P85 Form 2013-2026

What is the P85 Form

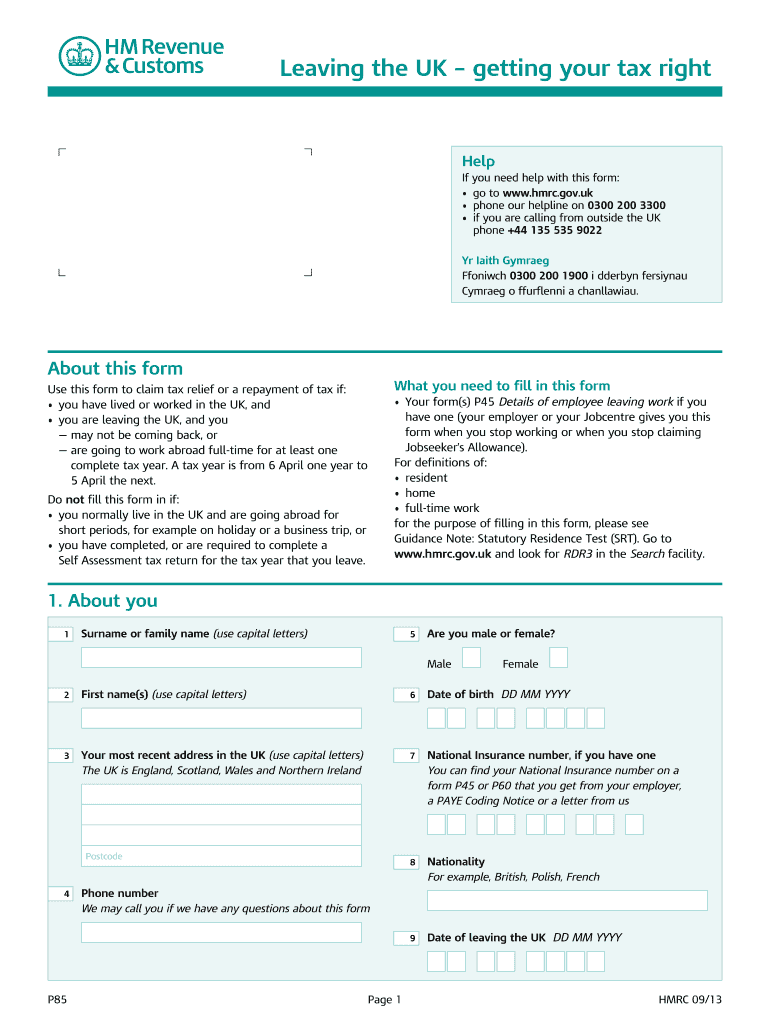

The P85 form is a document used by individuals who are leaving the United Kingdom to inform HM Revenue and Customs (HMRC) of their departure. It is primarily utilized to claim a tax refund for any overpaid taxes and to ensure that the individual's tax records are updated accordingly. The form helps determine the individual's residency status for tax purposes and is essential for those who may have income or assets in the UK after leaving.

How to use the P85 Form

To use the P85 form effectively, individuals should complete it accurately and submit it to HMRC. The form requires personal information, including the individual's name, address, and National Insurance number. Additionally, it asks for details about the departure date and the reasons for leaving the UK. After filling out the form, it can be submitted online or by mail, depending on the individual's preference. It is important to keep a copy of the submitted form for personal records.

Steps to complete the P85 Form

Completing the P85 form involves several key steps:

- Gather necessary personal information, such as your National Insurance number and details about your departure.

- Access the P85 form through the HMRC website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form online or by mailing it to HMRC.

Legal use of the P85 Form

The P85 form is legally recognized by HMRC as a valid means for individuals to declare their departure from the UK and manage their tax affairs. By submitting this form, individuals can ensure compliance with UK tax laws and avoid potential penalties for failing to notify HMRC of their change in residency status. It is crucial to submit the form promptly to facilitate any tax refunds and to maintain accurate tax records.

Key elements of the P85 Form

Several key elements are essential when completing the P85 form:

- Personal Information: Name, address, and National Insurance number.

- Departure Details: Date of departure and reasons for leaving the UK.

- Income Information: Details of any income earned while in the UK and any income expected after leaving.

- Residency Status: Information regarding the individual's residency status for tax purposes.

How to obtain the P85 Form

The P85 form can be obtained directly from the HMRC website, where it is available for download in PDF format. Alternatively, individuals can request a physical copy by contacting HMRC directly. It is advisable to ensure that the most current version of the form is used to avoid any compliance issues.

Quick guide on how to complete p85 form

Effortlessly Prepare P85 Form on Any Device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitution for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage P85 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign P85 Form with Ease

- Obtain P85 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign P85 Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p85 form

Create this form in 5 minutes!

How to create an eSignature for the p85 form

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a will codicil form UK?

A will codicil form UK is a legal document that allows you to make amendments or additions to your existing will. It is an essential tool for anyone looking to update their estate plans while keeping the original will intact. With airSlate SignNow, you can easily create and eSign a will codicil form UK to ensure your wishes are accurately reflected.

-

How does airSlate SignNow simplify the process of creating a will codicil form UK?

airSlate SignNow provides an intuitive platform that streamlines the creation of a will codicil form UK. You can access templates and guidance that help you fill out the necessary information quickly and correctly. This simplifies the process and reduces the chances of making mistakes.

-

Is there a fee for using the will codicil form UK on airSlate SignNow?

Yes, using the will codicil form UK on airSlate SignNow does involve a fee, but the cost is competitive and offers great value. We provide flexible pricing plans to accommodate different needs, ensuring you can find an option that works for your budget. Additionally, the convenience and security offered through our platform justify the investment.

-

What are the benefits of using airSlate SignNow for a will codicil form UK?

Using airSlate SignNow for your will codicil form UK offers numerous benefits, including ease of use, cost-effectiveness, and enhanced security. Our platform allows you to eSign documents securely, ensuring that your amendments are valid and binding. Also, you can access and manage your documents from any device.

-

Can I use airSlate SignNow for more than just a will codicil form UK?

Absolutely! airSlate SignNow is versatile and allows you to create and eSign a variety of legal documents beyond the will codicil form UK. From contracts to agreements, our platform supports multiple document types, making it ideal for both personal and business use.

-

How do I integrate airSlate SignNow with my existing document management system?

Integrating airSlate SignNow with your existing document management system is simple and straightforward. We offer API access and documentation to facilitate seamless integration, so you can incorporate the will codicil form UK and other documents into your workflow without hassle. This enhances productivity and ensures a smooth operation.

-

What security measures are in place for my will codicil form UK on airSlate SignNow?

Your security is our priority at airSlate SignNow. All documents, including your will codicil form UK, are encrypted in transit and at rest, ensuring that your sensitive information remains confidential. Additionally, we offer two-factor authentication and access controls to further protect your data.

Get more for P85 Form

Find out other P85 Form

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document