Form Ptax 300 R 2017

What is the Form Ptax 300 R

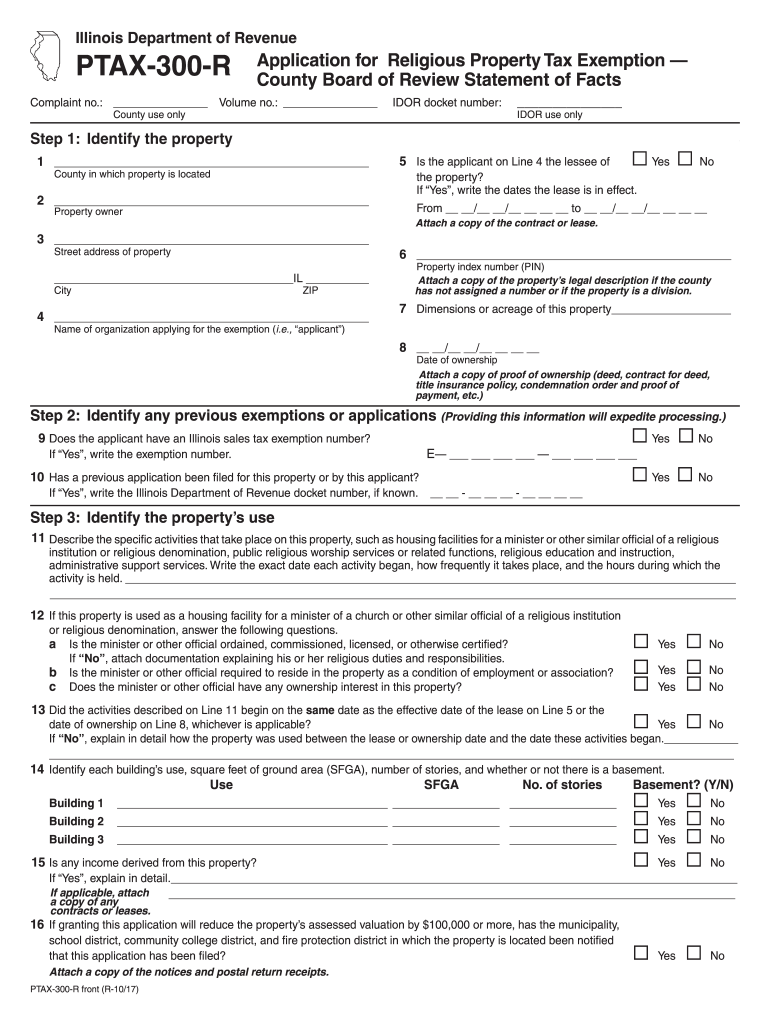

The Ptax 300 R form is an essential document used in Illinois for property tax exemptions. Specifically, it is designed for property owners to apply for various exemptions that can reduce their property tax burden. This form is primarily utilized by homeowners, including those eligible for general homestead exemptions, senior citizen exemptions, and disabled persons exemptions. Understanding the purpose and implications of the Ptax 300 R is crucial for property owners looking to maximize their tax benefits.

How to use the Form Ptax 300 R

Using the Ptax 300 R form involves several straightforward steps. First, property owners need to gather the necessary information about their property and personal details. This includes the property address, ownership information, and any relevant identification numbers. Once the form is completed, it can be submitted to the local assessor's office. It's important to ensure that all information is accurate and complete to avoid delays in processing. Utilizing electronic signatures can streamline this process, making it easier to submit the form digitally.

Steps to complete the Form Ptax 300 R

Completing the Ptax 300 R form requires careful attention to detail. Here are the steps to follow:

- Obtain the Ptax 300 R form from the Illinois Department of Revenue or your local assessor's office.

- Fill in the property owner's name and address, ensuring all details are correct.

- Indicate the type of exemption being applied for, such as general homestead or senior citizen exemption.

- Provide any required supporting documentation, such as proof of age or disability, if applicable.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate local office, either online or by mail.

Legal use of the Form Ptax 300 R

The Ptax 300 R form is legally binding when completed and submitted according to Illinois state regulations. It must be filled out truthfully, as providing false information can lead to penalties. The form is governed by various state laws that dictate eligibility and the types of exemptions available. Compliance with these legal requirements ensures that property owners can benefit from the exemptions without facing legal repercussions.

Eligibility Criteria

To qualify for the exemptions available through the Ptax 300 R form, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Ownership of the property for which the exemption is being claimed.

- Residency in the property as the primary residence.

- Meeting age or disability requirements for certain exemptions.

It is essential for applicants to review the specific criteria for each exemption type to determine their eligibility before submitting the form.

Form Submission Methods

The Ptax 300 R form can be submitted through various methods, providing flexibility for property owners. The available submission methods include:

- Online submission through the Illinois Department of Revenue's website or local assessor's office portal.

- Mailing the completed form to the appropriate local office.

- In-person submission at the local assessor's office.

Choosing the right submission method can help ensure timely processing of the application.

Quick guide on how to complete form ptax 300 r

Complete Form Ptax 300 R seamlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form Ptax 300 R on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form Ptax 300 R effortlessly

- Find Form Ptax 300 R and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to retain your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Ptax 300 R and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ptax 300 r

Create this form in 5 minutes!

How to create an eSignature for the form ptax 300 r

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Illinois PTAX 300 application form?

The Illinois PTAX 300 application form is a document used to apply for property tax exemptions in Illinois. This form allows property owners to report their eligibility for various tax benefits and ensures they receive the maximum savings available. Proper completion of this form is essential for accurate assessment and timely processing of your exemptions.

-

How can airSlate SignNow help with the Illinois PTAX 300 application form?

airSlate SignNow simplifies the process of submitting the Illinois PTAX 300 application form by allowing you to eSign and send documents securely online. With our platform, you can easily fill out the form, collect necessary signatures, and ensure your application is submitted without any delays. This streamlining reduces the paperwork hassle, making it easier to meet deadlines.

-

Is there a cost associated with using the Illinois PTAX 300 application form through airSlate SignNow?

Using airSlate SignNow offers a competitive pricing model that provides value for the features offered, including the management of the Illinois PTAX 300 application form. There are various subscription plans available, allowing businesses to choose one that fits their needs. Overall, the solution is cost-effective and designed for businesses looking to reduce operational costs.

-

What features does airSlate SignNow provide for the Illinois PTAX 300 application form?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSignature capabilities for the Illinois PTAX 300 application form. These tools help enhance productivity by streamlining document workflows, ensuring that you can manage your applications efficiently. Additionally, there's an intuitive interface that makes it easy for everyone to use.

-

Can I integrate airSlate SignNow with other software for handling the Illinois PTAX 300 application form?

Yes, airSlate SignNow seamlessly integrates with various third-party applications and services to enhance your workflow for the Illinois PTAX 300 application form. This includes integration with CRMs, document storage platforms, and more, ensuring you have everything needed to manage your documents in one place. These integrations also improve data accuracy and save you time.

-

How secure is the submission of the Illinois PTAX 300 application form via airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect your documents, including the Illinois PTAX 300 application form, ensuring that sensitive data remains confidential. Additionally, we comply with industry standards and regulations to provide users with a safe eSignature experience.

-

Can I track the status of my Illinois PTAX 300 application form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including the Illinois PTAX 300 application form. You can easily monitor when the document is viewed, signed, or completed, allowing you to stay informed about your application's progress and take action if needed.

Get more for Form Ptax 300 R

- Utility statement sample utility statement city of rocky mount 331 s rockymountnc form

- Caremark prior auth forms

- Planning 4 healthy babies form

- Hill rom vest order form

- Grade weekly reading summary log form

- Confined space sign in sheet form

- Motorcycle riders packet 25th infantry division 25idl army form

- Lscsc form

Find out other Form Ptax 300 R

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation