Form 29sc

What is the Form 29sc

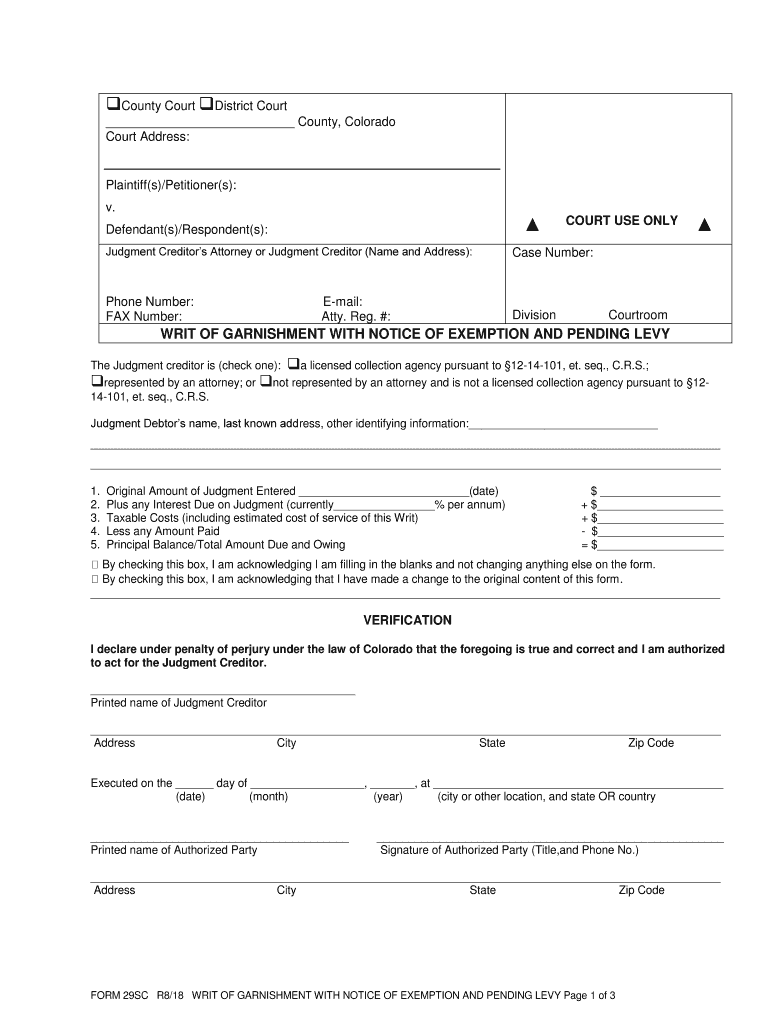

The Form 29sc is a legal document used in the state of Colorado to initiate a writ of garnishment. This form allows creditors to collect debts by seizing funds from a debtor's bank account or wages. It is essential for creditors to follow the appropriate legal procedures when filing this form to ensure compliance with state laws. Understanding the purpose and function of the Form 29sc is crucial for both creditors and debtors involved in the garnishment process.

How to use the Form 29sc

Utilizing the Form 29sc involves several steps to ensure that it is filled out correctly and submitted in accordance with Colorado law. First, the creditor must complete the form with accurate information regarding the debtor, the amount owed, and the details of the garnishment. Once the form is filled out, it must be filed with the appropriate court. After filing, a copy of the form must be served to the debtor and the garnishee, typically the bank or employer. This process ensures that all parties are informed and can respond appropriately.

Steps to complete the Form 29sc

Completing the Form 29sc requires careful attention to detail. Here are the key steps:

- Gather necessary information about the debtor, including their full name, address, and Social Security number.

- Clearly state the amount owed and any relevant case numbers associated with the debt.

- Fill in the garnishee's information, specifying where the funds are held or the debtor's place of employment.

- Sign and date the form to validate it.

- Make copies of the completed form for your records and for serving to the debtor and garnishee.

Legal use of the Form 29sc

The legal use of the Form 29sc is governed by Colorado state law, which outlines the procedures for garnishment. Creditors must ensure that they have obtained a judgment against the debtor before filing this form. Additionally, it is important to comply with all notification requirements, including informing the debtor of the garnishment action. Failure to adhere to these legal standards can result in delays or dismissal of the garnishment request.

State-specific rules for the Form 29sc

Each state has its own regulations regarding garnishment, and Colorado is no exception. The Form 29sc must be used in accordance with the Colorado Revised Statutes, which detail the rights of creditors and debtors. For instance, certain types of income, such as Social Security benefits, are exempt from garnishment. Understanding these state-specific rules is vital for ensuring that the garnishment process is executed legally and effectively.

Examples of using the Form 29sc

Examples of using the Form 29sc can help clarify its application in real-world scenarios. For instance, if a creditor has obtained a judgment against a debtor for unpaid medical bills, they may use the Form 29sc to garnish the debtor's wages. Another example could involve a landlord seeking to collect unpaid rent through garnishment of the tenant's bank account. These examples illustrate the practical use of the Form 29sc in enforcing debt collection.

Quick guide on how to complete form 29sc

Effortlessly prepare Form 29sc on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 29sc on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Form 29sc with ease

- Locate Form 29sc and click on Get Form to begin.

- Utilize the tools available to fill in your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Produce your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 29sc and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 29sc

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is a pending levy and how does airSlate SignNow help manage it?

A pending levy refers to a legal order that allows the seizure of assets to satisfy a tax debt. airSlate SignNow simplifies the process of managing pending levies by providing a secure platform for electronic signatures and document management, ensuring compliance with legal requirements while streamlining workflows.

-

How can airSlate SignNow assist with compliance related to pending levies?

With airSlate SignNow, you can ensure compliance relating to pending levies by using our legally binding e-signatures and audit trails. This helps businesses maintain accurate records and provide evidence of legitimate document handling in case of any disputes with tax authorities.

-

What features of airSlate SignNow are beneficial for handling pending levies?

Key features of airSlate SignNow that are beneficial for handling pending levies include customizable templates, real-time tracking of document status, and secure cloud storage. These capabilities streamline the document workflow, allowing users to focus on resolving issues related to pending levies efficiently.

-

Is airSlate SignNow cost-effective for small businesses managing pending levies?

Yes, airSlate SignNow offers a cost-effective solution tailored to small businesses facing pending levies. With flexible pricing plans and essential features, it enables businesses to manage documents without incurring signNow overhead, making it an economical choice.

-

Can I integrate airSlate SignNow with my existing financial software for managing pending levies?

Absolutely! airSlate SignNow offers seamless integrations with popular financial software, such as QuickBooks and Xero. This integration allows for efficient management of pending levies by linking your financial data directly to your document workflows.

-

What are the benefits of using airSlate SignNow over traditional methods for pending levies?

Using airSlate SignNow for pending levies offers numerous benefits compared to traditional methods. It enhances speed and efficiency through electronic signatures, reduces paper usage, and ensures documents are stored securely and accessed easily, minimizing the risk of errors or lost paperwork.

-

How can I track the status of documents related to pending levies in airSlate SignNow?

You can easily track the status of documents related to pending levies in airSlate SignNow through our user-friendly dashboard. The platform provides real-time notifications and updates, allowing you to stay informed about who has signed and the overall progress of each document.

Get more for Form 29sc

Find out other Form 29sc

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation