Form 1040 PR Federal Self Employment Contribution Statement for Residents of Puerto Rico 2020

What is the Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico

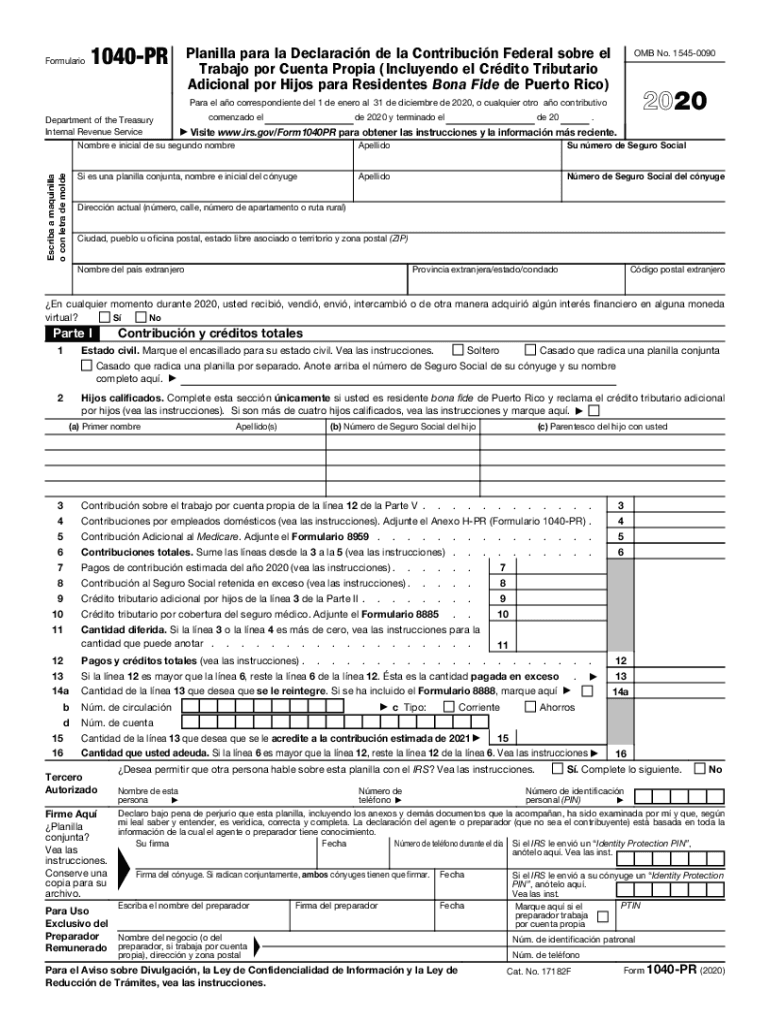

The Form 1040 PR is a federal tax form specifically designed for residents of Puerto Rico who are self-employed. This form serves as a declaration of income and is used to calculate the self-employment tax owed to the Internal Revenue Service (IRS). It is essential for individuals who earn income through self-employment, as it helps ensure compliance with federal tax obligations while also contributing to Social Security and Medicare programs. Understanding this form is crucial for maintaining accurate tax records and fulfilling legal requirements.

How to use the Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico

Using the Form 1040 PR involves several steps that ensure accurate reporting of self-employment income. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form with your personal information and report your total income from self-employment. It is important to detail any deductions you may qualify for, as these can significantly affect your taxable income. Once the form is complete, review it for accuracy before submitting it to the IRS.

Steps to complete the Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico

Completing the Form 1040 PR involves a systematic approach:

- Gather all relevant financial documentation, including income and expense records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total self-employment income in the designated section.

- List any allowable deductions to reduce your taxable income.

- Calculate the self-employment tax based on your net earnings.

- Sign and date the form to certify that the information is accurate.

Legal use of the Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico

The Form 1040 PR is legally recognized by the IRS as a valid method for reporting self-employment income for Puerto Rican residents. To ensure its legal standing, it must be filled out accurately and submitted by the appropriate deadlines. Compliance with all IRS regulations regarding this form is essential, as failure to do so may result in penalties or legal repercussions. Understanding the legal implications of this form is vital for all self-employed individuals in Puerto Rico.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 PR typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to remain aware of these dates to avoid late filing penalties. Additionally, any extensions must be requested in advance to ensure compliance.

Required Documents

When preparing to complete the Form 1040 PR, certain documents are necessary to ensure accurate reporting. These include:

- Income statements from self-employment activities.

- Receipts and documentation for business-related expenses.

- Previous year's tax return for reference.

- Any relevant IRS publications or guidelines pertaining to self-employment.

Having these documents readily available will facilitate a smoother and more accurate filing process.

Eligibility Criteria

To file the Form 1040 PR, individuals must meet specific eligibility criteria. Primarily, the form is intended for residents of Puerto Rico who earn income through self-employment. Additionally, individuals must have a valid Social Security number and should report income that meets or exceeds the minimum threshold set by the IRS for self-employment tax. Understanding these eligibility requirements is essential for proper compliance and tax reporting.

Quick guide on how to complete 2020 form 1040 pr federal self employment contribution statement for residents of puerto rico

Easily Prepare Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico on Any Device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delay. Manage Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Edit and eSign Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico with Ease

- Obtain Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1040 pr federal self employment contribution statement for residents of puerto rico

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1040 pr federal self employment contribution statement for residents of puerto rico

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the 1040 pr form and why do I need it?

The 1040 pr form is an essential tax document used for filing income taxes in specific jurisdictions. Completing this form accurately is crucial for ensuring compliance and can affect your tax refund or liability. Using airSlate SignNow can streamline this process, allowing you to eSign and send your 1040 pr form with ease.

-

How can airSlate SignNow simplify the process of completing a 1040 pr form?

airSlate SignNow provides an intuitive platform for managing your 1040 pr form. It enables you to fill out the form online, reduces paperwork, and allows for secure eSigning. This makes filing your taxes quicker and more efficient.

-

Is there a cost associated with using airSlate SignNow for my 1040 pr form?

Yes, while airSlate SignNow offers various pricing plans, they are designed to be cost-effective for individuals and businesses alike. Many users find that the value provided through seamless eSigning of documents like the 1040 pr far outweighs the associated fees.

-

What features does airSlate SignNow offer for handling 1040 pr forms?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, which perfectly complement handling 1040 pr forms. Additionally, users can easily integrate the platform with other tools and software for even more functionality.

-

Can I use airSlate SignNow for multiple 1040 pr forms throughout the year?

Absolutely! airSlate SignNow allows you to manage and send multiple 1040 pr forms as needed. This flexibility makes it easy to adapt to changes in your financial situation without the hassle of traditional paperwork.

-

What integrations does airSlate SignNow offer that can assist with 1040 pr forms?

airSlate SignNow integrates with various accounting and tax preparation software, making it easier for you to handle your 1040 pr forms. These integrations streamline your workflow, allowing for a more comprehensive approach to managing your tax filings.

-

How secure is the eSigning process for my 1040 pr form with airSlate SignNow?

The eSigning process for your 1040 pr form via airSlate SignNow is highly secure. Implementing advanced encryption and authentication technology, the platform ensures that your sensitive tax information is protected throughout the entire signing process.

Get more for Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico

Find out other Form 1040 PR Federal Self Employment Contribution Statement For Residents Of Puerto Rico

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate