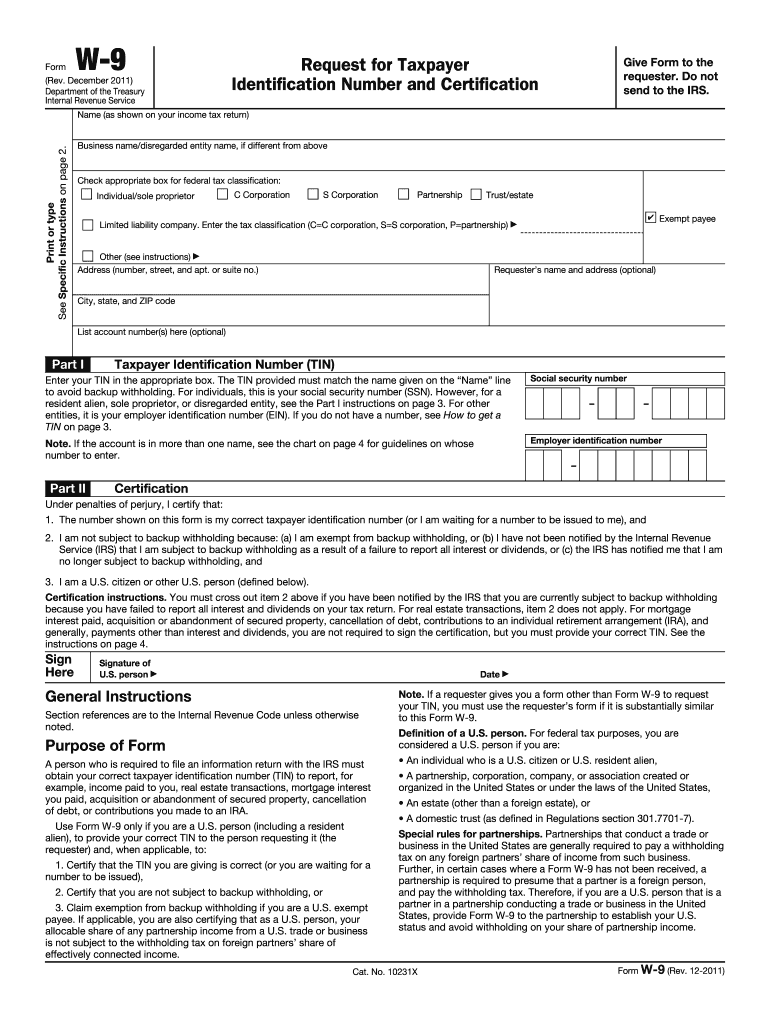

Name as Shown on Your Income Tax Return Business Namedisregarded Entity Name, If Different from above Finance Emory Form

What makes the name as shown on your income tax return business namedisregarded entity name if different from above finance emory form legally valid?

As the world takes a step away from office working conditions, the completion of documents more and more occurs online. The name as shown on your income tax return business namedisregarded entity name if different from above finance emory form isn’t an any different. Handling it using electronic tools differs from doing this in the physical world.

An eDocument can be regarded as legally binding provided that particular needs are met. They are especially vital when it comes to stipulations and signatures related to them. Entering your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it performed. You need a reliable tool, like airSlate SignNow that provides a signer with a electronic certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your name as shown on your income tax return business namedisregarded entity name if different from above finance emory form when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legal and safe. Furthermore, it provides a lot of opportunities for smooth completion security wise. Let's quickly run through them so that you can stay assured that your name as shown on your income tax return business namedisregarded entity name if different from above finance emory form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties' identities via additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data securely to the servers.

Filling out the name as shown on your income tax return business namedisregarded entity name if different from above finance emory form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete name as shown on your income tax return business namedisregarded entity name if different from above finance emory

Effortlessly prepare Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to edit and eSign Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory smoothly

- Obtain Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your preferred method of sharing your form, whether it be via email, text message (SMS), an invite link, or download it to your PC.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I had filed form 843 for refund of wrongly withheld Social Security taxes and Medicare taxes about 6 months back. I just realised that I mistakenly filled the wrong address in the column "Name and address shown on return if different from above". What should I do? Is that causing a delay in my refund?

You might want to contact them with a follow up letter, but, that isn't delay...843's can take quite a long time to get processed...I have some take 18 months.

Create this form in 5 minutes!

How to create an eSignature for the name as shown on your income tax return business namedisregarded entity name if different from above finance emory

How to make an eSignature for the Name As Shown On Your Income Tax Return Business Namedisregarded Entity Name If Different From Above Finance Emory online

How to make an eSignature for your Name As Shown On Your Income Tax Return Business Namedisregarded Entity Name If Different From Above Finance Emory in Google Chrome

How to make an electronic signature for signing the Name As Shown On Your Income Tax Return Business Namedisregarded Entity Name If Different From Above Finance Emory in Gmail

How to make an electronic signature for the Name As Shown On Your Income Tax Return Business Namedisregarded Entity Name If Different From Above Finance Emory right from your smart phone

How to create an electronic signature for the Name As Shown On Your Income Tax Return Business Namedisregarded Entity Name If Different From Above Finance Emory on iOS

How to create an eSignature for the Name As Shown On Your Income Tax Return Business Namedisregarded Entity Name If Different From Above Finance Emory on Android

People also ask

-

What is the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory' feature in airSlate SignNow?

The 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory' feature in airSlate SignNow allows users to accurately input their business name for tax purposes. This ensures that all documents signed reflect the correct entity name, minimizing the risk of discrepancies with tax filings. It streamlines the eSigning process for businesses classified as disregarded entities.

-

How does airSlate SignNow handle pricing for businesses under the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory'?

airSlate SignNow offers competitive pricing tailored for businesses, including those that require the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory' feature. Pricing plans are designed to be cost-effective, ensuring you get the best value for your eSigning needs. Choose from various subscription options to find the best fit for your business.

-

Can I integrate airSlate SignNow with my existing business software that uses the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory'?

Yes, airSlate SignNow integrates seamlessly with a variety of business software to accommodate the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory' requirement. This allows for a smooth workflow where all eSigned documents can easily sync with your existing systems. Check our integrations page for specific applications.

-

What are the key benefits of using airSlate SignNow for businesses with the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory'?

Using airSlate SignNow provides numerous benefits for businesses, particularly those concerned with the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory.' The platform offers an intuitive interface, robust security features, and compliance with legal standards, ensuring that your documents are signed efficiently and securely. Additionally, it enhances the overall productivity of your business.

-

Is airSlate SignNow suitable for small businesses that need the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory'?

Absolutely! airSlate SignNow is an ideal solution for small businesses needing the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory.' The platform is designed to be user-friendly and affordable, making it accessible to businesses of all sizes. Small businesses can easily manage document signing without the need for extensive training.

-

How can I ensure compliance when using airSlate SignNow for my business documents involving the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory'?

airSlate SignNow emphasizes compliance with regulations and legal standards, especially for businesses needing the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory.' Our platform provides audit trails and secure storage for signed documents to help you maintain compliance. Regular updates ensure you stay aligned with evolving legal requirements.

-

What types of documents can I eSign using airSlate SignNow related to the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory'?

With airSlate SignNow, you can eSign a wide range of documents relevant to the 'Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory.' This includes contracts, agreements, and tax-related documents. The versatility of our platform allows for seamless eSigning across different document types, enhancing your business efficiency.

Get more for Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory

- Indiana 2017 it 40 form

- Ltc 90 form

- Pit cg form

- Pdf affidavit of gift of motor vehicle or boat form

- About form 1040 ss us self employment tax return

- 2020 form 1040 pr federal self employment contribution statement for residents of puerto rico

- 2020 instructions for form 1120 s internal revenue service

- Content disposition http mdn 549395077 form

Find out other Name as Shown On Your Income Tax Return Business Namedisregarded Entity Name, If Different From Above Finance Emory

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure