Form GE 1 PKF Hawaii

What is the Form GE 1 PKF Hawaii

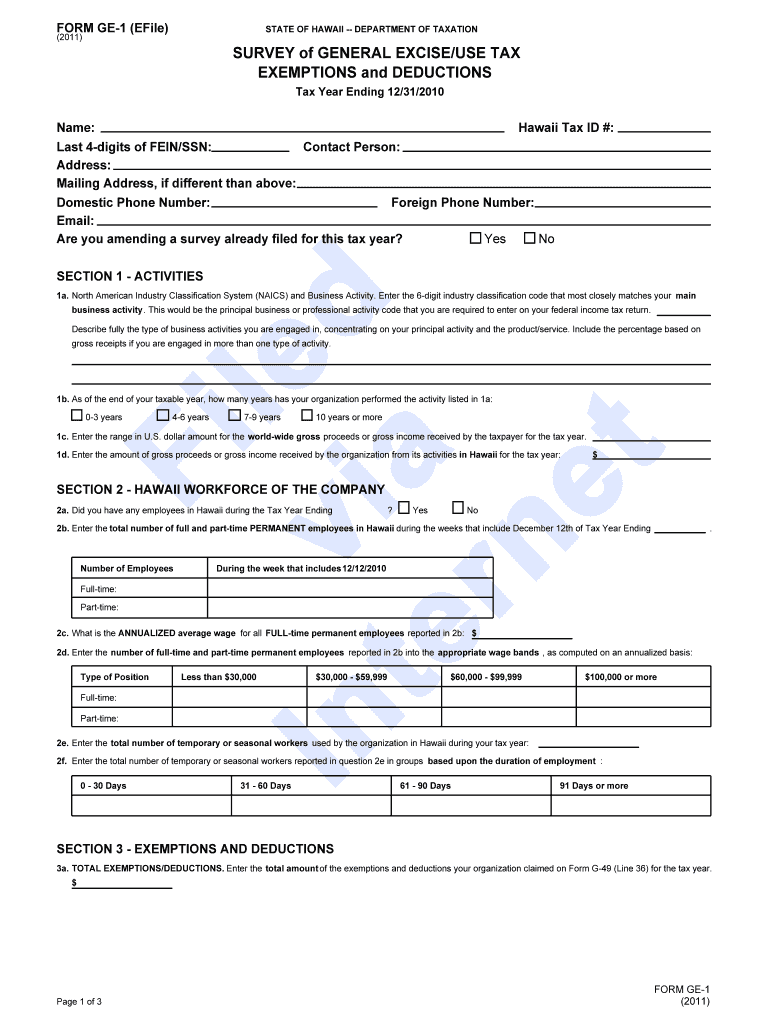

The Form GE 1 PKF Hawaii is a tax form specifically designed for businesses operating within the state of Hawaii. This form is essential for reporting general excise tax, which is levied on the gross income of businesses. The GE tax form is required for various types of entities, including sole proprietorships, partnerships, and corporations. Understanding the purpose of this form is crucial for compliance with Hawaii state tax regulations.

Steps to Complete the Form GE 1 PKF Hawaii

Completing the Form GE 1 PKF Hawaii involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements and receipts. Next, accurately report your gross income in the designated sections of the form. It is important to apply the correct tax rates based on your business activities. After filling out the form, review it for any errors or omissions before submission. Finally, ensure that you sign and date the form to validate it.

How to Obtain the Form GE 1 PKF Hawaii

The Form GE 1 PKF Hawaii can be obtained through the official Hawaii Department of Taxation website. It is available for download in PDF format, allowing for easy access and printing. Additionally, physical copies of the form may be available at local tax offices or government buildings across Hawaii. Ensuring you have the correct and most recent version of the form is essential for compliance.

Legal Use of the Form GE 1 PKF Hawaii

The legal use of the Form GE 1 PKF Hawaii is governed by state tax laws. Properly completing and submitting this form is necessary to fulfill your tax obligations and avoid potential penalties. The form must be filed within the designated deadlines to ensure compliance with Hawaii tax regulations. Failure to use the form correctly can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form GE 1 PKF Hawaii are crucial for maintaining compliance. Typically, the form must be submitted quarterly or annually, depending on the volume of business transactions. It is important to be aware of specific due dates, which can vary based on the filing frequency selected. Marking these dates on your calendar can help ensure timely submissions and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form GE 1 PKF Hawaii can be submitted through various methods to accommodate different preferences. Businesses have the option to file online through the Hawaii Department of Taxation's e-filing system, which offers a convenient and efficient way to submit the form. Alternatively, the completed form can be mailed to the appropriate tax office or delivered in person. Each submission method has its own guidelines, so it is essential to follow the instructions carefully.

Quick guide on how to complete form ge 1 pkf hawaii

Easily Prepare Form GE 1 PKF Hawaii on Any Device

Online document administration has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form GE 1 PKF Hawaii on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortlessly Edit and Electronically Sign Form GE 1 PKF Hawaii

- Find Form GE 1 PKF Hawaii and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form GE 1 PKF Hawaii and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the form ge 1 pkf hawaii

How to create an eSignature for the Form Ge 1 Pkf Hawaii in the online mode

How to make an eSignature for your Form Ge 1 Pkf Hawaii in Chrome

How to make an eSignature for putting it on the Form Ge 1 Pkf Hawaii in Gmail

How to make an eSignature for the Form Ge 1 Pkf Hawaii from your smart phone

How to create an electronic signature for the Form Ge 1 Pkf Hawaii on iOS

How to create an eSignature for the Form Ge 1 Pkf Hawaii on Android devices

People also ask

-

What is the form ge 1 hawaii and how is it used?

The form ge 1 hawaii is a crucial document for individuals and businesses conducting transactions in Hawaii. It ensures that necessary information is accurately recorded and submitted to the relevant authorities, streamlining the process for all parties involved.

-

How can airSlate SignNow help with form ge 1 hawaii?

airSlate SignNow provides a seamless solution to eSign and manage your form ge 1 hawaii. Its user-friendly interface allows users to easily fill out and sign the document electronically, saving time and reducing paperwork for efficient transactions.

-

What are the pricing options for airSlate SignNow when using form ge 1 hawaii?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes looking to handle documents like form ge 1 hawaii. You can choose from various plans that cater to your specific needs, ensuring you get great value for effective document management.

-

Are there any integrations available for using form ge 1 hawaii?

Yes, airSlate SignNow integrates with numerous applications, enhancing the workflow for processing form ge 1 hawaii. These integrations allow you to connect with your existing tools, making it easy to manage and send documents without disrupting your routine.

-

What are the benefits of using airSlate SignNow for form ge 1 hawaii?

By using airSlate SignNow for form ge 1 hawaii, you benefit from increased efficiency, security, and ease of use. The platform simplifies document handling, allows for quick access to signed forms, and ensures that your transactions are protected every step of the way.

-

Is there a mobile app for handling form ge 1 hawaii with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage form ge 1 hawaii on the go. This ensures that you can easily access, sign, and send your documents anytime and anywhere, providing flexibility for your busy schedule.

-

How does airSlate SignNow ensure the security of form ge 1 hawaii?

airSlate SignNow prioritizes security for your form ge 1 hawaii by utilizing industry-standard encryption and authentication protocols. This ensures that your sensitive information remains protected during transmission and storage, giving you peace of mind.

Get more for Form GE 1 PKF Hawaii

- Colonial life amp accident insurance company columbia sc form

- Revisions adopted by presidents cabinet 52218 form

- Grid landlord form

- Instructions for schedule d form 1040 or 1040 sr capital

- 2020 schedule j form 1040 internal revenue service

- 2020 form 1041 es estimated income tax for estates and trusts

- 2020 instructions for form 1042 s internal revenue service

- 2020 form 1094 c transmittal of employer provided health insurance offer and coverage information returns

Find out other Form GE 1 PKF Hawaii

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe