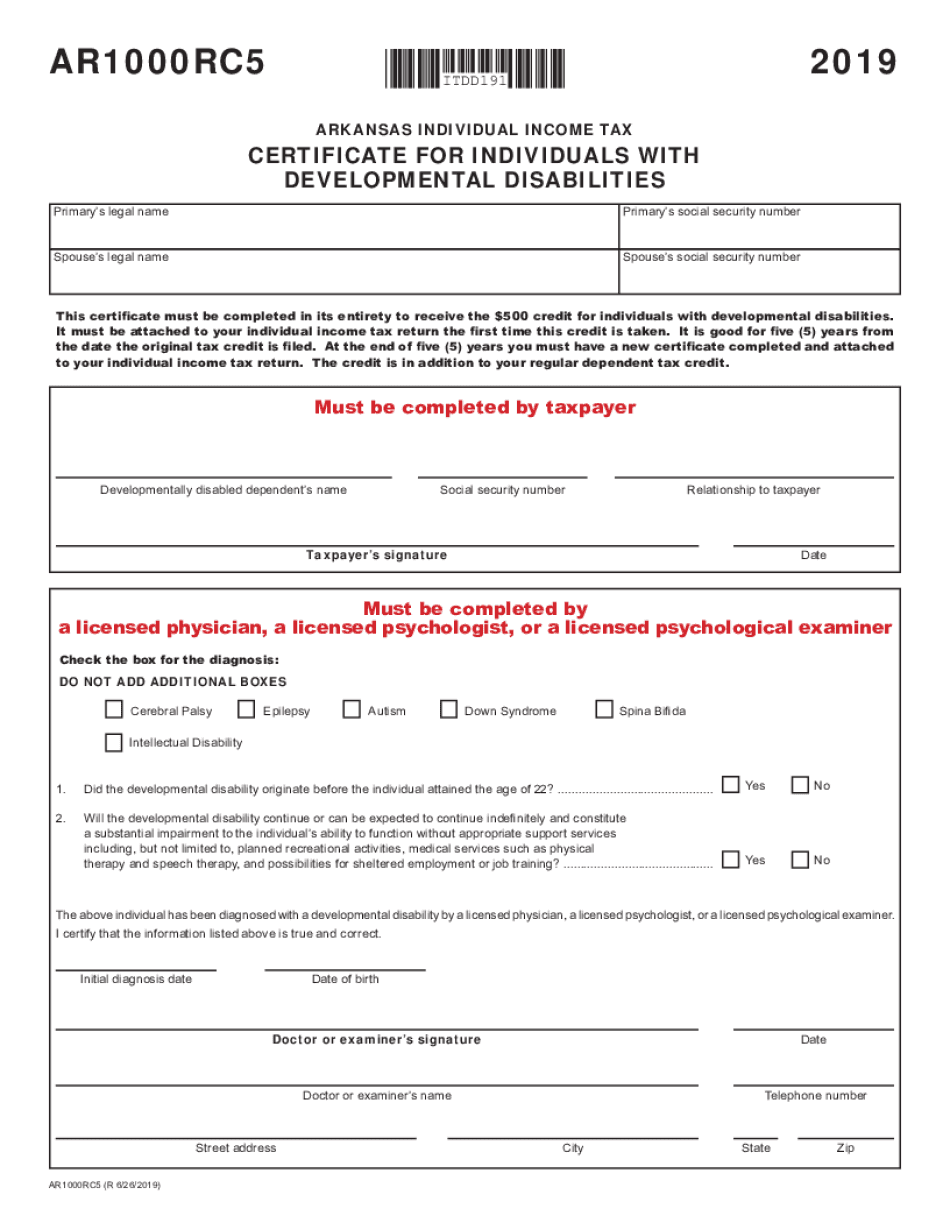

Ar1000rc5 2019

What is the AR1000RC5?

The AR1000RC5 is the Arkansas state tax form used to report income and calculate tax liabilities for residents of Arkansas. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It captures various income sources, deductions, and credits applicable under Arkansas tax law. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to Obtain the AR1000RC5

The AR1000RC5 form can be obtained through the Arkansas Department of Finance and Administration's official website. Additionally, physical copies are often available at local tax offices and libraries. It is advisable to ensure you have the most current version of the form, as tax regulations and requirements can change annually.

Steps to Complete the AR1000RC5

Completing the AR1000RC5 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately on the form.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for accuracy before submission.

Legal Use of the AR1000RC5

The AR1000RC5 is legally binding when completed correctly and submitted to the Arkansas Department of Finance and Administration. It is essential to provide accurate information to avoid legal repercussions. The form must be signed, and any discrepancies can lead to audits or penalties. Utilizing digital tools for e-signatures can enhance the legal validity of the submitted form.

Form Submission Methods

The AR1000RC5 can be submitted through various methods:

- Online: Many taxpayers prefer electronic filing for its convenience. Submitting the form online often expedites processing times.

- Mail: If you choose to file by mail, ensure you send it to the correct address provided by the Arkansas Department of Finance and Administration.

- In-Person: You may also submit the form in person at local tax offices, where staff can assist with any questions.

Filing Deadlines / Important Dates

Filing deadlines for the AR1000RC5 typically align with federal tax deadlines. For most taxpayers, the deadline is April 15 of each year. However, extensions may be available under specific circumstances. It is crucial to stay informed about any changes to filing dates, as these can vary from year to year.

Quick guide on how to complete ar1000rc5

Complete Ar1000rc5 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Ar1000rc5 on any device using airSlate SignNow apps for Android or iOS and simplify your document-centered processes today.

The easiest way to modify and eSign Ar1000rc5 seamlessly

- Obtain Ar1000rc5 and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ar1000rc5 while ensuring clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar1000rc5

Create this form in 5 minutes!

How to create an eSignature for the ar1000rc5

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the ar state tax form ar1000rc5 used for?

The ar state tax form ar1000rc5 is primarily used by individuals and businesses in Arkansas to report their state tax information. Completing this form accurately is crucial to ensure compliance with state tax laws and to avoid penalties.

-

How can airSlate SignNow help with the ar state tax form ar1000rc5?

airSlate SignNow simplifies the process of completing and signing the ar state tax form ar1000rc5 by providing an easy-to-use eSignature platform. You can fill out the form digitally, save it securely, and send it for eSignature, making tax season stress-free.

-

Is there a cost associated with using airSlate SignNow for the ar state tax form ar1000rc5?

Yes, there is a subscription cost for using the airSlate SignNow platform, but it is designed to be cost-effective for businesses and individuals alike. The pricing plans vary, allowing you to choose one that best fits your needs while ensuring you can complete the ar state tax form ar1000rc5 without hassle.

-

What features does airSlate SignNow offer for managing the ar state tax form ar1000rc5?

airSlate SignNow offers features such as document templates, real-time tracking, secure storage, and easy collaboration. These tools enhance the efficiency of managing the ar state tax form ar1000rc5, ensuring a seamless workflow from start to finish.

-

Can I integrate airSlate SignNow with other applications for the ar state tax form ar1000rc5?

Absolutely! airSlate SignNow supports various integrations with popular applications, making it easy to handle your documents, including the ar state tax form ar1000rc5, within your existing workflow. This allows you to enhance productivity and streamline your tax preparation process.

-

Is it secure to use airSlate SignNow for the ar state tax form ar1000rc5?

Yes, security is a top priority at airSlate SignNow. The platform employs industry-standard encryption and complies with data protection regulations to ensure that your information related to the ar state tax form ar1000rc5 is safe and confidential.

-

How can I get support if I have questions about the ar state tax form ar1000rc5?

airSlate SignNow offers customer support through various channels, including live chat, email, and an extensive knowledge base. If you have questions about filling out or submitting the ar state tax form ar1000rc5, assistance is readily available.

Get more for Ar1000rc5

- Suntek window films residential and commercial films form

- Your first bill important things to know 888 adt asap form

- Kids discovery academy inc discipline guidance form discipline guidance form

- Kennesaw state university senior citizens form

- Grandpas missing socks form

- Novasom sleep study order form

- Oreilly rebate form

- Texas board dental examiners form

Find out other Ar1000rc5

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement