Form 1094 C Transmittal of Employer Provided Health Insurance Offer and Coverage Information Returns 2020

What is the Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns

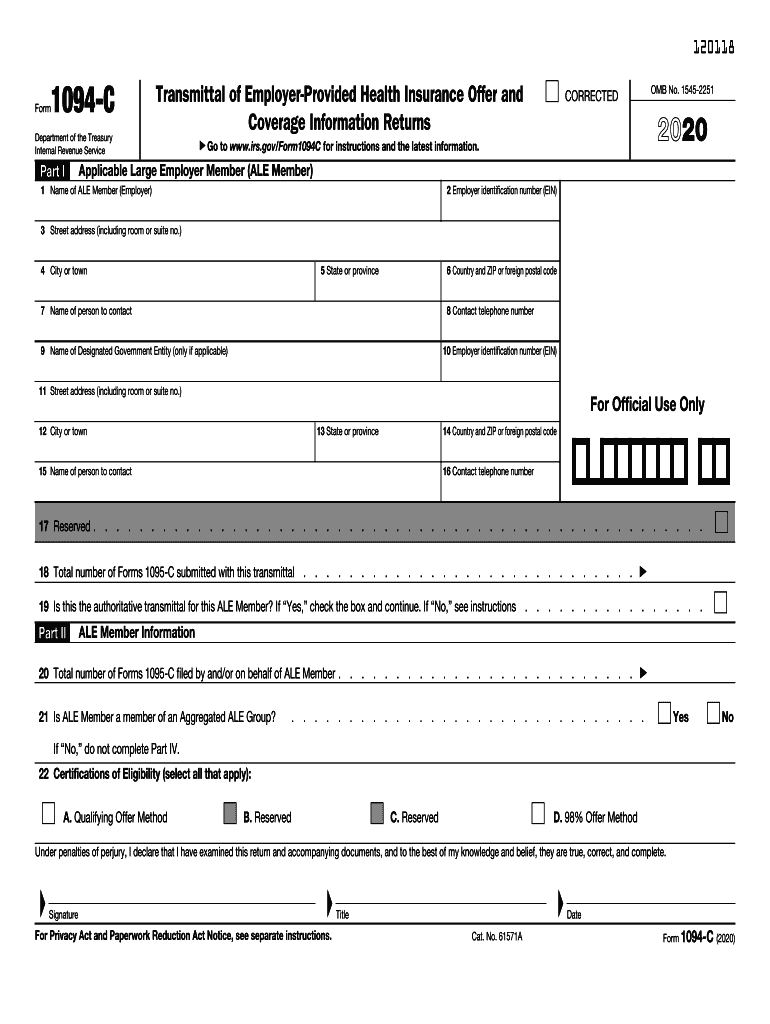

The Form 1094 C serves as a transmittal document for the Employer Provided Health Insurance Offer and Coverage Information Returns. This form is essential for employers subject to the Affordable Care Act (ACA) reporting requirements. It provides the IRS with information about the health insurance coverage offered to employees, including details on the coverage type and the number of full-time employees. The information collected helps the IRS determine compliance with the employer mandate under the ACA.

How to use the Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns

To effectively use the Form 1094 C, employers must complete it accurately before submission. The form requires details such as the employer's name, address, and Employer Identification Number (EIN). Employers should also report the total number of Forms 1095 C they are submitting, which provide information about individual employee coverage. It is crucial to ensure that all data is correct to avoid penalties. Once completed, the form can be submitted electronically or by mail to the IRS.

Steps to complete the Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns

Completing the Form 1094 C involves several steps:

- Gather necessary information, including the employer's EIN, contact details, and the number of full-time employees.

- Fill out the form, ensuring all sections are completed accurately, including the section detailing the number of 1095 C forms being submitted.

- Review all information for accuracy to prevent errors that could lead to penalties.

- Submit the form electronically through the IRS e-filing system or by mailing it to the appropriate IRS address.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing Form 1094 C. The form is typically due on the last day of February if filing by mail or March 31 if filing electronically. It is important to stay informed about any changes to these deadlines each tax year, as they can vary. Missing these deadlines may result in penalties, so timely submission is essential.

Penalties for Non-Compliance

Failure to file Form 1094 C accurately or on time can result in significant penalties. The IRS may impose fines for each month the form is late, with the amount increasing based on the size of the employer. Additionally, inaccuracies in the information reported can lead to further scrutiny and potential penalties under the ACA. Employers should prioritize compliance to avoid these financial repercussions.

Legal use of the Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns

The legal use of Form 1094 C is governed by the requirements set forth in the Affordable Care Act. Employers are legally obligated to provide accurate information regarding health insurance coverage offered to employees. This form must be completed in accordance with IRS guidelines to ensure it is legally binding. Utilizing electronic signatures and secure submission methods can enhance the legal standing of the submitted form.

Quick guide on how to complete 2020 form 1094 c transmittal of employer provided health insurance offer and coverage information returns

Effortlessly Prepare Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, modify, and eSign your documents swiftly without any holdups. Manage Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

The Easiest Way to Modify and eSign Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Effortlessly

- Access Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1094 c transmittal of employer provided health insurance offer and coverage information returns

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1094 c transmittal of employer provided health insurance offer and coverage information returns

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is IRS Form 1094C for 2016 and why is it important?

IRS Form 1094C for 2016 is a crucial document that employers must submit to report information about their health insurance offerings. It helps the IRS assess compliance with the Affordable Care Act. Submitting this form accurately ensures you avoid potential penalties.

-

How can airSlate SignNow assist in managing IRS Form 1094C for 2016?

airSlate SignNow streamlines the process of preparing and submitting IRS Form 1094C for 2016 by allowing users to electronically sign, send, and store their documents securely. Its user-friendly interface simplifies the complex reporting process, saving businesses time and effort.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1094C for 2016?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. These plans provide access to features specifically designed for managing IRS Form 1094C for 2016, making it a cost-effective solution for compliance.

-

What features of airSlate SignNow are beneficial for IRS Form 1094C for 2016?

Key features of airSlate SignNow beneficial for IRS Form 1094C for 2016 include electronic signatures, document templates, and secure cloud storage. These features help ensure that all necessary documents are properly prepared and easily accessible.

-

Can airSlate SignNow integrate with other software for IRS Form 1094C for 2016?

Absolutely, airSlate SignNow offers seamless integrations with various accounting and HR software platforms. This capability allows users to automate workflows and manage IRS Form 1094C for 2016 more efficiently, reducing the chances of errors.

-

How does using airSlate SignNow improve the submission process for IRS Form 1094C for 2016?

Using airSlate SignNow improves the submission process for IRS Form 1094C for 2016 by ensuring that all documents are electronically signed and securely stored. This not only speeds up the submission process but also enhances compliance and reduces administrative burdens.

-

What security measures does airSlate SignNow have in place for IRS Form 1094C for 2016?

airSlate SignNow employs top-notch security measures, including encryption and secure access controls, to protect sensitive information related to IRS Form 1094C for 2016. You can confidently manage your compliance documents, knowing your data is safeguarded.

Get more for Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns

Find out other Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement