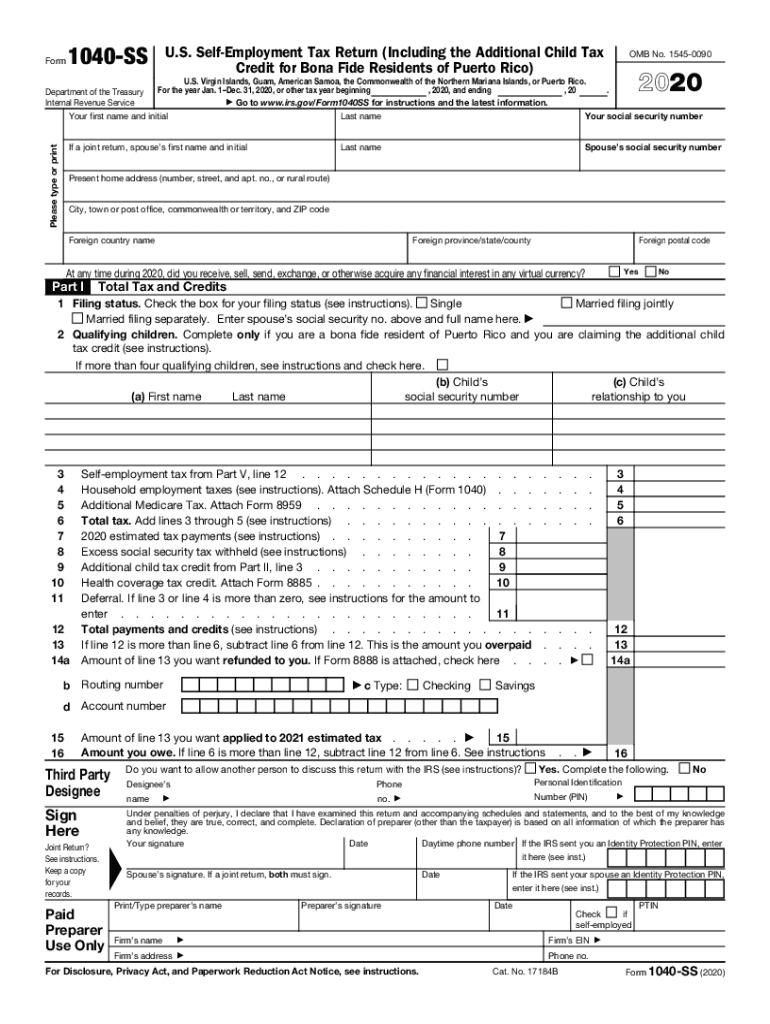

About Form 1040 SS, U S Self Employment Tax Return 2020

Understanding the SBA Standby Agreement (SBA Form 155)

The SBA standby agreement, commonly referred to as SBA Form 155, is a crucial document for businesses seeking financial assistance through the Small Business Administration. This form serves as a commitment from a lender to provide a loan to a small business, contingent upon certain conditions being met. It outlines the terms and conditions under which the loan will be granted and is essential for ensuring that both the lender and borrower understand their responsibilities.

Key Elements of SBA Form 155

SBA Form 155 includes several key elements that are vital for its validity and effectiveness. These elements typically encompass:

- Loan Amount: The total amount of financing being requested.

- Interest Rate: The agreed-upon interest rate for the loan.

- Repayment Terms: Details regarding the repayment schedule and duration.

- Conditions Precedent: Specific conditions that must be fulfilled before the loan can be disbursed.

- Signatures: Required signatures from both the lender and the borrower to validate the agreement.

Steps to Complete SBA Form 155

Completing SBA Form 155 involves several steps to ensure accuracy and compliance with SBA regulations. Here is a simplified process:

- Gather necessary financial information, including business details and loan requirements.

- Fill out the form, ensuring all fields are completed accurately.

- Review the terms and conditions outlined in the form.

- Obtain signatures from all parties involved.

- Submit the completed form to the lender for processing.

Legal Use of SBA Form 155

The legal use of SBA Form 155 is governed by federal regulations that dictate its role in the loan approval process. This form must be executed in compliance with the SBA's guidelines to ensure it is legally binding. Failure to adhere to these regulations may result in delays or denial of loan applications.

Filing Deadlines and Important Dates

When dealing with SBA Form 155, it is important to be aware of any relevant deadlines. These may include:

- Application Submission Deadline: The date by which the form must be submitted to the lender.

- Loan Approval Timeline: The expected timeframe for the lender to review and approve the loan.

Who Issues SBA Form 155

SBA Form 155 is issued by the Small Business Administration, a federal agency dedicated to supporting small businesses in the United States. The form is typically provided by lenders participating in SBA loan programs, ensuring that both parties are aligned on the terms of the standby agreement.

Quick guide on how to complete about form 1040 ss us self employment tax return

Complete About Form 1040 SS, U S Self Employment Tax Return seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without complications. Handle About Form 1040 SS, U S Self Employment Tax Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to alter and electronically sign About Form 1040 SS, U S Self Employment Tax Return effortlessly

- Obtain About Form 1040 SS, U S Self Employment Tax Return and press Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign About Form 1040 SS, U S Self Employment Tax Return and ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1040 ss us self employment tax return

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 ss us self employment tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is an SBA standby agreement SBA form 155?

The SBA standby agreement SBA form 155 is a crucial document used to outline the terms of a standby letter of credit. This form is essential for businesses seeking SBA financing, as it ensures that all parties understand their obligations. Using this form properly can help in securing funding and managing risk effectively.

-

How can airSlate SignNow help with SBA standby agreement SBA form 155?

With airSlate SignNow, you can easily prepare, send, and eSign the SBA standby agreement SBA form 155 online. Our platform provides a user-friendly interface that simplifies document management, ensuring smooth transactions. You can save time and reduce errors by having all your signing needs addressed in one place.

-

What are the costs associated with using airSlate SignNow for SBA standby agreement SBA form 155?

airSlate SignNow offers competitive pricing plans that suit businesses of all sizes. Our pricing includes unlimited document sending and eSigning for the SBA standby agreement SBA form 155, making it cost-effective. You can choose a plan that fits your business needs while enjoying comprehensive features.

-

What features does airSlate SignNow provide for managing the SBA standby agreement SBA form 155?

airSlate SignNow offers a variety of features that enhance the management of the SBA standby agreement SBA form 155. These include document templates, real-time tracking, and notification alerts for signed documents. Such features streamline the process, allowing you to focus on your business rather than paperwork.

-

Are there any integrations available for airSlate SignNow when working with SBA standby agreement SBA form 155?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing you to work efficiently with the SBA standby agreement SBA form 155. Integrations with CRM systems, cloud storage solutions, and other productivity tools facilitate smooth workflows. This means you can leverage existing tools while managing your documents.

-

What are the benefits of using airSlate SignNow for SBA standby agreement SBA form 155?

Using airSlate SignNow for the SBA standby agreement SBA form 155 provides numerous benefits like enhanced security, lower costs, and improved efficiency. Our platform ensures your documents are securely signed and stored, reducing the risk of fraud. Additionally, the ease of use allows for faster turnaround on critical documents.

-

How can I ensure compliance when using the SBA standby agreement SBA form 155?

Compliance when using the SBA standby agreement SBA form 155 is crucial, and airSlate SignNow helps ensure you meet all necessary regulations. Our platform provides compliant eSigning features and audit trails for all transactions. This means you can have peace of mind knowing that your documentation is secure and adheres to legal standards.

Get more for About Form 1040 SS, U S Self Employment Tax Return

Find out other About Form 1040 SS, U S Self Employment Tax Return

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract