Nys 45 2019

What is the NYS 45?

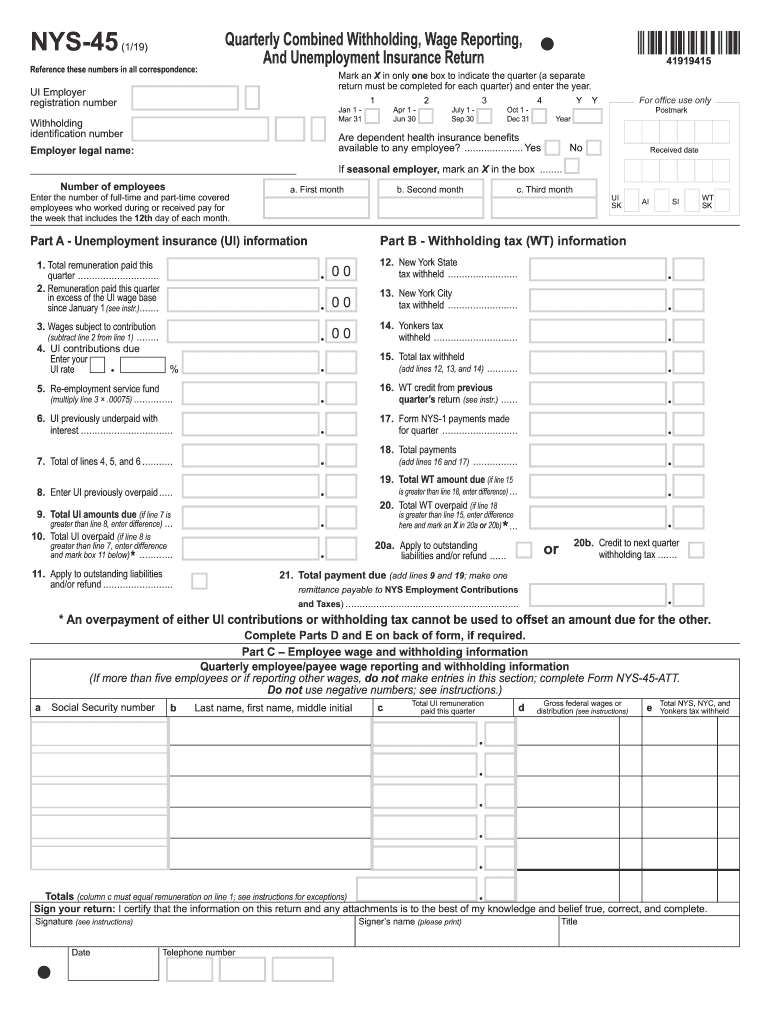

The NYS 45, also known as the New York State Employer's Quarterly Report, is a crucial document that employers in New York must file. This form provides the New York State Department of Taxation and Finance with information regarding employee wages, unemployment insurance, and taxes withheld. It is essential for maintaining compliance with state employment laws and for ensuring that employees receive the appropriate benefits. The NYS 45 is typically submitted on a quarterly basis and covers all employees working in New York State.

Steps to Complete the NYS 45

Completing the NYS 45 requires careful attention to detail. Here are the key steps to follow:

- Gather employee information, including names, Social Security numbers, and wages paid during the quarter.

- Calculate the total wages for each employee and the total taxes withheld.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed NYS 45 by the deadline, either online or via mail.

How to Obtain the NYS 45

Employers can obtain the NYS 45 form through the New York State Department of Taxation and Finance website. The form is available for download as a printable PDF. Additionally, many payroll software solutions include the NYS 45 as part of their reporting features, allowing for easier completion and submission.

Legal Use of the NYS 45

The NYS 45 is legally binding and must be completed accurately to avoid penalties. Employers are required to file this form to report wages and taxes withheld for their employees. Failure to file or inaccuracies in the form can result in fines and other legal consequences. It is important for employers to understand their obligations under New York State law regarding employment reporting.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the NYS 45. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for the 2023 calendar year are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The NYS 45 can be submitted through various methods to accommodate different employer needs. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a printed copy of the form to the appropriate address provided on the form.

- In-person submission at designated state offices, though this method is less common.

Quick guide on how to complete nys 45

Prepare Nys 45 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Nys 45 on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Nys 45 without effort

- Obtain Nys 45 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from your preferred device. Modify and electronically sign Nys 45 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys 45

Create this form in 5 minutes!

How to create an eSignature for the nys 45

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What are the nys 45 instructions for eSigning documents?

The nys 45 instructions provide guidance on how to complete and submit New York State's wage reporting forms electronically. With airSlate SignNow, eSigning these documents is straightforward, ensuring compliance with nys 45 instructions while streamlining the process for your business.

-

How does airSlate SignNow help with nys 45 instructions compliance?

airSlate SignNow simplifies the process of adhering to nys 45 instructions by offering an easy-to-use platform for electronic signatures. It ensures that all necessary documents are accurately signed and dated, helping your business maintain compliance without unnecessary delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Each plan provides access to features that help manage documentation as per nys 45 instructions, ensuring that you get value for your investment.

-

Can airSlate SignNow integrate with my existing software?

Yes, airSlate SignNow seamlessly integrates with several existing software applications. This compatibility allows businesses to easily incorporate eSigning for documents requiring nys 45 instructions without disrupting their current workflows.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, workflow automation, and secure cloud storage. These features not only enhance the eSigning experience but also assist businesses in adhering to nys 45 instructions efficiently.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely. airSlate SignNow ensures secure eSigning through encryption and robust security protocols. This is especially important when handling documents that follow nys 45 instructions, as it protects sensitive information throughout the process.

-

How quickly can I eSign documents with airSlate SignNow?

With airSlate SignNow, you can eSign documents almost instantly. The platform simplifies the signing process, allowing you to comply with nys 45 instructions without unnecessary delays, facilitating faster business operations.

Get more for Nys 45

Find out other Nys 45

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free