Form 70d 2018

What is the Form 70d

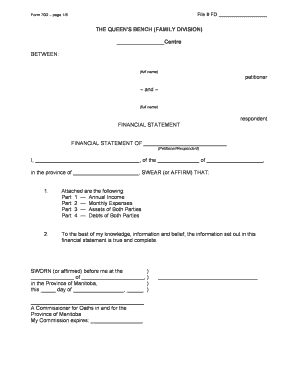

The Form 70d is a financial document used primarily for reporting income and tax-related information. It is essential for individuals and businesses to accurately disclose their earnings to comply with federal and state regulations. This form is particularly relevant for taxpayers who need to report specific income types, ensuring transparency in their financial dealings. Understanding the purpose and requirements of the Form 70d is crucial for maintaining compliance with tax laws.

How to use the Form 70d

Using the Form 70d involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and previous tax returns. Next, fill out the form with precise details regarding your income sources, deductions, and any applicable credits. It is important to review the completed form for accuracy before submission. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the Form 70d

Completing the Form 70d requires a systematic approach to ensure all information is accurate and complete. Follow these steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Fill in personal information, including your name, address, and Social Security number.

- Report all income sources, ensuring to categorize them correctly.

- Include any deductions or credits that apply to your situation.

- Review the form for any errors or omissions before finalizing.

Legal use of the Form 70d

The legal use of the Form 70d is governed by various federal and state tax regulations. To ensure compliance, it is essential to understand the legal implications of the information reported. The form must be submitted by the designated deadlines to avoid penalties. Additionally, eSigning the form through a compliant platform can enhance its legal standing, as it meets the requirements set forth by the ESIGN Act and UETA. Ensuring that the form is completed accurately and submitted on time is vital for legal compliance.

Key elements of the Form 70d

The Form 70d includes several key elements that are critical for accurate reporting. These elements typically consist of:

- Personal identification information, including taxpayer identification numbers.

- Detailed income reporting sections for various income types.

- Deductions and credits that may apply to the taxpayer's situation.

- Signature lines for verification and legal acknowledgment.

Understanding these elements is essential for ensuring that the form is filled out correctly and meets all legal requirements.

Required Documents

To complete the Form 70d, certain documents are required to substantiate the information reported. These documents may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, such as receipts for business expenses.

Having these documents readily available can simplify the completion process and ensure accuracy in reporting.

Quick guide on how to complete form 70d 464950166

Execute Form 70d seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a flawless eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without interruptions. Manage Form 70d on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form 70d effortlessly

- Obtain Form 70d and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more missing or misplaced documents, burdensome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 70d and ensure exceptional communication throughout the entirety of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 70d 464950166

Create this form in 5 minutes!

How to create an eSignature for the form 70d 464950166

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to gross 70d search?

airSlate SignNow is a powerful platform designed to streamline document signing and management processes. It relates to the gross 70d search by providing an effective solution that enhances efficiency, allowing businesses to execute eSignatures and manage documents seamlessly in response to market demand.

-

How does pricing for airSlate SignNow compare in the context of gross 70d search?

The pricing for airSlate SignNow is designed to fit various budgets, making it a cost-effective solution within the gross 70d search range. By offering competitive rates and flexible plans, businesses of all sizes can benefit from its features without exceeding their budget.

-

What are the key features of airSlate SignNow that support gross 70d search?

Key features of airSlate SignNow include customizable templates, secure eSignature capabilities, and real-time collaboration tools. These features cater to the gross 70d search by ensuring that users can effectively manage their document workflows while maintaining compliance and security.

-

How does airSlate SignNow benefit businesses in achieving their goals related to gross 70d search?

By utilizing airSlate SignNow, businesses can accelerate their document processes, reduce paper usage, and improve audit trails. These benefits align with the goals reflected in the gross 70d search, promoting sustainability and operational efficiency in a digital environment.

-

What integrations does airSlate SignNow offer to enhance gross 70d search capabilities?

airSlate SignNow integrates seamlessly with popular applications like Salesforce, Google Workspace, and Microsoft Office. These integrations enhance the gross 70d search capabilities by allowing users to manage their documents within their existing workflows and systems effortlessly.

-

How user-friendly is airSlate SignNow for new users focusing on gross 70d search?

airSlate SignNow provides an intuitive interface that simplifies the document signing process for new users engaging in gross 70d search. With straightforward navigation and comprehensive support resources, users can quickly adapt and make the most of the platform's features.

-

Can airSlate SignNow help with compliance as businesses pursue gross 70d search initiatives?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that all eSignatures and document management processes meet legal standards. This support is crucial for businesses focusing on gross 70d search, as it helps maintain regulatory adherence while optimizing workflows.

Get more for Form 70d

- John c lincoln health network financial assistance application form

- Grease trap cleaning and maintenance log form

- Dws esd 61lt form

- Fillabkle form 8854

- Tc 90cb renter refun application circuit breaker application forms ampamp publications

- Trs 358 change of address form images pcmac

- Startup equity agreement template form

- Startup investment agreement template form

Find out other Form 70d

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney