Tennessee Franchise Excise 2017

What is the Tennessee Franchise Excise

The Tennessee Franchise Excise is a tax imposed on businesses operating in the state of Tennessee. This tax is applicable to various business entities, including corporations, limited liability companies (LLCs), and partnerships. The Franchise Excise is calculated based on a business's net worth or the value of its property within the state. Understanding this tax is crucial for compliance and financial planning for businesses in Tennessee.

Steps to complete the Tennessee Franchise Excise

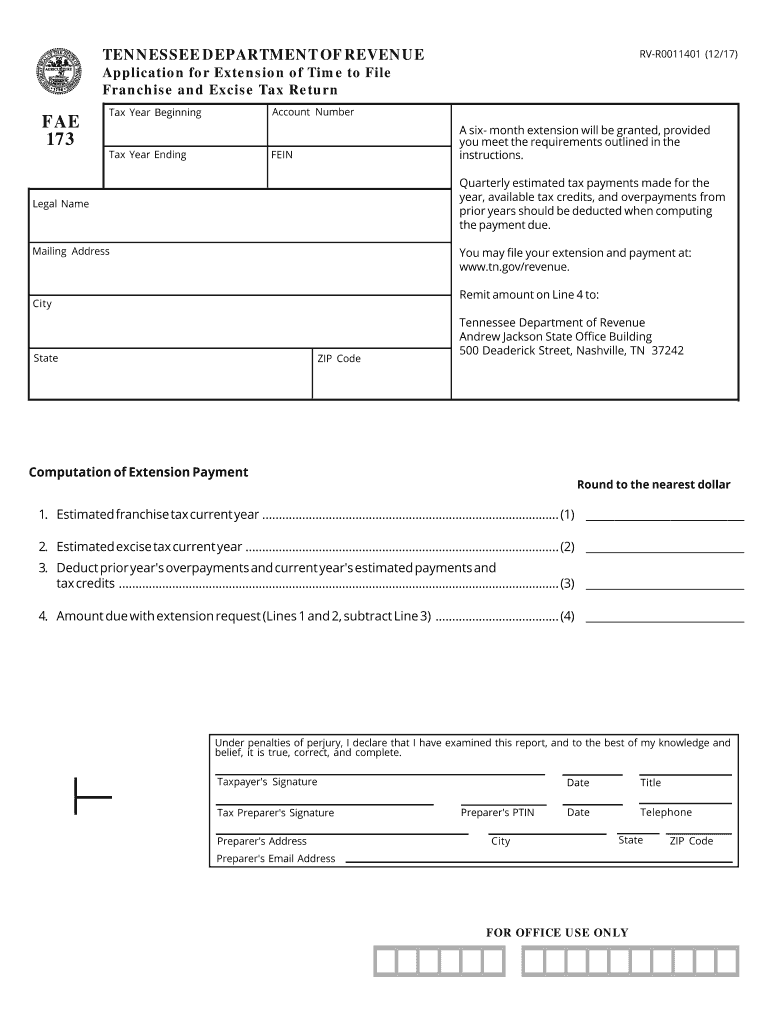

Completing the Tennessee Franchise Excise involves several key steps. First, businesses must gather financial information, including total assets and liabilities, to determine their net worth. Next, they need to fill out the appropriate form, specifically the 2018 FAE 173, ensuring all sections are accurately completed. After filling out the form, businesses can submit it either online or via mail. It is essential to keep a copy of the submitted form for record-keeping purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Franchise Excise are critical for compliance. Typically, the due date for filing the 2018 FAE 173 is the 15th day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the form is due by April 15. It is advisable for businesses to mark these dates on their calendars to avoid late penalties.

Legal use of the Tennessee Franchise Excise

The legal use of the Tennessee Franchise Excise is governed by state regulations. Businesses must ensure they are compliant with all relevant laws when calculating and reporting their excise tax. This includes maintaining accurate financial records and adhering to the specific guidelines outlined by the Tennessee Department of Revenue. Failure to comply can result in penalties or interest on unpaid taxes.

Required Documents

To complete the 2018 FAE 173, businesses must prepare several required documents. These typically include financial statements that reflect the business's net worth, previous tax filings, and any supporting documentation that verifies assets and liabilities. Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the 2018 FAE 173. They can file online through the Tennessee Department of Revenue's website, which often provides a more efficient and quicker processing time. Alternatively, businesses may choose to mail their completed forms to the appropriate state office. In-person submissions are also an option, although they may not be as common. It is important to choose the method that best suits the business's needs and ensure that submissions are made before the deadline.

Penalties for Non-Compliance

Non-compliance with the Tennessee Franchise Excise can lead to significant penalties. Businesses that fail to file their 2018 FAE 173 on time may incur late fees, interest on unpaid taxes, and potential legal action from the state. Understanding these penalties is essential for businesses to avoid unnecessary financial burdens and maintain good standing with state authorities.

Quick guide on how to complete tennessee franchise excise

Effortlessly Prepare Tennessee Franchise Excise on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the instruments you require to create, alter, and electronically sign your documents quickly without delays. Handle Tennessee Franchise Excise on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to Modify and eSign Tennessee Franchise Excise with Ease

- Find Tennessee Franchise Excise and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your selected device. Modify and eSign Tennessee Franchise Excise and ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee franchise excise

Create this form in 5 minutes!

How to create an eSignature for the tennessee franchise excise

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2018 fae 173 model, and how does it work?

The 2018 fae 173 is a versatile solution designed for efficient document management. It allows users to send and eSign documents seamlessly, improving workflow and reducing turnaround times. With its user-friendly interface, businesses can easily navigate through the signing process.

-

What are the key features of the 2018 fae 173?

The 2018 fae 173 boasts several key features, including advanced eSignature capabilities, real-time tracking, and document templates. These features enhance efficiency and ensure compliance in document handling. This model is perfect for businesses looking for an all-in-one signing solution.

-

How much does the 2018 fae 173 cost?

Pricing for the 2018 fae 173 varies based on the subscription plan chosen. Customers can select from monthly or annual plans, offering flexibility for businesses of all sizes. Each plan includes access to all essential features, ensuring a cost-effective document signing solution.

-

What are the benefits of using the 2018 fae 173 for my business?

Using the 2018 fae 173 helps businesses streamline document workflows, save time, and reduce paper usage. It enhances security with advanced encryption and ensures compliance, which is vital for many industries. Overall, it increases productivity and fosters a more sustainable business environment.

-

Can the 2018 fae 173 integrate with other software platforms?

Yes, the 2018 fae 173 offers integration with a variety of software platforms, including CRM systems and productivity tools. This flexibility allows businesses to enhance their existing workflows seamlessly. Integrations enable better data management and improve overall efficiency.

-

Is the 2018 fae 173 suitable for small businesses?

Absolutely, the 2018 fae 173 is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective pricing and easy-to-use features make it ideal for small businesses looking to enhance their document signing process. It enables them to compete effectively in a digital world.

-

How secure is the 2018 fae 173 for document signing?

The 2018 fae 173 prioritizes security, providing multiple layers of protection for sensitive documents. It utilizes advanced encryption and authentication processes to safeguard all eSignatures. This ensures that your business and client data remain confidential and secure.

Get more for Tennessee Franchise Excise

Find out other Tennessee Franchise Excise

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe