State of the World Cities Harmonious Cities by Issuu 2020

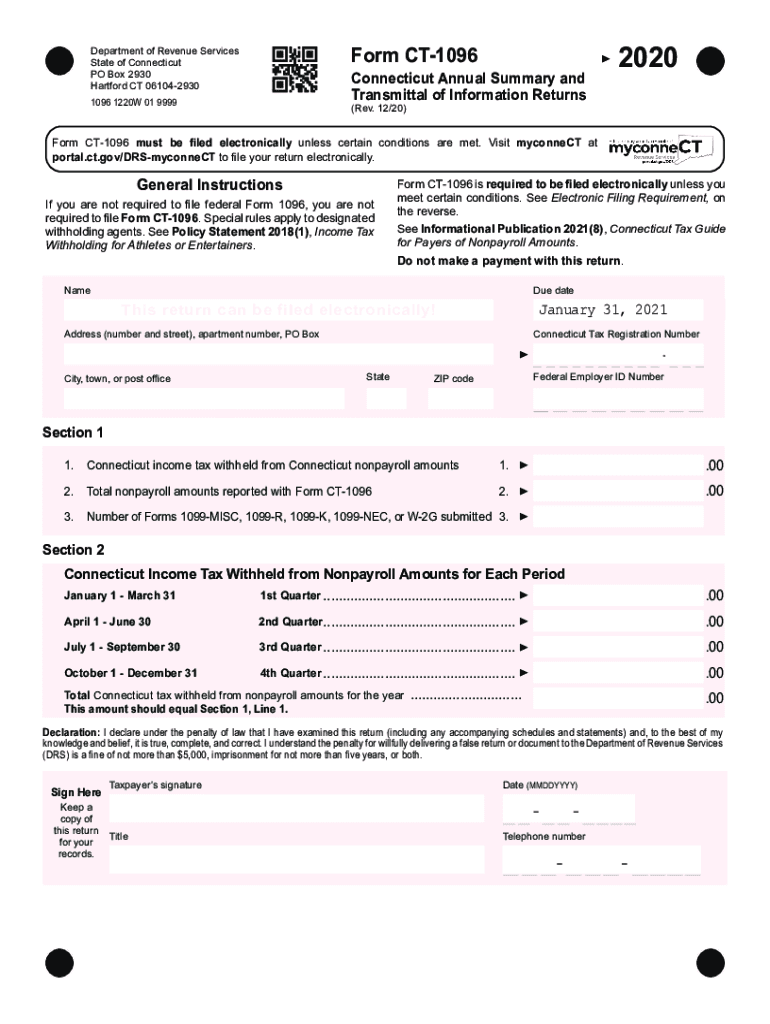

Understanding the Connecticut Miscellaneous Form

The Connecticut Miscellaneous form, often referred to as "connecticut misc," is a crucial document for various tax reporting purposes. This form is typically used by businesses and individuals to report income that does not fall under standard categories. It is essential to understand the specific uses and requirements of this form to ensure compliance with state regulations.

Key Elements of the Connecticut Miscellaneous Form

The Connecticut Miscellaneous form includes several key components that must be accurately completed. These elements typically involve reporting various types of income, such as non-employee compensation, rents, and royalties. Each section of the form requires precise information, including the payer's details, recipient's information, and the amount being reported. Ensuring all fields are filled correctly is vital for avoiding potential penalties.

Filing Deadlines and Important Dates

Timely filing of the Connecticut Miscellaneous form is crucial to avoid penalties. Generally, the form must be submitted by the end of January for the previous tax year. It is important to stay updated on any changes to deadlines, as these can vary based on specific circumstances or state regulations. Keeping a calendar of important dates can assist in maintaining compliance.

Submission Methods for the Connecticut Miscellaneous Form

There are several methods available for submitting the Connecticut Miscellaneous form. Individuals and businesses can file online through the Connecticut Department of Revenue Services website, mail a physical copy, or deliver it in person at designated offices. Each method has its own set of requirements and processing times, so it is beneficial to choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to file the Connecticut Miscellaneous form or submitting it late can result in significant penalties. The state may impose fines based on the amount of tax owed or the duration of the delay. Understanding these penalties is essential for individuals and businesses to avoid unnecessary financial burdens. Regularly reviewing compliance requirements can help mitigate risks associated with non-compliance.

Eligibility Criteria for Filing

Eligibility to file the Connecticut Miscellaneous form typically depends on the type of income being reported. Generally, any individual or business that has received or paid miscellaneous income during the tax year must file this form. It is important to review the specific eligibility criteria to ensure that all necessary parties are accounted for in the filing process.

Quick guide on how to complete state of the world cities 2009 harmonious cities by issuu

Complete State Of The World Cities Harmonious Cities By Issuu effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle State Of The World Cities Harmonious Cities By Issuu on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign State Of The World Cities Harmonious Cities By Issuu with ease

- Find State Of The World Cities Harmonious Cities By Issuu and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign State Of The World Cities Harmonious Cities By Issuu and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of the world cities 2009 harmonious cities by issuu

Create this form in 5 minutes!

How to create an eSignature for the state of the world cities 2009 harmonious cities by issuu

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Connecticut Misc and how does it work?

Connecticut Misc refers to miscellaneous forms and documents that businesses in Connecticut often need to manage. With airSlate SignNow, users can easily create, send, and eSign these documents, streamlining their workflow without the need for complex software.

-

What are the pricing options for Connecticut Misc services?

The pricing for using airSlate SignNow for Connecticut Misc documents varies depending on the plan you choose. We offer flexible pricing tailored to fit different business sizes and needs, ensuring cost-effectiveness while providing access to essential features for document management.

-

What features does airSlate SignNow offer for Connecticut Misc documents?

airSlate SignNow offers a range of features for managing Connecticut Misc documents, including eSigning, document templates, and real-time tracking. These tools enhance productivity and ensure secure, legally binding signatures on all your documents.

-

How can airSlate SignNow benefit my business in Connecticut?

Using airSlate SignNow for Connecticut Misc documents can signNowly enhance your business efficiency. It allows for quicker turnaround times on approvals and document handling, enabling you to focus on your core operations while ensuring compliance with local regulations.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software solutions. This allows businesses in Connecticut to easily connect their existing tools with our platform for a more streamlined process when handling miscellaneous paperwork.

-

Is airSlate SignNow secure for handling Connecticut Misc documents?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to ensure that your Connecticut Misc documents are safely managed. Our platform includes encryption and other security features to protect your sensitive information.

-

How easy is it to use airSlate SignNow for Connecticut Misc documents?

airSlate SignNow is designed with user-friendliness in mind, making it simple to manage your Connecticut Misc documents. Even those with limited technical skills can utilize our platform effectively due to its intuitive interface and helpful support resources.

Get more for State Of The World Cities Harmonious Cities By Issuu

- Name affidavit of seller utah form

- Non foreign affidavit under irc 1445 utah form

- Owners or sellers affidavit of no liens utah form

- Ut occupancy form

- Complex will with credit shelter marital trust for large estates utah form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497427629 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497427630 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497427631 form

Find out other State Of The World Cities Harmonious Cities By Issuu

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy