Il Annual Report Form 2012

What is the IL Annual Report Form

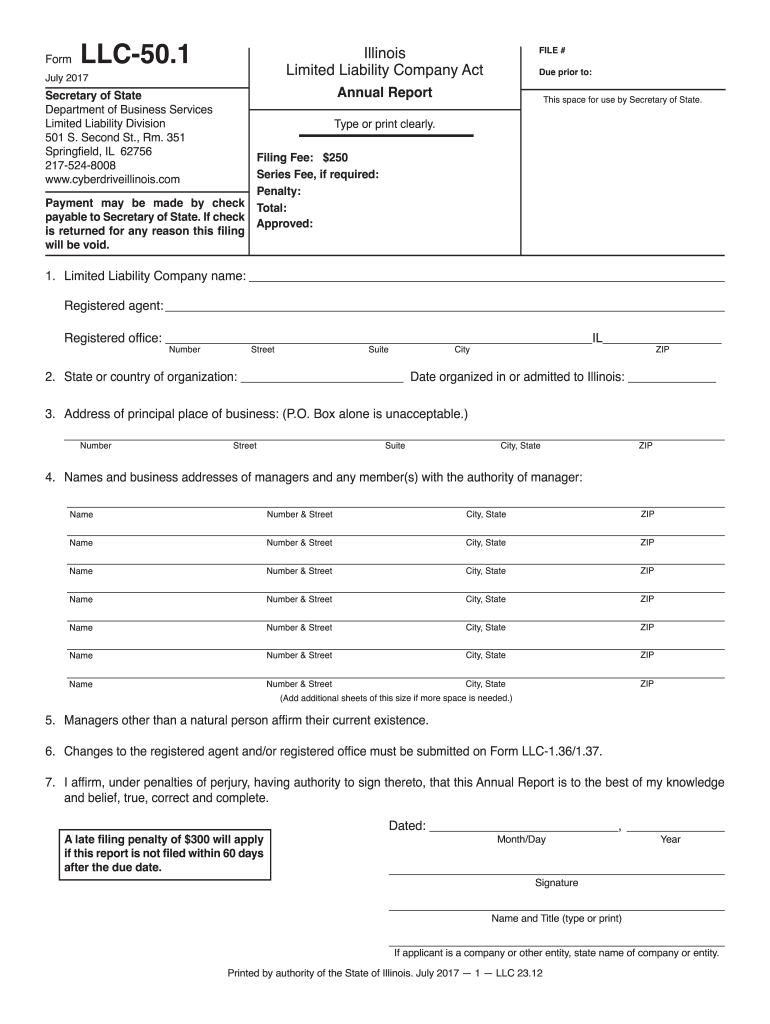

The IL Annual Report Form is a mandatory document for limited liability companies (LLCs) operating in Illinois. This form, officially known as the LLC-50.1, provides essential information about the business, such as its name, address, and the names of its members or managers. Filing this report is crucial for maintaining good standing with the state and ensuring compliance with Illinois regulations.

Steps to Complete the IL Annual Report Form

Completing the IL Annual Report Form involves several straightforward steps:

- Gather necessary information, including your LLC's name, address, and member or manager details.

- Access the form through the Illinois Secretary of State's website or other authorized platforms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form online or print it for mailing, depending on your preference.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the IL Annual Report Form. LLCs in Illinois must file their annual report by the first day of the anniversary month of their formation. For example, if your LLC was formed in March, the report is due by March 1 each year. Late filings may incur penalties, so timely submission is crucial.

Legal Use of the IL Annual Report Form

The IL Annual Report Form serves a legal purpose by ensuring that the state has up-to-date information about your LLC. This form is required to maintain your business's active status and protect your limited liability status. Failure to file can lead to administrative dissolution of the LLC, impacting its legal protections and operational capabilities.

Form Submission Methods (Online / Mail / In-Person)

There are several methods to submit the IL Annual Report Form:

- Online: Filing electronically through the Illinois Secretary of State's website is the quickest method.

- Mail: You can print the completed form and send it to the appropriate address provided on the form.

- In-Person: Submitting the form in person at the Secretary of State's office is also an option for those who prefer face-to-face interactions.

Key Elements of the IL Annual Report Form

The IL Annual Report Form includes several key elements that must be filled out accurately. These elements typically include:

- LLC name and file number

- Principal office address

- Names and addresses of members or managers

- Signature of an authorized representative

Providing accurate and complete information is vital to avoid delays or issues with your filing.

Quick guide on how to complete illinois limited liability annual report 2012 2019 form

Manage Il Annual Report Form anywhere, at any time

Your daily organizational tasks may require extra focus when managing state-specific business documents. Reclaim your working hours and reduce the costs associated with paper-intensive processes with airSlate SignNow. airSlate SignNow provides you with a variety of pre-prepared business documents, including Il Annual Report Form, which you can utilize and share with your business associates. Manage your Il Annual Report Form seamlessly with robust editing and eSignature features, and send it directly to your recipients.

Steps to obtain Il Annual Report Form in just a few clicks:

- Select a document pertinent to your state.

- Click Learn More to view the document and confirm its accuracy.

- Choose Get Form to begin your work.

- Il Annual Report Form will instantly open in the editor. No further actions are needed.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the document.

- Select the Sign feature to create your unique signature and eSign your document.

- When finished, click on Done, save changes, and access your document.

- Send the document via email or SMS, or utilize a link-to-fill option with your collaborators or allow them to download the files.

airSlate SignNow signNowly conserves your time managing Il Annual Report Form and enables you to find crucial documents in one location. An extensive library of documents is organized and created to support vital organizational procedures necessary for your business. The advanced editor minimizes the possibility of errors, allowing you to easily amend mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your everyday organizational operations.

Create this form in 5 minutes or less

Find and fill out the correct illinois limited liability annual report 2012 2019 form

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the illinois limited liability annual report 2012 2019 form

How to create an eSignature for your Illinois Limited Liability Annual Report 2012 2019 Form in the online mode

How to create an eSignature for your Illinois Limited Liability Annual Report 2012 2019 Form in Chrome

How to generate an electronic signature for putting it on the Illinois Limited Liability Annual Report 2012 2019 Form in Gmail

How to make an electronic signature for the Illinois Limited Liability Annual Report 2012 2019 Form right from your smartphone

How to create an eSignature for the Illinois Limited Liability Annual Report 2012 2019 Form on iOS

How to make an electronic signature for the Illinois Limited Liability Annual Report 2012 2019 Form on Android

People also ask

-

What is the IL Annual Report Form and why is it important?

The IL Annual Report Form is a crucial document required by the state of Illinois for businesses to maintain their good standing. By filing this form, companies provide updated information about their operations, ensuring compliance with state regulations. This annual requirement helps businesses avoid penalties and stay registered.

-

How can airSlate SignNow help with filing the IL Annual Report Form?

airSlate SignNow streamlines the process of preparing and eSigning the IL Annual Report Form. Our platform enables users to easily fill out the necessary fields, sign documents electronically, and securely send them to the appropriate state offices. This reduces administrative burden and speeds up compliance.

-

What features does airSlate SignNow offer for managing the IL Annual Report Form?

With airSlate SignNow, you can utilize features such as customizable templates, electronic signatures, and document tracking specifically for the IL Annual Report Form. These tools simplify the preparation process and ensure that all required information is accurately captured and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the IL Annual Report Form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for users focusing on the IL Annual Report Form. Our plans are designed to be cost-effective, making it easy for businesses of all sizes to comply with filing requirements without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing the IL Annual Report Form?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications and platforms, allowing you to manage the IL Annual Report Form alongside your existing business tools. This integration helps streamline workflows and ensures that your reporting processes are efficient and effective.

-

How secure is my information when using airSlate SignNow for the IL Annual Report Form?

Security is a top priority for airSlate SignNow. All data submitted through the platform, including the IL Annual Report Form, is encrypted and protected with advanced security measures. This ensures that your sensitive business information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for the IL Annual Report Form?

Using airSlate SignNow for the IL Annual Report Form offers several advantages, including time savings, enhanced accuracy through automated workflows, and the convenience of eSigning from anywhere. This platform simplifies the entire filing process, allowing businesses to focus on growth while ensuring compliance.

Get more for Il Annual Report Form

Find out other Il Annual Report Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document