Ad 435 Form

What is the Ad 435

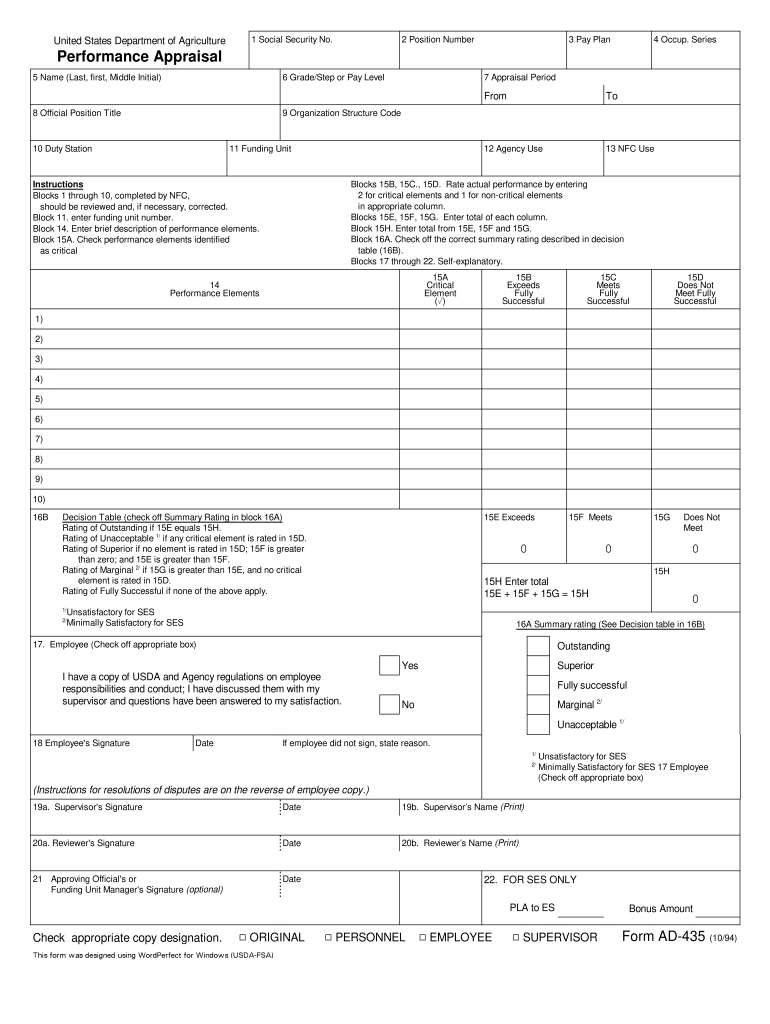

The Ad 435 is a form used primarily in agricultural contexts, particularly related to the United States Department of Agriculture (USDA). It serves as a performance report for various agricultural programs and assists in documenting compliance with federal regulations. This form is essential for producers and stakeholders who participate in USDA programs, ensuring that they meet the necessary requirements for funding and support.

How to use the Ad 435

Using the Ad 435 involves several steps to ensure proper completion and submission. First, gather all relevant information regarding your agricultural activities and any applicable regulations. Next, fill out the form accurately, providing details such as your operation's performance metrics and compliance with USDA guidelines. It is crucial to review the form for accuracy and completeness before submission. Finally, submit the form through the designated channels, either online or via mail, as specified by the USDA.

Steps to complete the Ad 435

Completing the Ad 435 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including previous performance reports and compliance records.

- Fill in the required fields, ensuring all information is accurate and up-to-date.

- Review the form for any errors or omissions.

- Sign and date the form to validate your submission.

- Submit the completed form to the appropriate USDA office, either electronically or by mail.

Legal use of the Ad 435

The legal use of the Ad 435 is governed by USDA regulations. It is important to ensure that all information provided on the form is truthful and accurate, as any discrepancies may lead to penalties or disqualification from USDA programs. The form must be submitted within the specified deadlines to maintain compliance with federal guidelines. Understanding these legal frameworks helps ensure that your submission is valid and recognized by the USDA.

Required Documents

When completing the Ad 435, several documents may be required to support your submission. These can include:

- Previous Ad 435 forms to show historical performance.

- Financial records related to agricultural operations.

- Compliance documents that demonstrate adherence to USDA regulations.

- Any additional forms or reports that may be specified by the USDA for your specific program.

Form Submission Methods

The Ad 435 can be submitted through various methods, depending on the USDA's guidelines. Common submission methods include:

- Online submission through the USDA's designated portal.

- Mailing a physical copy of the completed form to the appropriate USDA office.

- In-person submission at local USDA offices, where assistance may be available.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Ad 435 can result in significant penalties. These may include:

- Loss of eligibility for USDA programs and funding.

- Monetary fines for false information or late submissions.

- Legal action if violations are deemed severe.

Understanding these penalties highlights the importance of accurate and timely submissions to avoid potential repercussions.

Quick guide on how to complete ad 435

Execute Ad 435 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Handle Ad 435 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to adjust and eSign Ad 435 without hassle

- Obtain Ad 435 and then click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ad 435 and guarantee outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ad 435

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What are overtime wages and how do they work?

Overtime wages refer to the additional pay employees receive for hours worked beyond the standard workweek, typically over 40 hours. Understanding how overtime wages are calculated is crucial for both employers and employees to ensure fair compensation. airSlate SignNow can help streamline the documentation required for tracking these hours efficiently.

-

How does airSlate SignNow help with overtime wages documentation?

airSlate SignNow offers businesses a seamless way to prepare, send, and sign documents related to overtime wages. With our eSignature solution, employers can quickly distribute overtime agreements and ensure compliance, making it easier to manage employee workload and documentation needs. This leads to more transparent and accurate tracking of overtime wages.

-

What features does airSlate SignNow include for managing overtime wages?

Our platform includes features such as customizable document templates, automated reminders, and secure storage, specifically designed to simplify the management of overtime wages. These tools not only enhance efficiency but also ensure that all the necessary forms are legally compliant. With airSlate SignNow, you can focus on your core business while we handle the paperwork related to overtime wages.

-

Is airSlate SignNow cost-effective for small businesses managing overtime wages?

Yes, airSlate SignNow is designed to be a cost-effective solution that meets the needs of small businesses managing overtime wages. Our pricing plans are tailored to offer essential features without breaking the bank, making it easier for small businesses to ensure accurate and timely payment of overtime wages. Affordable plans mean you can prioritize employee satisfaction without financial strain.

-

Can airSlate SignNow integrate with payroll systems to manage overtime wages?

Absolutely! airSlate SignNow can easily integrate with various payroll systems to ensure that overtime wages are accurately calculated and paid. This seamless integration helps streamline the payroll process while reducing administrative burdens. Keeping your overtime wages up-to-date becomes hassle-free with such connectivity.

-

How secure is the data related to overtime wages in airSlate SignNow?

Data security is a top priority at airSlate SignNow. We utilize advanced encryption and secure access protocols to protect sensitive information related to overtime wages. With our platform, businesses can rest assured that their documents and employee data are safeguarded from unauthorized access.

-

What benefits can companies expect from using airSlate SignNow for overtime wages?

Using airSlate SignNow for managing overtime wages offers companies numerous benefits, such as increased accuracy in wage calculations, reduced processing time, and enhanced employee satisfaction. Our intuitive solution simplifies the entire signing process, allowing businesses to focus more on their operational goals. Ultimately, this leads to better management of overtime wages and overall workflow efficiency.

Get more for Ad 435

- Direct reimbursement claim form davis vision

- Patient property form

- Home care intake form template

- Pa short form

- Community housing queensu cacurrent tenantcurrent tenant application for new lease january community form

- Family victim impact statements and sentencing homicide cases form

- Birth certificate application form 732854794

- Ending a child support assessment humanservicesgovau humanservices gov form

Find out other Ad 435

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online