Concurrent Knowingly Revenue 2017

Understanding the Concurrent Knowingly Revenue

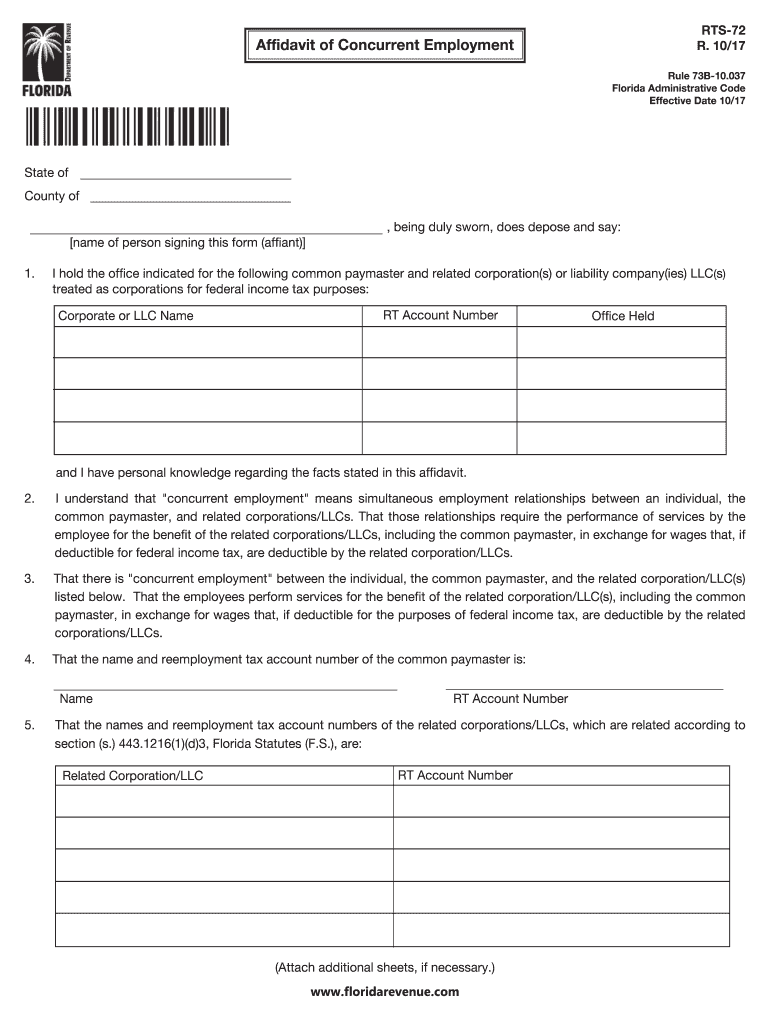

The Concurrent Knowingly Revenue refers to a specific financial disclosure that outlines the revenue earned concurrently across various streams or activities. This form is essential for individuals and businesses to report income accurately, ensuring compliance with tax regulations. It plays a crucial role in maintaining transparency and accountability in financial reporting.

Steps to Complete the Concurrent Knowingly Revenue

Filling out the Concurrent Knowingly Revenue form involves several key steps to ensure accuracy and compliance:

- Gather Documentation: Collect all relevant financial documents, including income statements and receipts.

- Identify Revenue Streams: Clearly outline each source of income, specifying amounts and dates.

- Complete the Form: Fill out the form accurately, ensuring all sections are addressed.

- Review for Accuracy: Double-check all entries for correctness to avoid errors.

- Submit the Form: Choose your submission method, whether online, by mail, or in person.

Legal Use of the Concurrent Knowingly Revenue

The legal use of the Concurrent Knowingly Revenue form is vital for compliance with tax laws. It ensures that all income is reported accurately, which can help prevent legal issues related to underreporting. Utilizing this form correctly can also provide protection in case of audits or inquiries from tax authorities.

Required Documents for Submission

When preparing to submit the Concurrent Knowingly Revenue form, several documents are necessary to support your claims:

- Income statements from all revenue sources

- Receipts for expenses related to the reported income

- Previous tax returns, if applicable

- Any additional documentation that verifies income amounts

Disclosure Requirements

Disclosure requirements for the Concurrent Knowingly Revenue form mandate that all income sources must be fully reported. This includes any concurrent earnings from multiple activities. Failure to disclose all income can lead to penalties, making it essential to provide complete and accurate information.

Penalties for Non-Compliance

Non-compliance with the requirements of the Concurrent Knowingly Revenue form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to adhere to all reporting guidelines to avoid these consequences.

Examples of Using the Concurrent Knowingly Revenue

Understanding how to apply the Concurrent Knowingly Revenue form can be enhanced through practical examples:

- A freelancer who earns income from multiple clients must report each source on the form.

- A business owner with various revenue streams, such as product sales and services, needs to detail each income source.

- Individuals with rental properties earning concurrent income must disclose all rental earnings accurately.

Quick guide on how to complete concurrent knowingly revenue

Complete Concurrent Knowingly Revenue seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Concurrent Knowingly Revenue on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to alter and eSign Concurrent Knowingly Revenue effortlessly

- Locate Concurrent Knowingly Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to finalize your updates.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, exhaustive form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Alter and eSign Concurrent Knowingly Revenue and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct concurrent knowingly revenue

Create this form in 5 minutes!

How to create an eSignature for the concurrent knowingly revenue

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the concurrent employing disclosure feature offered by airSlate SignNow?

The concurrent employing disclosure feature allows businesses to streamline their document management processes. This feature ensures that all parties involved in the signing process can review and sign documents simultaneously, enhancing efficiency. By using airSlate SignNow, you can effectively handle concurrent employing disclosures with ease.

-

How does airSlate SignNow enhance the management of concurrent employing disclosures?

airSlate SignNow simplifies the management of concurrent employing disclosures through its user-friendly interface and robust functionalities. Users can easily track document progress, send reminders, and receive notifications when documents are signed. This ensures compliance and timely execution of all necessary disclosures.

-

What pricing options does airSlate SignNow offer for businesses utilizing concurrent employing disclosures?

airSlate SignNow provides flexible pricing plans suitable for diverse business needs, including those specifically handling concurrent employing disclosures. Plans are designed to accommodate small teams or large enterprises, ensuring you only pay for what you use. Each plan offers features that support seamless e-signature and document management.

-

Can airSlate SignNow integrate with other tools to manage concurrent employing disclosures?

Yes, airSlate SignNow can integrate with various third-party applications to facilitate the management of concurrent employing disclosures. You can connect it with CRM, ERP, and other systems to automate workflows and enhance productivity. Integration allows for smoother document handling and tracking across multiple platforms.

-

What benefits do businesses gain from using airSlate SignNow for concurrent employing disclosures?

Utilizing airSlate SignNow for concurrent employing disclosures offers numerous benefits, including increased efficiency and faster turnaround times. By allowing multiple parties to sign documents at once, you minimize delays and enhance communication within your team. This leads to improved overall process management and satisfaction.

-

Is airSlate SignNow secure for handling sensitive concurrent employing disclosures?

Absolutely! airSlate SignNow prioritizes the security of your documents, including concurrent employing disclosures. The platform employs advanced encryption and industry-standard security measures to protect sensitive information. You can trust that your documents are safe and secure during the signing process.

-

How can I get started with airSlate SignNow for concurrent employing disclosures?

Getting started with airSlate SignNow for concurrent employing disclosures is simple. Sign up for a free trial to explore the platform's features and benefits. Once onboarded, you can quickly create, manage, and send documents for e-signature, enhancing your workflow right away.

Get more for Concurrent Knowingly Revenue

- Non tax filer statement college board form

- Fillable sq 1 1481 combination roof and overflow form

- Scouts canada physical fitness form

- Empowerchiro form

- Reptile classifying worksheet form

- Behavior reward chart form

- Needymeds find help with the cost of medicine www form

- Percentage partnership agreement template form

Find out other Concurrent Knowingly Revenue

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document