Sd 2210 Form 2016

What is the Sd 2210 Form

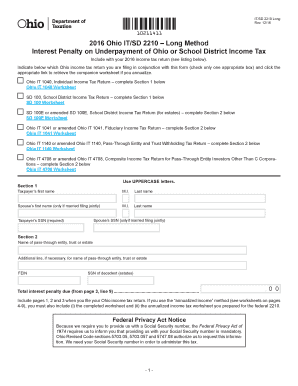

The Ohio Form IT SD 2210 is a tax form used by individuals to calculate and report underpayment of estimated taxes. This form is specifically designed for taxpayers who may not have paid enough tax throughout the year, leading to potential penalties. It helps determine whether an individual owes a penalty for underpayment and provides a means to calculate the amount due. Understanding the purpose of this form is essential for compliance with Ohio tax regulations.

How to use the Sd 2210 Form

Using the Ohio Form IT SD 2210 involves several key steps. First, gather your income information and any relevant tax documents. Next, you will need to calculate your total tax liability for the year and compare it to the amount you have already paid through withholding or estimated payments. If there is a shortfall, the form will guide you through the calculation of any penalties owed. It is important to follow the instructions carefully to ensure accurate reporting and compliance.

Steps to complete the Sd 2210 Form

Completing the Ohio Form IT SD 2210 requires a systematic approach. Begin by entering your personal information at the top of the form. Next, calculate your total tax liability by adding up all sources of income. Then, determine the amount you have already paid in estimated taxes and withholding. If your payments are less than your liability, use the provided worksheets to calculate the penalty for underpayment. Finally, review your entries for accuracy before submitting the form to the Ohio Department of Taxation.

Legal use of the Sd 2210 Form

The Ohio Form IT SD 2210 is legally recognized for reporting underpayment of estimated taxes. To ensure its legal validity, the form must be completed accurately and submitted by the specified deadlines. Compliance with Ohio tax laws is crucial to avoid penalties. Additionally, using a reliable eSignature solution can enhance the legal standing of the submitted form, as it provides a secure and verifiable method of signing and submitting documents electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Form IT SD 2210 are crucial for taxpayers to observe. Typically, the form must be submitted along with your annual tax return by the due date, which is usually April 15. However, if you are making estimated payments, it is essential to adhere to quarterly deadlines to avoid penalties. Keeping track of these dates ensures compliance and helps in managing your tax obligations effectively.

Required Documents

When completing the Ohio Form IT SD 2210, several documents are necessary to ensure accurate reporting. You will need your W-2 forms, 1099s, and any other income statements that reflect your earnings for the year. Additionally, gather records of any estimated tax payments made throughout the year. Having these documents on hand will facilitate the completion of the form and help in calculating your total tax liability accurately.

Form Submission Methods (Online / Mail / In-Person)

The Ohio Form IT SD 2210 can be submitted through various methods, providing flexibility for taxpayers. You may choose to file the form online using the Ohio Department of Taxation's e-filing system, which offers a convenient and secure way to submit your information. Alternatively, you can mail the completed form to the appropriate address listed on the form instructions. In-person submissions may also be possible at designated tax offices, depending on local regulations.

Quick guide on how to complete sd 2210 form

Effortlessly Prepare Sd 2210 Form on Any Device

Digital document handling has gained immense traction among companies and individuals alike. It serves as a perfect sustainable alternative to traditional printed and signed paperwork, enabling you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Sd 2210 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered activity today.

The Easiest Way to Edit and eSign Sd 2210 Form with Ease

- Locate Sd 2210 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form – via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Sd 2210 Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sd 2210 form

Create this form in 5 minutes!

How to create an eSignature for the sd 2210 form

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is Ohio Form IT SD 2210 for the 2015 year?

Ohio Form IT SD 2210 for the 2015 year is a tax form used by businesses to report and calculate underpayment of estimated taxes. This form helps ensure compliance with state tax laws and allows for accurate tax calculations based on the taxable income for that year. Filing this form correctly can prevent penalties and interest accrual.

-

How can airSlate SignNow help me with Ohio Form IT SD 2210 for 2015?

airSlate SignNow provides a user-friendly platform for eSigning and sending important tax documents, including Ohio Form IT SD 2210 for the 2015 year. Our solution streamlines the process, allowing you to quickly gather signatures and share documents without the hassle of printing or mailing. This efficiency not only saves time but also enhances document security.

-

Is there a cost associated with using airSlate SignNow for Ohio Form IT SD 2210?

Yes, airSlate SignNow offers several pricing plans to suit your business needs, which includes features for managing documents like Ohio Form IT SD 2210 for the 2015 year. Each plan is designed to provide flexibility and scalability as your eSigning needs grow. You can choose a subscription that aligns with your document management requirements.

-

Can I integrate airSlate SignNow with other software to manage Ohio Form IT SD 2210?

Absolutely! airSlate SignNow supports a variety of integrations with popular software solutions, allowing you to manage Ohio Form IT SD 2210 for the 2015 year seamlessly. Whether you use CRM, accounting, or project management tools, our platform can enhance your workflow and save you time through automated processes.

-

What are the benefits of using airSlate SignNow for tax documents like Ohio Form IT SD 2210?

Using airSlate SignNow for tax documents such as Ohio Form IT SD 2210 for the 2015 year can improve your operational efficiency with fast eSigning and document tracking. The platform enhances collaboration by allowing multiple users to access and sign documents simultaneously. This not only speeds up the processing time but also ensures compliance with deadline requirements.

-

How secure is my data when I use airSlate SignNow for Ohio Form IT SD 2210?

airSlate SignNow prioritizes the security of your data when you're handling sensitive documents like Ohio Form IT SD 2210 for the 2015 year. We implement strong encryption protocols and comply with industry standards to protect your information. You can trust that your documents are secure throughout the entire signing and management process.

-

Can I access Ohio Form IT SD 2210 on mobile using airSlate SignNow?

Yes! airSlate SignNow’s mobile-friendly interface allows you to access, fill out, and eSign Ohio Form IT SD 2210 for the 2015 year from your smartphone or tablet. This flexibility enables you to manage your documents on-the-go, ensuring you never miss a deadline, regardless of where you are.

Get more for Sd 2210 Form

- Ny commissioner of health nyna form

- Turner tech capstone form

- Courtyard credit card authorization form 1 doc

- Exponential regression practice worksheet answer key form

- Mpi bill of sale 80939016 form

- Tri care plus enrollment application read agency form

- Missouri department of social services family supp form

- Licensing and certification missouri department of form

Find out other Sd 2210 Form

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now