Streamlined Sales and Use Tax Agreement Form 2018

What is the Streamlined Sales And Use Tax Agreement Form

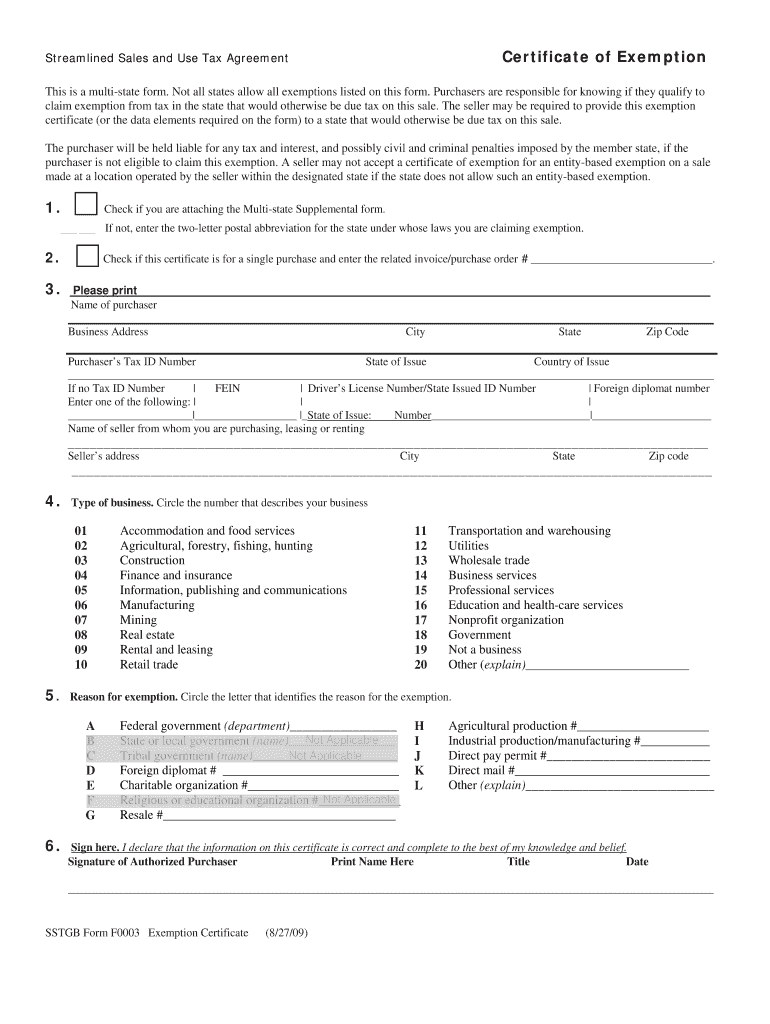

The Streamlined Sales And Use Tax Agreement Form is a document designed to simplify the sales and use tax process for businesses operating across multiple states in the United States. This form is part of an initiative to standardize sales tax regulations, making it easier for businesses to comply with varying state laws. It allows for streamlined reporting and payment of sales tax, reducing the administrative burden on businesses and promoting compliance with tax obligations.

How to use the Streamlined Sales And Use Tax Agreement Form

Using the Streamlined Sales And Use Tax Agreement Form involves several steps. First, businesses must gather necessary information, including their sales tax identification numbers and details about their operations in different states. Next, they should complete the form accurately, ensuring all sections are filled out according to the instructions provided. Once completed, the form can be submitted electronically or via mail, depending on the requirements of the state in which the business operates.

Steps to complete the Streamlined Sales And Use Tax Agreement Form

Completing the Streamlined Sales And Use Tax Agreement Form requires careful attention to detail. Here are the key steps:

- Gather all relevant business information, including tax identification numbers.

- Review the form for specific instructions related to your state.

- Fill out the form, ensuring accuracy in all entries.

- Double-check for any missing information or errors.

- Submit the form according to the specified submission method, either online or by mail.

Legal use of the Streamlined Sales And Use Tax Agreement Form

The legal use of the Streamlined Sales And Use Tax Agreement Form is governed by state tax laws and regulations. When properly completed and submitted, the form is considered a legally binding document that facilitates compliance with sales tax obligations. It is essential for businesses to ensure that the form is filled out accurately to avoid potential legal issues or penalties associated with incorrect tax reporting.

Key elements of the Streamlined Sales And Use Tax Agreement Form

Several key elements are crucial for the Streamlined Sales And Use Tax Agreement Form. These include:

- Business Identification: Accurate tax identification numbers and business details.

- Transaction Information: Details about the types of sales and services provided.

- State Compliance: Specific information related to the states where the business operates.

- Signature: A signature confirming the accuracy of the information provided.

Examples of using the Streamlined Sales And Use Tax Agreement Form

Businesses can utilize the Streamlined Sales And Use Tax Agreement Form in various scenarios. For instance, a retail company operating in multiple states can use the form to report sales tax uniformly across those states. Similarly, an online business selling products to customers nationwide can streamline its tax reporting process by using this form, ensuring compliance with state-specific regulations while minimizing administrative efforts.

Quick guide on how to complete streamlined sales and use tax agreement 2009 form

Prepare Streamlined Sales And Use Tax Agreement Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly and without holdups. Manage Streamlined Sales And Use Tax Agreement Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Streamlined Sales And Use Tax Agreement Form without hassle

- Find Streamlined Sales And Use Tax Agreement Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important portions of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Streamlined Sales And Use Tax Agreement Form and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct streamlined sales and use tax agreement 2009 form

Create this form in 5 minutes!

How to create an eSignature for the streamlined sales and use tax agreement 2009 form

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is a Streamlined Sales And Use Tax Agreement Form?

The Streamlined Sales And Use Tax Agreement Form is a standardized document that simplifies the sales tax process across multiple states. This form facilitates compliance for businesses by streamlining reporting and payment, making it easier to manage tax obligations.

-

How can the Streamlined Sales And Use Tax Agreement Form benefit my business?

Utilizing the Streamlined Sales And Use Tax Agreement Form can signNowly reduce the complexity of tax compliance. Businesses can save time and resources by automating the process, ensuring accuracy and minimizing the risk of penalties due to errors in tax filings.

-

Is there a cost associated with using the Streamlined Sales And Use Tax Agreement Form?

The Streamlined Sales And Use Tax Agreement Form can be accessed through airSlate SignNow at competitive pricing. Our cost-effective solution ensures that all businesses, regardless of size, can efficiently manage their tax agreements without incurring excessive expenses.

-

Can I integrate the Streamlined Sales And Use Tax Agreement Form with other software?

Yes, airSlate SignNow allows seamless integration with various business software, including accounting and ERP systems. This feature ensures that your Streamlined Sales And Use Tax Agreement Form works smoothly with the tools you already use, enhancing efficiency and workflow.

-

How do I get started with the Streamlined Sales And Use Tax Agreement Form?

Getting started with the Streamlined Sales And Use Tax Agreement Form is easy with airSlate SignNow. Simply sign up for an account, access the form templates, and follow the step-by-step instructions to customize and send your documents for eSignature.

-

Is the Streamlined Sales And Use Tax Agreement Form legally binding?

Yes, the Streamlined Sales And Use Tax Agreement Form signed through airSlate SignNow is legally binding. Our platform complies with eSignature laws, providing a secure method for document execution that holds up in court.

-

What features are included with the Streamlined Sales And Use Tax Agreement Form on airSlate SignNow?

The Streamlined Sales And Use Tax Agreement Form on airSlate SignNow includes features such as customizable templates, eSignature capabilities, real-time tracking, and cloud storage. These tools streamline your tax management process, helping you stay organized and compliant.

Get more for Streamlined Sales And Use Tax Agreement Form

- Cord marriage certificate form

- Ut arlington undergraduate financial statement for international students uta form

- Octane q37 service manual form

- Application for specified medical professions for form

- Nfcu 584 pdf form

- The rush fun park bday party invitation form

- Louisiana tax power of attorney form r 7006 pdf

- Mineral revenues in louisiana form

Find out other Streamlined Sales And Use Tax Agreement Form

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast