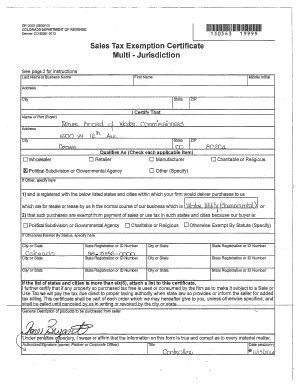

Dr 0563 Example Form

What is the Colorado sales tax exemption certificate form DR 0563?

The Colorado sales tax exemption certificate form DR 0563 is a legal document that allows eligible purchasers to claim an exemption from sales tax on specific purchases. This form is primarily used by organizations, such as non-profits and government entities, that qualify for sales tax exemptions under Colorado law. By submitting the DR 0563, these entities can provide proof of their exempt status to sellers, ensuring that they do not pay sales tax on eligible transactions.

How to use the Colorado sales tax exemption certificate form DR 0563

To use the DR 0563 form, eligible purchasers must complete it accurately and provide it to the seller at the time of purchase. The form requires information such as the purchaser's name, address, and the reason for the exemption. It is essential to ensure that all information is correct to avoid potential issues with tax compliance. Sellers should retain a copy of the completed form for their records, as it serves as documentation of the tax-exempt sale.

Steps to complete the Colorado sales tax exemption certificate form DR 0563

Completing the DR 0563 form involves several straightforward steps:

- Obtain the form from a reliable source, such as the Colorado Department of Revenue website.

- Fill in the purchaser's name and address in the designated fields.

- Indicate the reason for the exemption by selecting the appropriate category.

- Provide any additional required information, such as the seller's name and address.

- Sign and date the form to certify its accuracy.

Once completed, the form should be presented to the seller during the transaction.

Legal use of the Colorado sales tax exemption certificate form DR 0563

The DR 0563 form is legally binding when filled out correctly and used in accordance with Colorado tax laws. It is crucial for purchasers to ensure that they meet the eligibility criteria for tax exemption. Misuse of the form, such as claiming exemptions for ineligible purchases, can result in penalties and back taxes owed. Sellers must also verify that the form is valid before accepting it to avoid potential tax liabilities.

Eligibility criteria for the Colorado sales tax exemption certificate form DR 0563

To qualify for using the DR 0563 form, purchasers must meet specific eligibility criteria set by the Colorado Department of Revenue. Generally, the following entities are eligible:

- Non-profit organizations recognized under IRS regulations

- Government agencies and instrumentalities

- Certain educational institutions

- Other organizations as defined by Colorado law

It is essential for applicants to review the specific requirements and ensure they can provide the necessary documentation to support their exempt status.

Form submission methods for the Colorado sales tax exemption certificate form DR 0563

The DR 0563 form does not require formal submission to the Colorado Department of Revenue; instead, it is presented directly to the seller at the time of purchase. Sellers should keep the form on file for their records, as it serves as proof of the tax-exempt status of the transaction. For record-keeping purposes, both the purchaser and seller may want to maintain copies of the completed form.

Quick guide on how to complete dr 0563 example

Complete Dr 0563 Example effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Dr 0563 Example on any platform using airSlate SignNow's mobile apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Dr 0563 Example with ease

- Obtain Dr 0563 Example and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that task by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, laborious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Dr 0563 Example to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0563 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0563 and how does it relate to airSlate SignNow?

dr 0563 is a reference code that helps identify specific features or functionalities within the airSlate SignNow platform. It signifies a range of capabilities aimed at streamlining document management and eSigning processes. Understanding dr 0563 can enhance your experience with our platform, ensuring you leverage all available tools effectively.

-

What are the pricing options for airSlate SignNow including dr 0563?

airSlate SignNow offers competitive pricing plans tailored to various business needs, including those specifically involving dr 0563 features. Our pricing is designed to be cost-effective while providing comprehensive solutions for eSigning and document management. You can check our website for detailed pricing information and join the many businesses benefiting from dr 0563.

-

What features does airSlate SignNow offer under the dr 0563 category?

The dr 0563 category encompasses advanced features such as customizable templates, automated workflows, and seamless integrations with other applications. These features enable businesses to enhance their document handling processes. Leveraging dr 0563 will certainly optimize your efficiency and productivity when managing electronic signatures.

-

How does airSlate SignNow improve business efficiency with dr 0563?

By implementing dr 0563 features within airSlate SignNow, businesses can signNowly reduce the time taken for document signing and approval processes. This code includes tools that automate repetitive tasks, thereby minimizing manual errors. As a result, your organization can focus more on core activities and drive growth.

-

Can dr 0563 features be integrated with other software?

Yes, dr 0563 features within airSlate SignNow are designed to integrate smoothly with various third-party applications, enhancing your overall productivity. Popular integrations include CRM systems, project management tools, and cloud storage solutions. This seamless connectivity helps ensure that your document management processes are streamlined and efficient.

-

What are the benefits of using airSlate SignNow with dr 0563 for small businesses?

For small businesses, utilizing airSlate SignNow with dr 0563 can provide numerous advantages, including reduced operational costs and improved document turnaround times. The user-friendly interface allows teams to adapt quickly without extensive training. Additionally, the security features associated with dr 0563 ensure that your documents are safeguarded during the signing process.

-

How can I get support for dr 0563 features in airSlate SignNow?

For support related to dr 0563 features, users can access a variety of resources, including detailed documentation, instructional videos, and a dedicated customer service team. Our support staff is available to address any specific inquiries or troubleshooting needs you may have. Please visit our support page for comprehensive assistance.

Get more for Dr 0563 Example

- Pdf 2021 instructions for form 8865 internal revenue service

- Us nonresident alien income tax returnform 1040nrus nonresident alien income tax returnform 1040nrabout form 1040 nr us

- Form 6251 department of the treasury internal revenue

- About form 5330 return of excise taxes related to

- Irs publication 503 fill and sign printable template form

- Pdf form it 214 claim for real property tax credit for homeowners

- Tips for estimated tax department of taxation and finance form

- Wwwuslegalformscomform librarytaxfl dr 309634n 2021 2022 fill out tax template onlineus

Find out other Dr 0563 Example

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free