T1 Ovp Form 2020-2026

What is the T1 OVP Form

The T1 OVP form, also known as the T1 Original Voluntary Payment form, is a crucial document used primarily for tax purposes in the United States. This form allows individuals to report their income and calculate their tax obligations. It is essential for taxpayers to complete this form accurately to ensure compliance with federal regulations and avoid potential penalties. The T1 OVP form is designed to provide a clear outline of the taxpayer's financial situation, including income sources, deductions, and credits.

How to Use the T1 OVP Form

Using the T1 OVP form involves several key steps to ensure that all information is accurately reported. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that all sections are completed with accurate figures. It is important to double-check calculations and verify that all required information is included. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and the specific requirements of the tax authority.

Steps to Complete the T1 OVP Form

Completing the T1 OVP form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring that figures match your documentation.

- Include any deductions or credits you qualify for, providing necessary documentation where required.

- Review the completed form for accuracy, checking all calculations and ensuring all sections are filled out.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal Use of the T1 OVP Form

The T1 OVP form is legally binding when completed and submitted in accordance with IRS guidelines. To ensure its legal validity, it is important to adhere to all relevant tax laws and regulations. This includes accurately reporting income, claiming eligible deductions, and providing truthful information. Failure to comply with these regulations can result in penalties, including fines or audits. Utilizing a reliable electronic signing platform can further enhance the legal standing of the completed form by providing a secure method of submission and documentation.

Required Documents

To successfully complete the T1 OVP form, certain documents are required. These typically include:

- W-2 forms from employers detailing annual income.

- 1099 forms for any freelance or contract work.

- Receipts or documentation for deductible expenses.

- Any previous year tax returns for reference.

- Identification documents, such as a Social Security card or driver's license.

Form Submission Methods

The T1 OVP form can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online submission through the IRS e-file system, which allows for immediate processing and confirmation.

- Mailing a paper copy of the completed form to the appropriate IRS address, which may take longer to process.

- In-person submission at designated IRS offices, where assistance may be available for any questions or concerns.

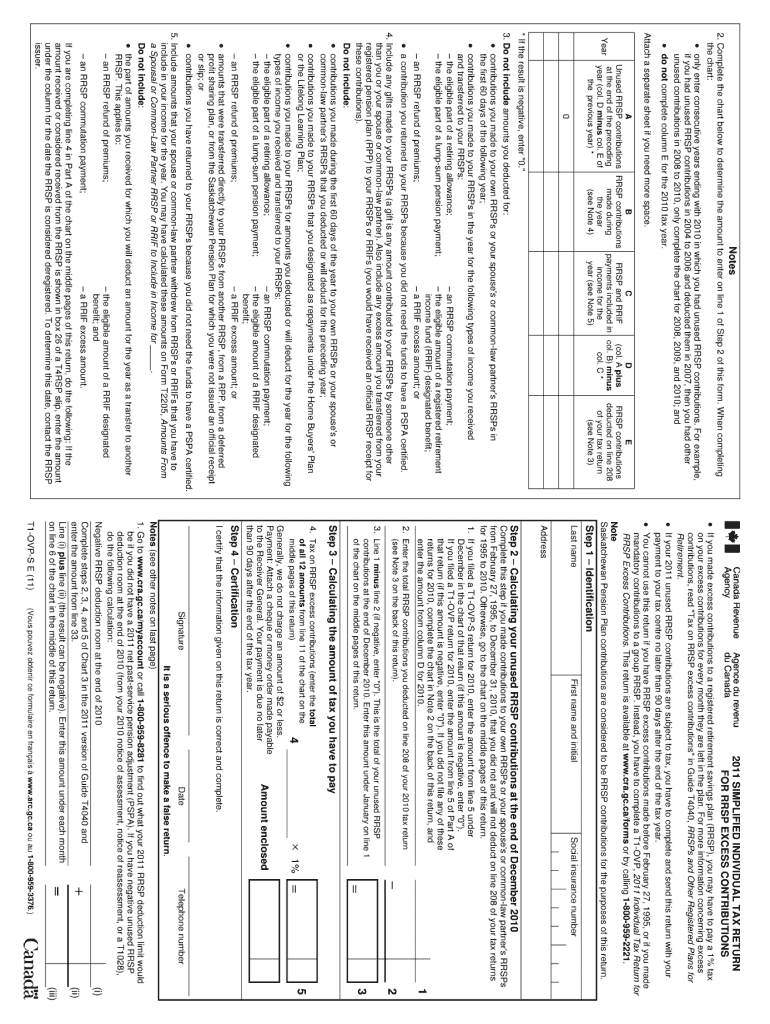

Quick guide on how to complete t1 ovp 2011 form

Complete T1 Ovp Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage T1 Ovp Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign T1 Ovp Form without difficulty

- Find T1 Ovp Form and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign T1 Ovp Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1 ovp 2011 form

Create this form in 5 minutes!

How to create an eSignature for the t1 ovp 2011 form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a formulaire t1 ovp and how does it work?

A formulaire t1 ovp is a specific document used for various administrative purposes in business transactions. It enables users to fill out, sign, and send important information securely. With airSlate SignNow, you can effortlessly manage the entire lifecycle of a formulaire t1 ovp online.

-

How can airSlate SignNow help me with my formulaire t1 ovp?

airSlate SignNow offers a user-friendly platform that allows you to create, edit, and eSign your formulaire t1 ovp efficiently. The tool provides templates that simplify document creation and ensure compliance. Plus, it helps you streamline your workflow by reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow for formulaire t1 ovp?

airSlate SignNow provides various pricing plans based on features and usage requirements. You can choose a plan that fits your budget while effectively handling your formulaire t1 ovp needs. Additionally, there is usually a free trial available for new users to explore the platform.

-

Can I integrate airSlate SignNow with other tools for my formulaire t1 ovp?

Yes, airSlate SignNow seamlessly integrates with various applications and services, allowing you to streamline your processes for your formulaire t1 ovp. Popular integrations include Google Drive, Salesforce, and more. This connectivity enhances operational efficiency and speeds up document processing.

-

What features does airSlate SignNow offer for managing formulaire t1 ovp?

With airSlate SignNow, you get features like electronic signatures, document templates, and real-time tracking for your formulaire t1 ovp. These functionalities enhance collaboration and ensure that you can manage your documents securely and effectively. It also provides audit trails for increased accountability.

-

Why should I choose airSlate SignNow for my formulaire t1 ovp needs?

Choosing airSlate SignNow for your formulaire t1 ovp means opting for efficiency, cost-effectiveness, and ease of use. The platform empowers you to manage documents without the hassle of paperwork, thus improving productivity. Its strong emphasis on security ensures that your sensitive data is protected.

-

Is it easy to get started with airSlate SignNow for formulaire t1 ovp?

Absolutely! Getting started with airSlate SignNow for your formulaire t1 ovp is straightforward and user-friendly. You can register for an account within minutes and access various resources and templates tailored to your needs. Support is also available if you encounter any issues.

Get more for T1 Ovp Form

- Form am0320 liquor licence transfer this application form is for a person or organisation applying for transfer of a liquor

- Social behavior questionnaire for students form

- Taste of herbs flavor wheel form

- Homelink fax form

- Direct deposit form example filled out

- Wells fargo budget worksheet 100423721 form

- Notice to appear example form

- Cdc letterhead template form

Find out other T1 Ovp Form

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile