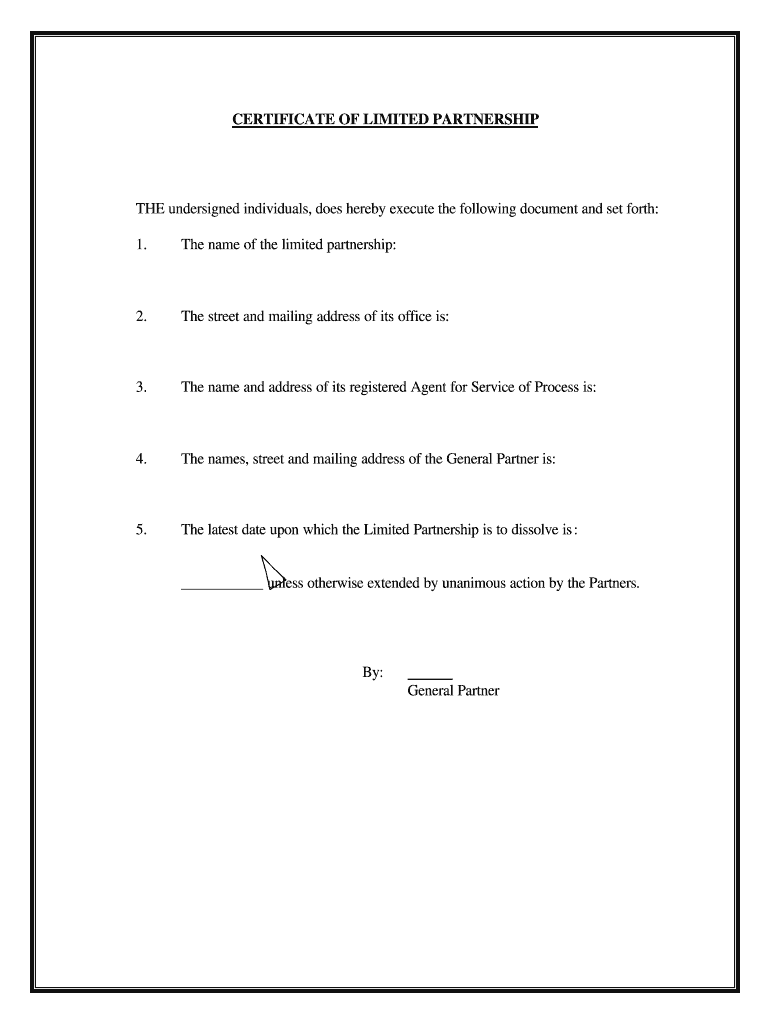

A Family Limited Partnership Agreement Template is a legal document that outlines the structure and terms of a family limited partnership. This type of partnership is often used to manage family-owned assets, such as real estate or investments, while providing tax benefits and protecting family wealth. The template typically includes details about the partners, their respective ownership percentages, the management of the partnership, and the distribution of profits and losses. It serves as a foundational document for establishing the partnership and ensuring that all parties understand their rights and responsibilities.

Key elements of the Family Limited Partnership Agreement Template

When creating a Family Limited Partnership Agreement, several key elements must be included to ensure its effectiveness and legal compliance. These elements typically encompass:

- Partnership Name: The official name under which the partnership will operate.

- Partners: A list of all partners involved, including their roles and contributions.

- Capital Contributions: Details on the financial investments made by each partner.

- Profit and Loss Distribution: How profits and losses will be allocated among partners.

- Management Structure: Guidelines on how the partnership will be managed and who will make decisions.

- Transfer of Interests: Rules regarding the transfer or sale of partnership interests.

- Dispute Resolution: Procedures for resolving any disagreements among partners.

How to use the Family Limited Partnership Agreement Template

Using a Family Limited Partnership Agreement Template involves several steps to ensure that it meets the specific needs of the family and complies with legal requirements. First, gather all relevant information about the partners and the assets involved. Next, customize the template by filling in the details specific to your partnership, such as names, contributions, and management structure. It is advisable to consult with a legal professional to review the completed document to ensure it adheres to state laws and adequately protects the interests of all partners. Once finalized, all partners should sign the agreement to make it legally binding.

Legal use of the Family Limited Partnership Agreement Template

The Family Limited Partnership Agreement Template is legally binding once it is properly executed by all parties involved. To ensure its legal validity, the agreement must comply with state laws governing partnerships. This includes adhering to regulations regarding the formation and operation of limited partnerships. Additionally, the document should be stored securely, as it may be required for tax purposes or in the event of disputes. It is essential to keep the agreement updated to reflect any changes in partnership structure or state laws.

Steps to complete the Family Limited Partnership Agreement Template

Completing a Family Limited Partnership Agreement Template involves a systematic approach to ensure clarity and compliance. The steps typically include:

- Identify all partners and their roles within the partnership.

- Outline the capital contributions from each partner.

- Define how profits and losses will be shared.

- Establish the management structure and decision-making processes.

- Include provisions for the transfer of partnership interests.

- Incorporate dispute resolution mechanisms.

- Review the document with legal counsel before finalizing.

Examples of using the Family Limited Partnership Agreement Template

Family Limited Partnership Agreements can be utilized in various scenarios. For instance, a family may use the agreement to manage a family-owned business, ensuring that profits are distributed fairly among family members. Another example is when a family wishes to pool resources for real estate investments, allowing them to share risks and rewards. Additionally, the agreement can facilitate estate planning by outlining how assets will be transferred to heirs, minimizing tax liabilities and ensuring a smooth transition of wealth.

Quick guide on how to complete family limited partnership agreement and certificate

Complete Family Limited Partnership Agreement Template seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Manage Family Limited Partnership Agreement Template on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to edit and eSign Family Limited Partnership Agreement Template effortlessly

- Locate Family Limited Partnership Agreement Template and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Family Limited Partnership Agreement Template and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

-

How do I form and structure a family investment partnership firm between my parents, my wife, and myself to invest in stocks and real estate?

There are a number of business entities you can use for this purpose. Of course, you’ll want final blessings from a family practice and contract lawyer, but before you spend $300-$400 per hour listening to options, read about those options first on your own. You’ll likely eliminate several quickly.My personal choice would probably be a TIC, or Tenancy in Common. Family deals are rarely without arguments, and the TIC separates everyone into their own roles within the scope of the TIC Agreement. That agreement will memorialize who in the managing Tenant, who can or cannot participate in decisions, and how a majority is signNowed for each decision. It will also prescribe termination, disposition, distribution of profits and expenses, capital calls, etc. This agreement should always be written by an attorney, with your direction as to the business points.You can do a partnership, but the problem is in the wrap up. A General Partnership does not allow individual partners to go their own way with sale proceeds. Unless the partnership is terminated prior to the disposition of funds, you must either take cash, or as a continuing entity you can trade into something else, but it’s all or nothing, binary. A TIC does allow this, and each Tenant’s role is defined in the controlling document more than by state and federal laws.Good luck, and good investing.JW

Create this form in 5 minutes!

How to create an eSignature for the family limited partnership agreement and certificate

How to generate an eSignature for your Family Limited Partnership Agreement And Certificate in the online mode

How to generate an eSignature for your Family Limited Partnership Agreement And Certificate in Chrome

How to make an eSignature for signing the Family Limited Partnership Agreement And Certificate in Gmail

How to create an eSignature for the Family Limited Partnership Agreement And Certificate straight from your mobile device

How to create an eSignature for the Family Limited Partnership Agreement And Certificate on iOS

How to make an eSignature for the Family Limited Partnership Agreement And Certificate on Android

People also ask

-

What is a certificate of partnership sample?

A certificate of partnership sample is a document that formally establishes a partnership agreement between two or more parties. It typically outlines the roles, contributions, and responsibilities of each partner. Utilizing airSlate SignNow, you can create, customize, and eSign your certificate of partnership sample easily, ensuring a smooth onboarding process for your business.

-

How can airSlate SignNow help with creating a certificate of partnership sample?

airSlate SignNow offers a user-friendly platform that enables you to create a certificate of partnership sample quickly. You can start from a customizable template, add required fields, and personalize it to fit your business needs. This streamlines the document preparation process, allowing for efficient collaboration and signing.

-

What features does airSlate SignNow offer for handling documents like a certificate of partnership sample?

airSlate SignNow provides multiple features designed to make document management easy, including customizable templates, eSigning, document sharing, and real-time tracking. These features ensure that your certificate of partnership sample is created and signed efficiently, while maintaining legal compliance and security.

-

Is there a trial version available for airSlate SignNow to test the certificate of partnership sample feature?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including the creation of a certificate of partnership sample. This trial provides an excellent opportunity to assess its ease of use and effectiveness in managing your documents before committing to a subscription.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to different business needs. These plans provide varying levels of features for creating and managing documents, including the certificate of partnership sample. You can choose a plan that suits your budget and the scale of your operations.

-

Can I integrate airSlate SignNow with other business applications?

Absolutely! airSlate SignNow seamlessly integrates with numerous business applications, such as CRM systems and productivity tools. This allows you to automate workflows and easily manage documents like your certificate of partnership sample alongside your other business operations.

-

How secure is the data when using airSlate SignNow for my certificate of partnership sample?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and complies with industry standards to protect your data, including your certificate of partnership sample. You can be confident that your documents are safe throughout the eSigning process.

Get more for Family Limited Partnership Agreement Template

- Colorado critical incident form

- Ct bhp prtf referral form

- Member change form wesleyedu

- Pdsa worksheet team name cycle start date cycle end date aim statement plan area to work on describe the change you are testing form

- Florida el2 form 2014

- Florida no benefits form

- Apd off site custody form

- Biomedical waste plan form

Find out other Family Limited Partnership Agreement Template

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT