102 10 2003-2026

What is the Illinois Form NFP 102.10?

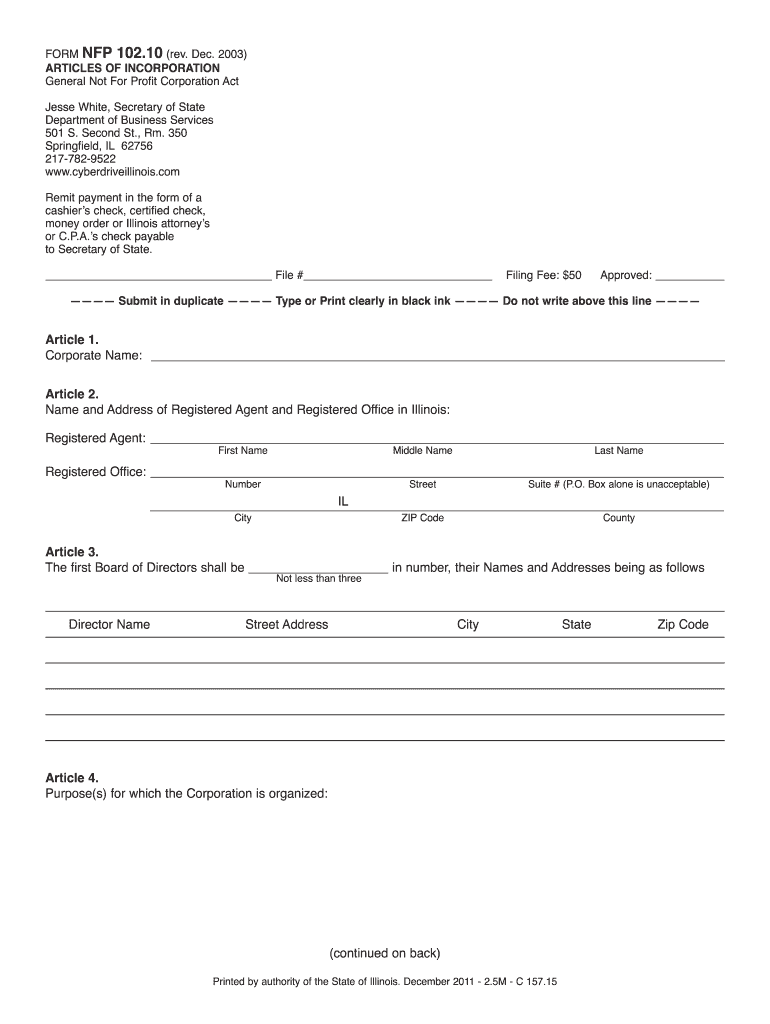

The Illinois Form NFP 102.10 is a crucial document used for the incorporation of not-for-profit organizations in the state of Illinois. This form serves as the official Articles of Incorporation for non-profit entities, outlining the organization's purpose, structure, and governance. By filing this form, organizations can gain legal recognition, which is essential for operating as a non-profit and for eligibility to receive tax-exempt status. Understanding the components of the NFP 102.10 is vital for ensuring compliance with state regulations.

How to Obtain the Illinois Form NFP 102.10

Obtaining the Illinois Form NFP 102.10 is straightforward. The form can be accessed through the Illinois Secretary of State's website, where it is available for download in PDF format. Additionally, physical copies may be available at local government offices or libraries. It is important to ensure that you are using the most current version of the form, as updates may occur that reflect changes in state law or administrative procedures.

Steps to Complete the Illinois Form NFP 102.10

Completing the Illinois Form NFP 102.10 involves several key steps:

- Begin by gathering necessary information about your organization, including its name, purpose, and the names and addresses of the board members.

- Fill out the form accurately, ensuring that all required fields are completed. This includes specifying the type of non-profit organization and its intended activities.

- Review the form for accuracy and completeness. It is advisable to have another party review your entries to catch any errors.

- Sign the form where indicated, ensuring that all signatories are authorized representatives of the organization.

- Submit the completed form to the appropriate state office, either online or by mail, along with any required filing fees.

Legal Use of the Illinois Form NFP 102.10

The legal use of the Illinois Form NFP 102.10 is critical for establishing a legitimate non-profit organization. This form must be completed in accordance with Illinois state laws governing non-profits. The information provided in the form must accurately reflect the organization's structure and purpose to avoid potential legal issues. Proper filing ensures compliance with the Illinois Not-for-Profit Corporation Act, which governs the operation of non-profit entities in the state.

Key Elements of the Illinois Form NFP 102.10

The Illinois Form NFP 102.10 includes several key elements that must be addressed:

- Organization Name: The chosen name must be unique and comply with state naming requirements.

- Purpose Statement: A clear description of the organization's mission and activities is required.

- Board of Directors: Names and addresses of the initial directors must be provided.

- Registered Agent: An individual or business entity designated to receive legal documents on behalf of the organization.

- Incorporator Information: Details of the person completing the form must be included.

Form Submission Methods for the Illinois NFP 102.10

The completed Illinois Form NFP 102.10 can be submitted through various methods:

- Online Submission: Organizations can file the form electronically through the Illinois Secretary of State's online portal, which may expedite processing times.

- Mail: The form can be printed and mailed to the appropriate state office along with the required filing fee.

- In-Person: Organizations may also deliver the form in person to the Secretary of State's office, which can be beneficial for immediate processing.

Quick guide on how to complete nfp 102 10 form

Manage 102 10 from anywhere, at any moment

Your daily business activities might require additional focus when handling state-specific business documents. Reclaim your working hours and minimize the paper expenses tied to document-heavy processes with airSlate SignNow. airSlate SignNow offers a vast array of pre-formatted business documents, including 102 10, which you can utilize and distribute to your business associates. Manage your 102 10 effortlessly with robust editing and eSignature features and send it directly to your recipients.

Steps to obtain 102 10 in just a few clicks:

- Select a form pertinent to your state.

- Simply click Learn More to access the document and ensure it is correct.

- Choose Get Form to begin using it.

- 102 10 will automatically open within the editor. No additional steps are required.

- Utilize airSlate SignNow’s enhanced editing tools to complete or modify the form.

- Locate the Sign feature to create your personalized signature and electronically sign your document.

- When prepared, click Done, save changes, and access your document.

- Send the form via email or text message, or use a link-to-fill method with your partners or allow them to download the document.

airSlate SignNow signNowly streamlines your process in managing 102 10 and enables you to find essential documents in one location. A comprehensive library of forms is organized and crafted to address key business operations necessary for your company. The sophisticated editor minimizes the risk of errors, as you can swiftly rectify mistakes and review your documents on any device before dispatching them. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Form 102 (ICAI) for an articleship? Can anyone provide a sample format?

Form 102 serves as a contract between you and your Principal at work. It becomes binding only when its Franked.Franking is nothing but converting it into a Non Judicial Paper. So u'll be filling in your name, your articleship period and other details and you and your boss(principal) will sign it on each page and at the end. It need not be sent to the institute , one copy is for you and another for your Principal .Nothin to worry..And while filling the form if you have any query , just see the form filled by old articles. The record will be with your Principal or ask your seniors.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

Whose signatures are required in form 102 for articleship? If I get the forms 102 franked and fill them will they suffice, or do I have to execute a deed on a stamp paper also?

Franking on Form 102 is enough, no need to execute any deed.Form 102 should be signed by you and your principal.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the nfp 102 10 form

How to generate an eSignature for the Nfp 102 10 Form in the online mode

How to create an electronic signature for your Nfp 102 10 Form in Google Chrome

How to generate an eSignature for signing the Nfp 102 10 Form in Gmail

How to create an eSignature for the Nfp 102 10 Form from your smart phone

How to make an electronic signature for the Nfp 102 10 Form on iOS

How to generate an electronic signature for the Nfp 102 10 Form on Android

People also ask

-

What is the Illinois Form NFP 102.10?

The Illinois Form NFP 102.10 is a registration application that non-profit organizations must file to operate within the state of Illinois. This form collects essential information about the organization, including its mission, governance, and financial details, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with completing the Illinois Form NFP 102.10?

airSlate SignNow streamlines the process of eSigning and sending the Illinois Form NFP 102.10. With our user-friendly platform, organizations can complete the form digitally, reducing the time spent on paperwork and ensuring that all documents are securely stored and easily accessible.

-

What are the pricing options for using airSlate SignNow to file the Illinois Form NFP 102.10?

airSlate SignNow offers affordable pricing plans tailored to meet various business needs. Whether you’re a small non-profit or a larger organization, our plans provide robust features that assist in filing the Illinois Form NFP 102.10 efficiently, without breaking your budget.

-

Are there any integrations available with airSlate SignNow for handling the Illinois Form NFP 102.10?

Yes, airSlate SignNow offers various integrations with popular software platforms, including CRM systems and document management tools. These integrations facilitate seamless workflow management when submitting the Illinois Form NFP 102.10, making it easier to manage your organization's documents.

-

What benefits does airSlate SignNow provide for eSigning the Illinois Form NFP 102.10?

Using airSlate SignNow to eSign the Illinois Form NFP 102.10 brings numerous benefits, such as enhanced security, reduced turnaround time, and improved compliance. Our platform ensures that all signatures are legally binding, allowing you to finalize documents with confidence.

-

Can multiple users collaborate on the Illinois Form NFP 102.10 using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Illinois Form NFP 102.10. You can invite team members to review, edit, and electronically sign the document, ensuring that everyone’s input is included in the final submission.

-

Is airSlate SignNow easy to use for newcomers filling out the Illinois Form NFP 102.10?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for newcomers to navigate. Our intuitive interface allows you to quickly learn how to complete and send the Illinois Form NFP 102.10 without any prior experience, simplifying the process signNowly.

Get more for 102 10

- Lake county ohio homestead application form

- It nrc form

- How to claim louisiana state tax refund is spouse owes child support form

- Louisiana solar tax credit form

- Louisiana commercial farmer form

- Tax forms rhode island division of taxation rigov

- State of the world cities 2009 harmonious cities by issuu form

- Sc 2788 a rev 26 abr 12pdf departamento de hacienda form

Find out other 102 10

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later