C Schedule a C Form

What is the C Schedule A C Form

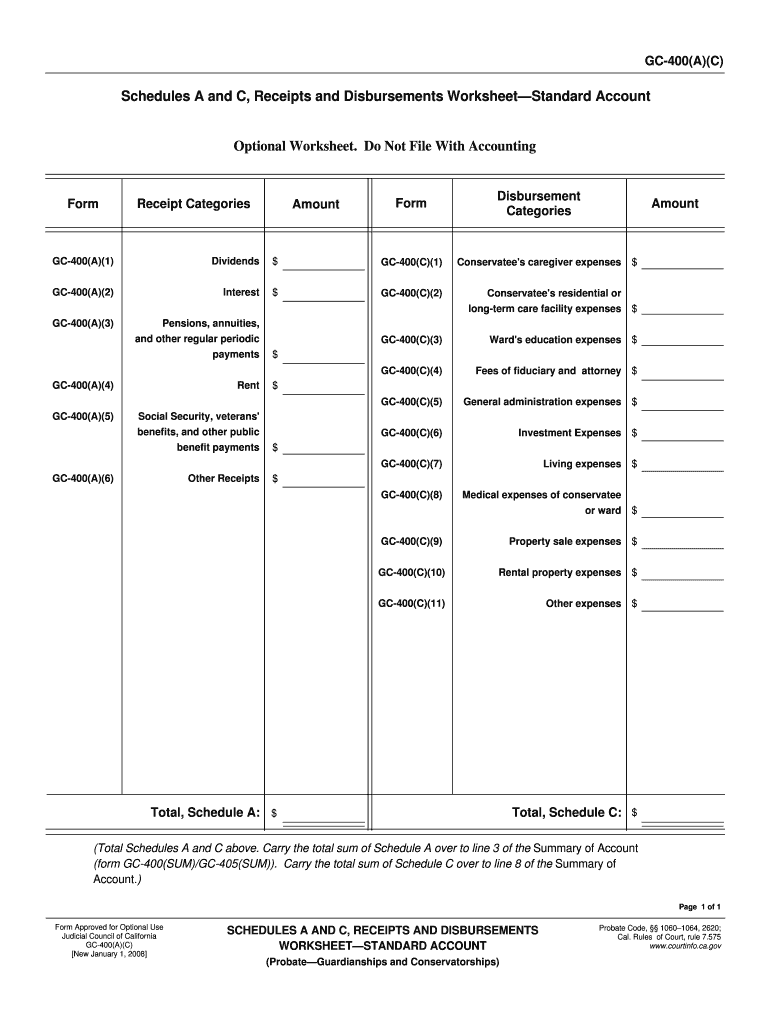

The C Schedule A C Form is a tax document used by individuals and businesses to report various types of income and expenses. This form is particularly relevant for self-employed individuals or those operating small businesses, as it allows them to detail their income sources and deduct eligible expenses. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the C Schedule A C Form

To effectively use the C Schedule A C Form, start by gathering all necessary financial documents, including income statements and receipts for deductible expenses. The form is structured to guide users through reporting income, listing expenses, and calculating net profit or loss. It is crucial to follow the instructions carefully to ensure all information is accurate and complete, as errors can lead to delays or penalties.

Steps to complete the C Schedule A C Form

Completing the C Schedule A C Form involves several key steps:

- Gather financial records, including income and expense documentation.

- Fill out the income section, detailing all sources of income.

- List deductible expenses in the appropriate categories, ensuring to include only eligible costs.

- Calculate the total income and subtract total expenses to determine net profit or loss.

- Review the completed form for accuracy before submission.

Legal use of the C Schedule A C Form

The C Schedule A C Form is legally recognized by the IRS, provided it is filled out accurately and submitted on time. Proper use of this form ensures compliance with federal tax laws, allowing individuals and businesses to take advantage of deductions while avoiding potential legal issues. It is essential to keep records of all information reported on the form for future reference and audits.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the C Schedule A C Form. These guidelines outline eligibility criteria for deductions, acceptable types of income, and required documentation. Familiarizing oneself with these guidelines is vital for ensuring compliance and maximizing potential tax benefits. Users should refer to the most current IRS publications for detailed instructions and updates related to the form.

Filing Deadlines / Important Dates

Filing deadlines for the C Schedule A C Form typically align with the annual tax return due date. For most taxpayers, this is April 15 of each year. However, extensions may be available under certain circumstances. It is important to be aware of these deadlines to avoid penalties and ensure timely submission of tax documents.

Quick guide on how to complete c schedule a c form

Effortlessly prepare C Schedule A C Form on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-conscious alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your papers quickly and without delays. Manage C Schedule A C Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign C Schedule A C Form with ease

- Obtain C Schedule A C Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to preserve your modifications.

- Choose how you wish to send your form—via email, SMS, or invite link—or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign C Schedule A C Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c schedule a c form

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is a c schedule account in airSlate SignNow?

A c schedule account allows users to plan and manage document signing more efficiently within airSlate SignNow. This feature provides options to set reminders and specify dates for document signing, ensuring that all parties are aligned and deadlines are met.

-

How can I create a c schedule account?

To create a c schedule account, simply visit the airSlate SignNow website and sign up for an account. After you create your account, you can enable the c schedule feature in your settings to start managing your document workflows effectively.

-

What are the pricing tiers for a c schedule account?

airSlate SignNow offers various pricing tiers for a c schedule account, catering to different business needs. You can choose from individual, team, and enterprise plans, with each plan offering unique features and benefits to optimize your signing process.

-

What features are included in a c schedule account?

A c schedule account includes features like automated reminders, the ability to schedule documents for signing, email notifications, and customizable workflows. These features are designed to streamline the signing process and enhance user productivity.

-

Can I integrate my c schedule account with other tools?

Yes, a c schedule account in airSlate SignNow can be easily integrated with popular applications like Google Drive, Dropbox, and Salesforce. These integrations enhance collaboration and allow users to manage their documents more seamlessly.

-

What benefits does a c schedule account offer my business?

A c schedule account provides your business with increased efficiency and compliance in document handling. It helps your team stay organized by tracking deadlines and signing statuses, ultimately saving time and reducing the risk of lost documents.

-

Is there a mobile app for managing my c schedule account?

Yes, airSlate SignNow offers a mobile app that allows you to manage your c schedule account on-the-go. This app enables you to send and eSign documents from anywhere, ensuring that your signing process remains flexible and efficient.

Get more for C Schedule A C Form

Find out other C Schedule A C Form

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple