Instructions for Schedule D Form 1040 or 1040 SR, Capital 2020

What are the instructions for Schedule D Form 1040 or 1040 SR, Capital?

The 2020 IRS 1040 Schedule D instructions provide guidance for reporting capital gains and losses on your tax return. Schedule D is used to summarize the total capital gains and losses from transactions involving stocks, bonds, and other investments. Understanding these instructions is essential for accurately completing your tax obligations and ensuring compliance with IRS regulations.

Steps to complete the instructions for Schedule D Form 1040 or 1040 SR, Capital

Completing the 2020 IRS 1040 Schedule D involves several steps:

- Gather necessary documents, including records of all capital transactions.

- Determine your capital gains and losses by calculating the difference between the sale price and the purchase price of your assets.

- Fill out Part I of Schedule D for short-term capital gains and losses, and Part II for long-term capital gains and losses.

- Transfer the totals from Schedule D to your Form 1040 or 1040 SR.

- Review your entries for accuracy before submitting your tax return.

Key elements of the instructions for Schedule D Form 1040 or 1040 SR, Capital

Several key elements are crucial when working with the 2020 IRS 1040 Schedule D instructions:

- Short-term vs. long-term gains: Understand the difference, as they are taxed at different rates.

- Netting gains and losses: Be aware of how to offset gains with losses to potentially reduce your tax liability.

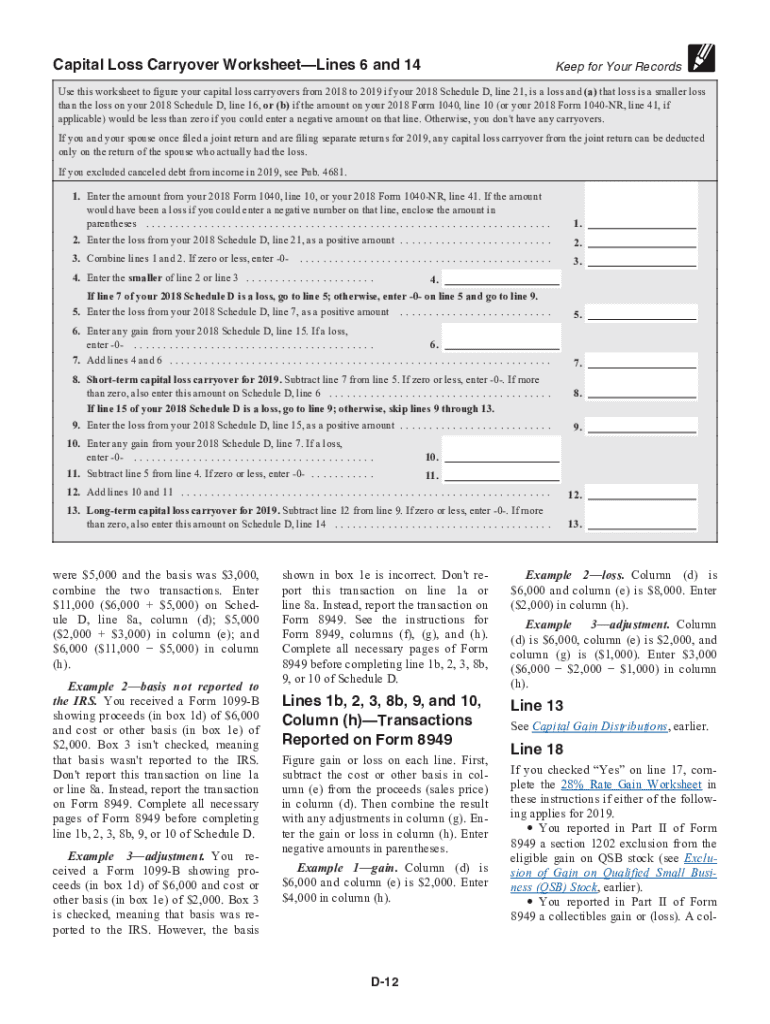

- Carryover rules: Familiarize yourself with rules regarding capital losses that can be carried over to future tax years.

IRS guidelines for Schedule D Form 1040 or 1040 SR, Capital

The IRS provides specific guidelines for completing Schedule D. These include instructions on how to report various types of transactions, such as sales, exchanges, and gifts of capital assets. It is important to refer to the IRS guidelines to ensure that you are following the correct procedures and reporting your income accurately.

Filing deadlines and important dates for Schedule D Form 1040 or 1040 SR, Capital

For the 2020 tax year, the filing deadline for Form 1040 and associated schedules, including Schedule D, is typically April 15 of the following year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for non-compliance with Schedule D Form 1040 or 1040 SR, Capital

Failure to comply with the instructions for Schedule D can result in various penalties, including fines and interest on unpaid taxes. Accurate reporting is essential to avoid these consequences. The IRS may also conduct audits if discrepancies are found in your reported capital gains and losses.

Quick guide on how to complete instructions for schedule d form 1040 or 1040 sr capital

Effortlessly Create Instructions For Schedule D Form 1040 Or 1040 SR, Capital on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely keep it online. airSlate SignNow supplies you with all the tools required to generate, modify, and electronically sign your documents swiftly without interruptions. Manage Instructions For Schedule D Form 1040 Or 1040 SR, Capital on any device with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The easiest way to alter and electronically sign Instructions For Schedule D Form 1040 Or 1040 SR, Capital with ease

- Locate Instructions For Schedule D Form 1040 Or 1040 SR, Capital and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Schedule D Form 1040 Or 1040 SR, Capital while ensuring seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule d form 1040 or 1040 sr capital

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule d form 1040 or 1040 sr capital

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What are the 2020 IRS 1040 Schedule instructions?

The 2020 IRS 1040 Schedule instructions provide detailed guidelines on how to fill out your tax return, including income types, deductions, and credits. By following these instructions carefully, you can ensure accurate reporting and potentially maximize your tax refund.

-

How can airSlate SignNow assist with the 2020 IRS 1040 Schedule instructions?

airSlate SignNow simplifies the document signing process, allowing you to easily eSign and share your completed 2020 IRS 1040 Schedule instructions. This ensures that your documents are secure and can be managed efficiently without the hassle of printing and mailing.

-

Are there any costs associated with using airSlate SignNow for 2020 IRS 1040 Schedule instructions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to features that can help streamline your document management, including signing workflows for the 2020 IRS 1040 Schedule instructions.

-

What features does airSlate SignNow offer for tax documents, specifically for the 2020 IRS 1040 Schedule instructions?

airSlate SignNow provides essential features such as templates, customizable workflows, and real-time tracking for your tax documents. These functionalities ensure that your 2020 IRS 1040 Schedule instructions are processed smoothly and securely.

-

Can I integrate airSlate SignNow with other tools for managing 2020 IRS 1040 Schedule instructions?

Absolutely! airSlate SignNow can be integrated with various popular business tools, enhancing your workflow efficiency while handling the 2020 IRS 1040 Schedule instructions. This means you can easily sync data and streamline document management across platforms.

-

What are the benefits of using airSlate SignNow for signing the 2020 IRS 1040 Schedule instructions?

Using airSlate SignNow to sign your 2020 IRS 1040 Schedule instructions offers convenience, speed, and security. You can eSign documents from anywhere, at any time, minimizing delays and ensuring you meet your tax deadlines effectively.

-

Is it safe to use airSlate SignNow for my 2020 IRS 1040 Schedule instructions?

Yes, airSlate SignNow prioritizes your security with encryption and compliance with data protection laws. Your information in the 2020 IRS 1040 Schedule instructions is handled securely, giving you peace of mind while managing sensitive tax documents.

Get more for Instructions For Schedule D Form 1040 Or 1040 SR, Capital

- Authorization release insurance information

- Identification of insurance for college or university and authorization form

- Agreement condominium 497331391 form

- Liability computer form

- Debt contract template form

- Sample goals statement form

- Sample letter intent 497331395 form

- License agreement end user form

Find out other Instructions For Schedule D Form 1040 Or 1040 SR, Capital

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free