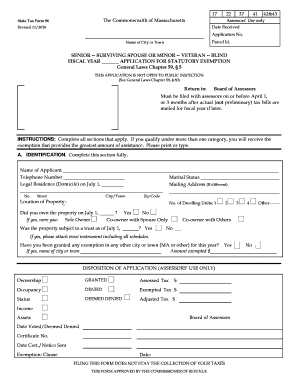

State Tax Form 96 Mass Gov Mass 2017

What is the State Tax Form 96 Mass Gov Mass

The State Tax Form 96 is a document used by residents of Massachusetts for specific tax-related purposes. This form is typically utilized for reporting various types of income or tax credits. Understanding the purpose of this form is essential for accurate tax filing and compliance with state regulations. It is important to ensure that all information provided on the form is accurate to avoid potential issues with the Massachusetts Department of Revenue.

How to use the State Tax Form 96 Mass Gov Mass

Using the State Tax Form 96 involves several steps to ensure proper completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is crucial to double-check all entries for errors before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements set by the Massachusetts Department of Revenue.

Steps to complete the State Tax Form 96 Mass Gov Mass

Completing the State Tax Form 96 requires a systematic approach:

- Gather necessary documents, such as W-2 forms and other income statements.

- Access the form through the Massachusetts government website or obtain a physical copy.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income and any applicable deductions or credits.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring you follow the submission guidelines.

Legal use of the State Tax Form 96 Mass Gov Mass

The legal use of the State Tax Form 96 is governed by Massachusetts tax laws. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Ensuring compliance with these laws is crucial for the form to be legally binding and accepted by the state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the State Tax Form 96 are critical to avoid penalties. Typically, the form must be submitted by April 15 for individual taxpayers, aligning with federal tax deadlines. However, specific circumstances, such as extensions or unique filing situations, may alter these dates. It is advisable to check the Massachusetts Department of Revenue website for the most current deadlines and any updates regarding filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The State Tax Form 96 can be submitted through various methods, offering flexibility to taxpayers. Options include:

- Online Submission: Use the Massachusetts Department of Revenue's online portal for electronic filing.

- Mail: Send a completed paper form to the designated address provided by the state.

- In-Person: Visit a local Department of Revenue office for assistance and submission.

Quick guide on how to complete state tax form 96 massgov mass 6967415

Complete State Tax Form 96 Mass Gov Mass seamlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the functionalities needed to create, modify, and electronically sign your documents quickly without delays. Handle State Tax Form 96 Mass Gov Mass on any platform utilizing airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and electronically sign State Tax Form 96 Mass Gov Mass with ease

- Obtain State Tax Form 96 Mass Gov Mass and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to retain your modifications.

- Choose your preferred method for sending your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign State Tax Form 96 Mass Gov Mass and guarantee effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state tax form 96 massgov mass 6967415

Create this form in 5 minutes!

How to create an eSignature for the state tax form 96 massgov mass 6967415

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the State Tax Form 96 Mass Gov Mass?

The State Tax Form 96 Mass Gov Mass is an essential document required for certain tax filings in Massachusetts. It assists taxpayers in reporting and paying their state taxes accurately. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the State Tax Form 96 Mass Gov Mass?

airSlate SignNow simplifies the process of completing and eSigning the State Tax Form 96 Mass Gov Mass. With our user-friendly platform, you can easily fill out the form electronically, ensuring all necessary information is accurately captured and securely submitted.

-

Is there a cost associated with using airSlate SignNow for the State Tax Form 96 Mass Gov Mass?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to meet different business needs. Utilizing our service for the State Tax Form 96 Mass Gov Mass helps save time and reduce errors, making it a worthwhile investment for tax compliance.

-

What features does airSlate SignNow offer for managing the State Tax Form 96 Mass Gov Mass?

Our platform provides features such as customizable templates, secure storage, and tracking capabilities for the State Tax Form 96 Mass Gov Mass. These functionalities ensure that your documents are organized, accessible, and easy to manage throughout the signing process.

-

Can I integrate airSlate SignNow with other software for filing the State Tax Form 96 Mass Gov Mass?

Yes, airSlate SignNow integrates seamlessly with various software applications, facilitating a streamlined workflow for filing the State Tax Form 96 Mass Gov Mass. By connecting with your existing systems, you can enhance productivity and ensure that your tax documents are efficiently processed.

-

What are the benefits of using airSlate SignNow for the State Tax Form 96 Mass Gov Mass?

Using airSlate SignNow for the State Tax Form 96 Mass Gov Mass can signNowly improve efficiency and accuracy. Our platform allows users to eSign documents quickly, track their signing status, and store completed forms securely, reducing the hassle associated with traditional paper filing.

-

How secure is the information submitted on the State Tax Form 96 Mass Gov Mass through airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform ensures that all documents, including the State Tax Form 96 Mass Gov Mass, are encrypted and stored securely, safeguarding sensitive information from unauthorized access during the signing process.

Get more for State Tax Form 96 Mass Gov Mass

Find out other State Tax Form 96 Mass Gov Mass

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure