Form 114a 2015

What is the Form 114a

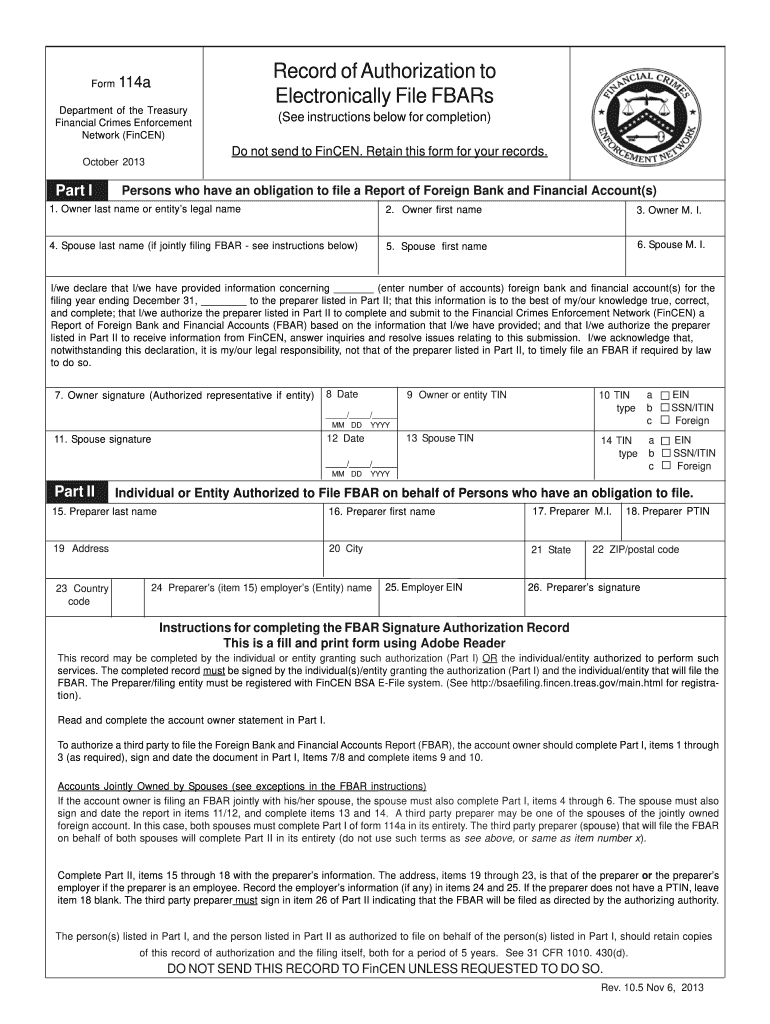

The Form 114a, also known as the Report of Foreign Bank and Financial Accounts (FBAR), is a crucial document for U.S. taxpayers with foreign financial interests. This form is specifically used to report foreign bank accounts and other financial accounts held outside of the United States. It is required by the Financial Crimes Enforcement Network (FinCEN) to ensure compliance with the Bank Secrecy Act. Individuals and entities that meet certain criteria must file this form annually to avoid severe penalties.

How to use the Form 114a

Using the Form 114a involves several key steps. First, taxpayers must determine if they have a financial interest in or signature authority over foreign accounts that exceed a combined total of $10,000 at any point during the calendar year. Once eligibility is established, the form can be completed electronically through the FinCEN's BSA E-Filing System. It is essential to provide accurate information regarding account details, including the account number, financial institution, and maximum account balance during the reporting period.

Steps to complete the Form 114a

Completing the Form 114a requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information regarding your foreign accounts, including account numbers and financial institution details.

- Access the BSA E-Filing System to begin filling out the form.

- Enter your personal information, including your name, address, and Social Security number.

- List all foreign financial accounts, ensuring that the total exceeds the $10,000 threshold.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically by the deadline, which is typically April 15, with an automatic extension available until October 15.

Legal use of the Form 114a

The legal use of the Form 114a is governed by U.S. law, specifically the Bank Secrecy Act. Filing this form is mandatory for U.S. citizens, residents, and entities with foreign accounts that meet the reporting threshold. Failure to comply can result in significant penalties, including fines and possible criminal charges. It is crucial to understand the legal implications of not filing, as the IRS and FinCEN actively enforce compliance.

Filing Deadlines / Important Dates

The filing deadline for the Form 114a is April 15 of each year. However, if you miss this deadline, you can still file by October 15, which is an automatic extension. It is important to keep these dates in mind to avoid penalties. Additionally, taxpayers should be aware that the form must be filed electronically, as paper submissions are not accepted.

Penalties for Non-Compliance

Non-compliance with the Form 114a filing requirements can lead to severe penalties. For willful violations, penalties can reach up to $100,000 or 50% of the account balance at the time of the violation, whichever is greater. Non-willful violations may incur a penalty of up to $10,000 per violation. Understanding these penalties underscores the importance of timely and accurate filing.

Quick guide on how to complete form 114a 2013

Create Form 114a effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and safely preserve it online. airSlate SignNow offers you all the features required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form 114a across any platform using airSlate SignNow's Android or iOS applications and enhance any documentation-related process today.

The simplest method to modify and eSign Form 114a with ease

- Locate Form 114a and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to secure your changes.

- Decide how you would like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, monotonous form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 114a while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 114a 2013

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is Form 114a, and why is it important for businesses?

Form 114a is a crucial document for businesses that need to report foreign bank accounts to comply with U.S. regulations. Ensuring accurate completion can help businesses avoid penalties and maintain compliance. Using airSlate SignNow simplifies the signing and submission process for Form 114a, making it easier to manage.

-

How can airSlate SignNow help me with signing Form 114a?

With airSlate SignNow, you can effortlessly eSign Form 114a, ensuring a secure and legally binding agreement. The platform allows you to send the form directly to recipients for their electronic signatures, streamlining your document management processes. This is especially useful for businesses handling multiple signatures or approvals.

-

What are the pricing options for using airSlate SignNow for Form 114a?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs when managing documents like Form 114a. You can choose from monthly or annual subscriptions, with the option to select features that best suit your requirements. This flexibility ensures that you only pay for what you need.

-

Are there any specific features in airSlate SignNow that support Form 114a management?

Yes, airSlate SignNow includes features like templates, automated workflows, and status tracking that directly enhance your handling of Form 114a. These tools help you streamline the preparation, signing, and storing processes, ensuring nothing is overlooked. Additionally, the platform offers customizable notifications to keep you informed on document progress.

-

Can I integrate airSlate SignNow with other applications while handling Form 114a?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 114a alongside your other business tools. This flexibility means you can connect with CRMs, cloud storage, and more to maximize efficiency. Integrating these solutions helps maintain organized workflows and enhances productivity.

-

What security measures does airSlate SignNow implement for Form 114a?

airSlate SignNow prioritizes your data security with features such as encryption, secure cloud storage, and robust privacy policies for documents like Form 114a. The platform is compliant with industry standards, ensuring that your sensitive information remains protected. This provides peace of mind as you navigate compliance requirements.

-

How does eSigning Form 114a with airSlate SignNow benefit my business?

eSigning Form 114a with airSlate SignNow increases efficiency and reduces turnaround time compared to traditional methods. It eliminates the need for printing, scanning, and mailing, allowing for quick transaction completion. Additionally, the easy-to-use interface encourages faster approvals, which is beneficial for your business operations.

Get more for Form 114a

- P1 pr 009 affidavit of heirship form

- Cs 186d 2 form

- E3xtend health hra omaha ne form

- Silent auction donation form 394030636

- Volunteer questionnaire form personal information

- How to reduce the negative mental health effects of divorce form

- Faqsveteran services military injury relief fund mirf form

- Pay grade rank form

Find out other Form 114a

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA