Vat431nb Form 2019

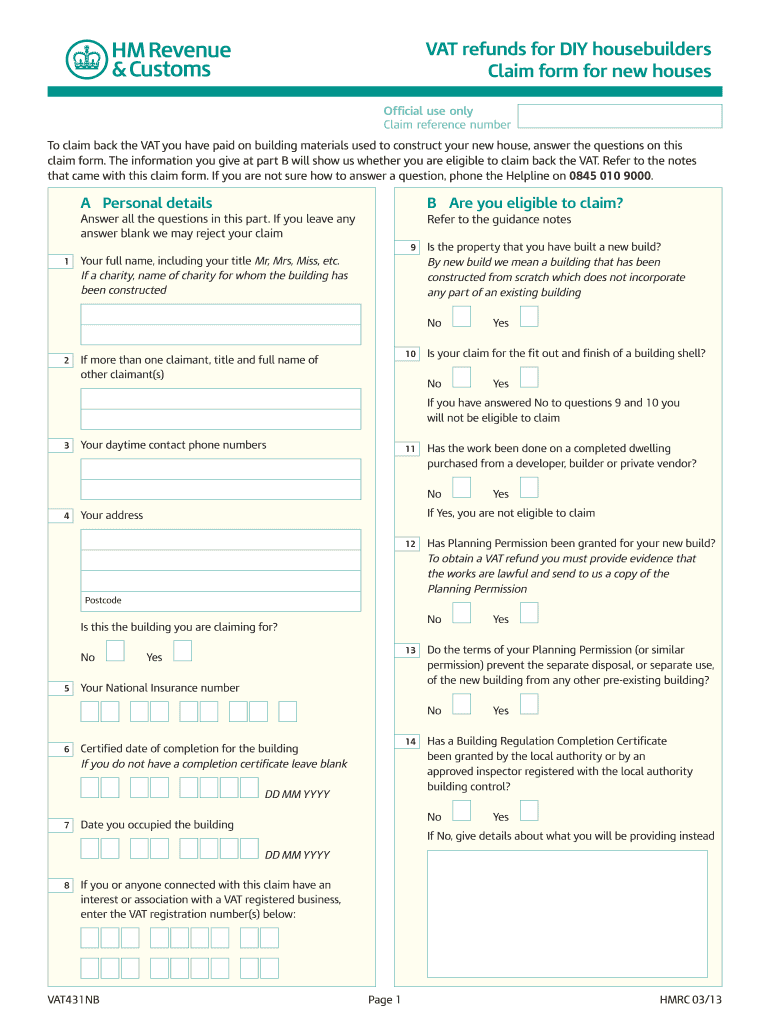

What is the Vat431nb Form

The Vat431nb Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration or application for certain tax credits or deductions. Understanding the purpose of this form is essential for individuals and businesses seeking to optimize their tax filings. The Vat431nb Form is designed to ensure compliance with federal tax regulations while allowing taxpayers to claim eligible benefits.

How to use the Vat431nb Form

Using the Vat431nb Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial records relevant to the tax year. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, either electronically or by mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the Vat431nb Form

Completing the Vat431nb Form requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant documents, such as income statements, previous tax returns, and any supporting documentation for claims.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Complete the financial sections, ensuring that all figures are correct and match your supporting documents.

- Review the form thoroughly for any mistakes or missing information.

- Sign and date the form before submission.

Legal use of the Vat431nb Form

The Vat431nb Form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal standing, it is crucial to provide accurate information and adhere to all filing requirements. The form must be signed by the taxpayer or an authorized representative, affirming that the information provided is true and complete. Failure to comply with legal standards may result in penalties or denial of claims.

Filing Deadlines / Important Dates

Timely filing of the Vat431nb Form is essential to avoid penalties and ensure eligibility for any claimed benefits. The IRS typically sets specific deadlines for tax forms, which may vary each year. It is advisable to check the IRS website or consult with a tax professional for the most current filing deadlines related to the Vat431nb Form. Mark these dates on your calendar to ensure that you submit your form on time.

Form Submission Methods (Online / Mail / In-Person)

The Vat431nb Form can be submitted through various methods, depending on your preference and the guidelines provided by the IRS. You may choose to file the form online using approved e-filing software, which can streamline the process and provide immediate confirmation of submission. Alternatively, you can mail a paper copy of the form to the designated IRS address. In some cases, in-person submission may be available at local IRS offices, though this option may vary by location.

Quick guide on how to complete vat431nb 2013 form

Complete Vat431nb Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Vat431nb Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Vat431nb Form seamlessly

- Obtain Vat431nb Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Vat431nb Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat431nb 2013 form

Create this form in 5 minutes!

How to create an eSignature for the vat431nb 2013 form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the Vat431nb Form and why is it important?

The Vat431nb Form is a crucial document for businesses that need to report VAT transactions accurately. It helps ensure compliance with tax regulations and facilitates smoother cash flow management. Utilizing the Vat431nb Form within airSlate SignNow simplifies the signing process, making it easy for your team to manage necessary documents.

-

How can airSlate SignNow help me with the Vat431nb Form?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Vat431nb Form. With its user-friendly interface, you can easily customize the form and send it out for signatures. This efficiency reduces paperwork and enhances your overall document management process.

-

What are the pricing options for using airSlate SignNow for the Vat431nb Form?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, making it cost-effective to manage the Vat431nb Form. You can choose from various subscription options based on your needs, with transparent pricing that allows you to find the best fit for your business. The investment is worth the value it brings in terms of efficiency and compliance.

-

Can I integrate airSlate SignNow with other tools while using the Vat431nb Form?

Yes, airSlate SignNow allows seamless integration with a variety of tools and platforms, enhancing your workflow while managing the Vat431nb Form. Integrations with CRM systems, cloud storage services, and productivity applications can streamline your processes. This connectivity ensures that all your documents, including the Vat431nb Form, are easily accessible.

-

What features does airSlate SignNow offer for the Vat431nb Form?

airSlate SignNow offers features like customizable templates, automated workflows, and secure eSignature capabilities specifically for the Vat431nb Form. These features not only simplify the signing process but also ensure the security and integrity of your documents. The solution enhances productivity by minimizing time spent on paperwork.

-

Is airSlate SignNow mobile-friendly for managing the Vat431nb Form?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to manage the Vat431nb Form on the go. Whether you're using a smartphone or tablet, you can easily sign and send documents, ensuring that your business operations remain efficient even when you're away from your desk.

-

How does airSlate SignNow ensure the security of the Vat431nb Form?

Security is a top priority at airSlate SignNow, and robust measures are in place to protect the Vat431nb Form. The platform uses encryption, two-factor authentication, and secure cloud storage to keep your documents safe from unauthorized access. This ensures that your sensitive information remains confidential and compliant.

Get more for Vat431nb Form

- Zahlungsauftrag universal llb vaduz version 25062014 llb form

- Emotional healing with spotting emotional healing emotional dom form

- Carrier certificate form

- Uccjea affidavit georgia form

- Sf 424 certifications and assurances form

- Vision waiver certification form

- Respect restorative discipline agreement template form

- Responsibility agreement template form

Find out other Vat431nb Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors