Rd Form 1980 2013-2026

What is the Rd Form 1980

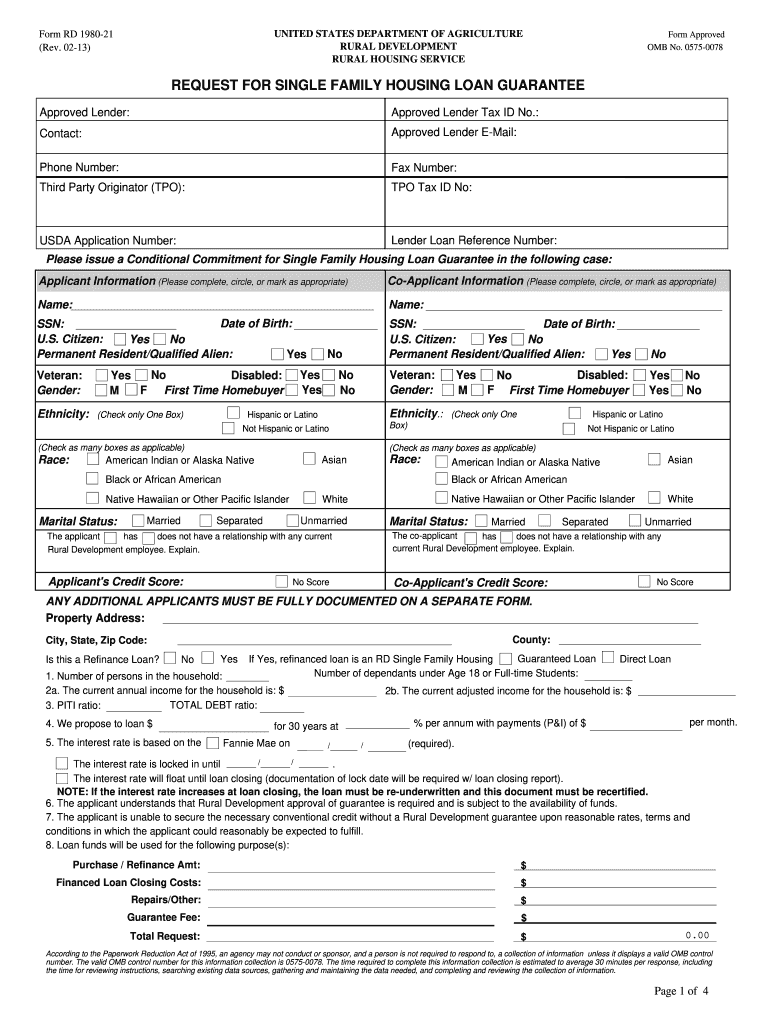

The Rd Form 1980, also known as the housing request loan form, is a critical document used to apply for housing assistance through the U.S. Department of Agriculture (USDA). This form is specifically designed for individuals seeking loans to purchase, build, or improve homes in rural areas. It is part of the USDA's Rural Development program, which aims to enhance the quality of life and economy in rural America by providing access to affordable housing. The form captures essential information about the applicant’s financial status, property details, and intended use of the loan funds.

Steps to Complete the Rd Form 1980

Completing the Rd Form 1980 involves several key steps to ensure accuracy and compliance with USDA requirements. First, gather all necessary documentation, such as proof of income, credit history, and details about the property. Next, fill out the form carefully, providing complete and truthful information in each section. Pay special attention to financial disclosures, as these will be critical in determining eligibility. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, which may include online submission or mailing it to your local USDA office.

Required Documents

When applying with the Rd Form 1980, applicants must provide several supporting documents to verify their eligibility. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns

- Credit report to assess creditworthiness

- Identification documents, including a driver's license or Social Security card

- Property information, including an appraisal or property tax statement

- Any additional documentation requested by the USDA to support your application

Ensuring that all required documents are included with the form can significantly expedite the processing time and improve the chances of approval.

Eligibility Criteria

To qualify for a housing request loan using the Rd Form 1980, applicants must meet specific eligibility criteria established by the USDA. These criteria typically include:

- Being a U.S. citizen or a qualified non-citizen

- Meeting income limits based on the area median income

- Demonstrating a need for safe and sanitary housing

- Having a suitable credit history

- Residing in a designated rural area as defined by the USDA

Understanding these eligibility requirements is essential for applicants to assess their chances of receiving a loan.

Form Submission Methods

The Rd Form 1980 can be submitted through various methods, allowing applicants flexibility based on their preferences. The primary submission methods include:

- Online Submission: Applicants can complete and submit the form electronically through the USDA's online portal.

- Mail: The completed form can be printed and mailed to the local USDA Rural Development office.

- In-Person: Applicants may also choose to deliver the form in person at their local USDA office for direct assistance.

Choosing the right submission method can help streamline the application process and ensure timely processing.

Legal Use of the Rd Form 1980

The Rd Form 1980 is legally binding once it is completed and submitted according to USDA guidelines. It is essential for applicants to provide accurate information, as any discrepancies can lead to delays or denial of the loan request. The form must comply with federal regulations governing housing loans, including adherence to the Fair Housing Act and other relevant legislation. Utilizing a reliable eSignature platform can enhance the legal standing of the submitted form, ensuring that all signatures are verifiable and compliant with electronic signature laws.

Quick guide on how to complete rd form 1980

Complete Rd Form 1980 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Rd Form 1980 on any platform with airSlate SignNow Android or iOS applications and streamline any document-driven process today.

The easiest method to edit and electronically sign Rd Form 1980 without hassle

- Find Rd Form 1980 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Rd Form 1980 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rd form 1980

Create this form in 5 minutes!

How to create an eSignature for the rd form 1980

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is a housing form loan and how does it work?

A housing form loan is a specific type of loan document used in the home financing process. It outlines the terms, conditions, and obligations of both the borrower and the lender. Utilizing airSlate SignNow, you can streamline the process of signing and managing these housing form loans, making it more efficient.

-

How much does it cost to use airSlate SignNow for housing form loans?

airSlate SignNow offers flexible pricing plans that cater to various business needs. The cost varies depending on the features and the number of users you require. Overall, it provides a cost-effective solution for managing housing form loans compared to traditional methods.

-

What features does airSlate SignNow offer for managing housing form loans?

airSlate SignNow offers features specifically designed for housing form loans, including eSignature capabilities, document templates, and automatic reminders. These tools help streamline the loan process, ensuring that all parties can easily access and sign documents without delays.

-

Can I integrate airSlate SignNow with other tools for housing form loan management?

Yes, airSlate SignNow allows seamless integration with various third-party applications. This includes CRM systems and document management tools, enabling a holistic approach to managing your housing form loans while keeping your workflow efficient.

-

What are the benefits of using airSlate SignNow for housing form loans?

Using airSlate SignNow for housing form loans enhances efficiency and reduces turnaround times. Its user-friendly interface makes document signing easy for everyone, while its tracking features ensure transparency in the loan process. Overall, it simplifies the complexities often involved in home financing.

-

Is airSlate SignNow secure for handling sensitive housing form loan documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. It employs advanced encryption and compliance standards to protect sensitive information associated with housing form loans. You can rest assured that your data is safe while using our platform.

-

How can airSlate SignNow assist with compliance in housing form loans?

airSlate SignNow helps ensure compliance by providing features such as audit trails and secure storage for housing form loan documents. These features allow businesses to maintain records and demonstrate compliance with regulatory requirements, making the loan process more secure.

Get more for Rd Form 1980

- Death cum retirement gratuity form

- General procedures for commissing of air systems jkr form

- Consent form for areola repigmentation 2 pdf

- Arizona form352credit for contributionsto qualify

- Arizona form 600 b claim for unclaimed property deceased owner

- Forms forms and publications library state of oregon

- Building permit loudonville ohio form

- Vendor preference affidavit of eligibility city of albuquerque form

Find out other Rd Form 1980

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now