Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version 2022

What is the Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

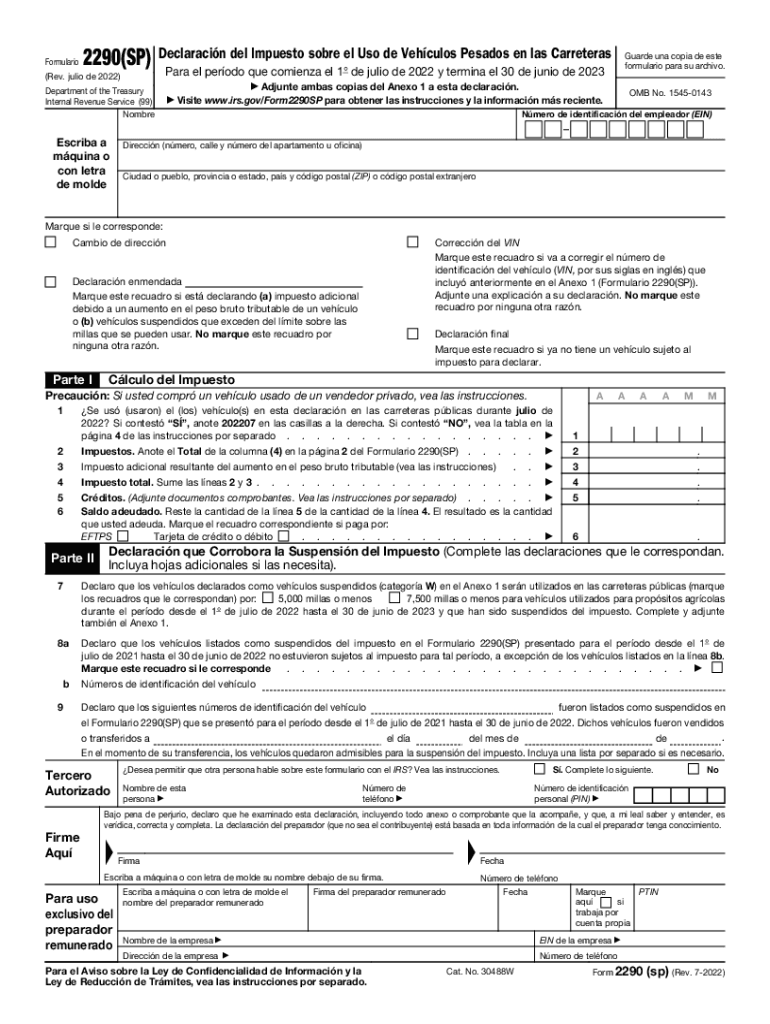

The Form 2290SP, also known as the Heavy Vehicle Use Tax Return Spanish Version, is a tax form used by vehicle owners in the United States to report and pay the Heavy Vehicle Use Tax (HVUT). This form is specifically designed for Spanish-speaking taxpayers who own heavy vehicles with a gross weight of 55,000 pounds or more. The tax is assessed annually and is required for vehicles that operate on public highways. The form must be submitted to the Internal Revenue Service (IRS) to ensure compliance with federal tax regulations.

Steps to complete the Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

Completing the Form 2290SP involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your vehicle, including its gross weight and identification number. Next, fill out the form, providing details such as your name, address, and the vehicle's information. It is important to calculate the tax amount based on the vehicle's weight and the tax rate for the current year. Once the form is completed, review it for any errors before submitting it to the IRS. You can file the form electronically or by mail, depending on your preference.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 2290SP. These guidelines include instructions on how to calculate the Heavy Vehicle Use Tax based on the vehicle's weight and the applicable rates. Additionally, the IRS outlines the deadlines for filing the form, which typically falls on the last day of the month following the month in which the vehicle was first used on public highways. Understanding these guidelines is crucial for ensuring timely and accurate tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2290SP are critical for avoiding penalties. The form must be filed annually, with the deadline typically set for the last day of August for vehicles first used in July. If a vehicle is used for the first time after July, the deadline is the last day of the month following its first use. It is important to keep track of these dates to ensure that the form is submitted on time and to avoid incurring any late fees or penalties from the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Form 2290SP can be submitted through various methods, providing flexibility for taxpayers. Electronic filing is available and is often the preferred method due to its speed and efficiency. Taxpayers can also choose to mail the completed form to the IRS. For those who prefer in-person submissions, visiting a local IRS office may be an option, although it is advisable to check for availability and appointment requirements. Each method has its own processing times and considerations, so selecting the right one is important for timely compliance.

Penalties for Non-Compliance

Failure to file the Form 2290SP on time or to pay the required Heavy Vehicle Use Tax can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, if a taxpayer fails to pay the tax owed, interest will accrue on the unpaid amount. Understanding these penalties emphasizes the importance of timely and accurate submission of the form to avoid unnecessary financial burdens.

Quick guide on how to complete form 2290sp rev july 2022 heavy vehicle use tax return spanish version

Effortlessly prepare Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version on any device using airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest method to alter and eSign Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version effortlessly

- Find Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Recheck all details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2290sp rev july 2022 heavy vehicle use tax return spanish version

Create this form in 5 minutes!

People also ask

-

What is the formulario 2290 and who needs it?

The formulario 2290 is a federal tax form used to pay the Heavy Vehicle Use Tax (HVUT) for vehicles operating on public highways. It is essential for businesses and individuals who operate heavy trucks with a gross weight of 55,000 pounds or more. Accurate completion of the formulario 2290 is crucial to avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the formulario 2290?

airSlate SignNow simplifies the process of preparing and submitting your formulario 2290 by providing easy-to-use templates and eSignature capabilities. You can fill out the form digitally, ensuring accuracy and compliance. Additionally, airSlate SignNow allows you to securely send and sign documents, making the overall process more efficient.

-

Is there a cost associated with using airSlate SignNow to submit formulario 2290?

Yes, airSlate SignNow offers various pricing plans to suit different needs, starting from a cost-effective option for small businesses to more comprehensive plans for larger organizations. The pricing includes features that facilitate easy completion and electronic submission of the formulario 2290. Check the airSlate SignNow website for details on subscription options.

-

What features does airSlate SignNow offer for formulario 2290 users?

airSlate SignNow provides an array of features including document templates, eSigning, secure cloud storage, and mobile access. You can collaborate with your team in real-time while handling the formulario 2290. These features not only enhance productivity but also ensure that your tax submissions are accurate and timely.

-

Can I integrate airSlate SignNow with other software to manage formulario 2290?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems, accounting software, and more. This allows you to streamline your workflow when handling the formulario 2290 and other important documents. By utilizing integrations, you can keep all your business operations efficient and centralized.

-

How secure is my information when using airSlate SignNow for formulario 2290?

Security is a top priority at airSlate SignNow. All documents, including the formulario 2290, are encrypted during transmission and storage. Additionally, airSlate SignNow complies with industry standards to protect sensitive information, giving you peace of mind when handling your tax documents.

-

Can I track the status of my formulario 2290 submission using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking functionalities that allow you to monitor the status of your formulario 2290 submission. You'll receive notifications when documents are viewed, signed, or completed, which helps you stay informed throughout the process.

Get more for Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

- New jersey compensation form

- Nj workers compensation 497319699 form

- New jersey compensation 497319700 form

- New jersey workers compensation 497319701 form

- New jersey compensation 497319702 form

- Informal hearing workers

- Legal last will and testament form for single person with no children new jersey

- Legal last will and testament form for a single person with minor children new jersey

Find out other Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement