Ir330 Form 2018

What is the Ir330 Form

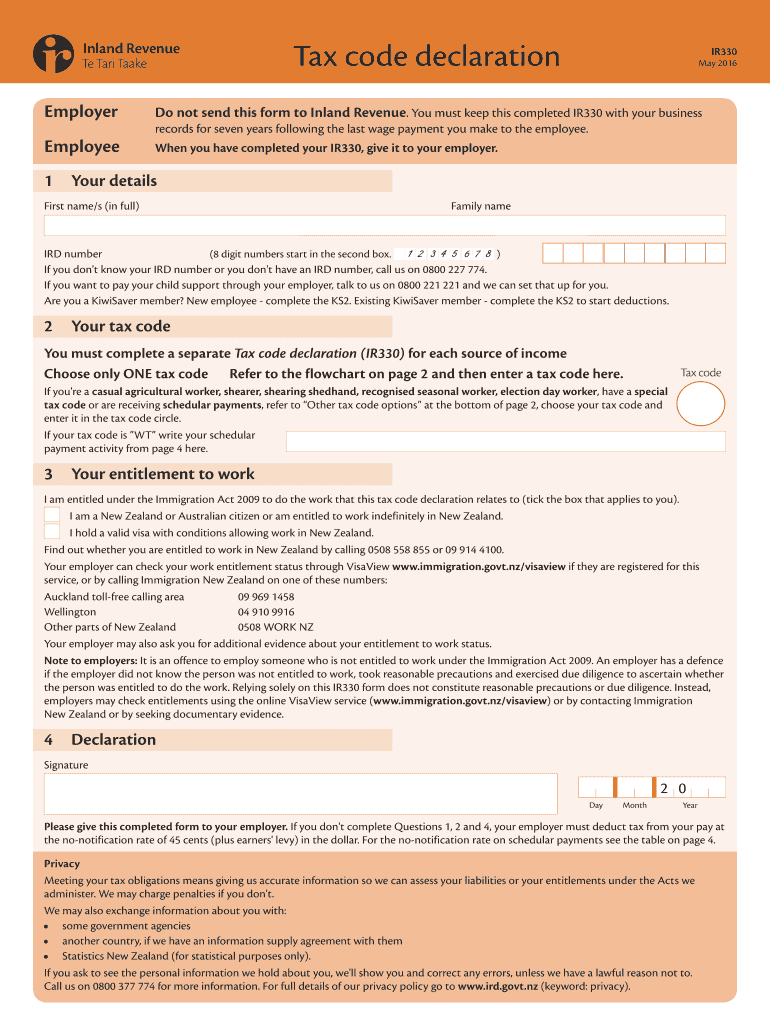

The Ir330 Form is a crucial document used in the United States for tax purposes. It is primarily utilized by employers to report the withholding of income tax from employee wages. This form ensures that the correct amount of federal income tax is withheld from an employee's paycheck, helping both the employer and employee comply with tax regulations. By accurately completing the Ir330 Form, employers can avoid penalties and ensure their employees are properly taxed according to their income levels.

How to use the Ir330 Form

Using the Ir330 Form involves several straightforward steps. First, employers must gather the necessary information about their employees, including their Social Security numbers, filing status, and the number of allowances they are claiming. Next, employers fill out the form by entering this information accurately. Once completed, the form should be submitted to the appropriate tax authority. It is essential for employers to keep a copy of the form for their records, as it may be needed for future reference or audits.

Steps to complete the Ir330 Form

Completing the Ir330 Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather employee information, including name, address, and Social Security number.

- Determine the employee's filing status and the number of allowances they wish to claim.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the completed form to the relevant tax authority and retain a copy for your records.

Legal use of the Ir330 Form

The legal use of the Ir330 Form is essential for compliance with federal tax laws. Employers are required to use this form to report income tax withholding accurately. Failure to use the form correctly can lead to penalties, including fines and interest on unpaid taxes. Additionally, employees rely on the accurate reporting of their tax withholdings to ensure they are not over- or under-withheld, which can impact their tax returns. Therefore, understanding the legal implications of using the Ir330 Form is crucial for both employers and employees.

Key elements of the Ir330 Form

The Ir330 Form contains several key elements that must be completed accurately. These include:

- Employee's full name and address

- Employee's Social Security number

- Filing status (single, married, etc.)

- Number of allowances claimed

- Additional amount to withhold, if applicable

Each of these elements plays a significant role in determining the correct amount of tax to withhold from an employee's paycheck, making it vital to complete them with precision.

Form Submission Methods

The Ir330 Form can be submitted through various methods, depending on the preferences of the employer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's website

- Mailing a physical copy of the form to the appropriate address

- In-person submission at designated tax offices

Choosing the right submission method can help ensure timely processing and compliance with tax regulations.

Quick guide on how to complete ir330 2016 form

Complete Ir330 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, edit, and electronically sign your documents without delays. Handle Ir330 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Ir330 Form seamlessly

- Find Ir330 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign Ir330 Form to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir330 2016 form

Create this form in 5 minutes!

How to create an eSignature for the ir330 2016 form

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Ir330 Form and why is it important?

The Ir330 Form is a crucial document used in New Zealand for tax declarations related to an employee's income tax. It provides essential information that helps employers deduct the correct amount of tax from an employee's earnings. Understanding how to fill out the Ir330 Form accurately can prevent tax issues and ensure compliance with local tax laws.

-

How does airSlate SignNow simplify the Ir330 Form process?

airSlate SignNow streamlines the process of managing the Ir330 Form by allowing users to create, send, and eSign the document electronically. This not only saves time but also reduces errors associated with manual handling. With airSlate SignNow, users can ensure timely submissions and maintain a digital record of all signed documents.

-

What are the costs associated with using airSlate SignNow for the Ir330 Form?

airSlate SignNow offers a range of pricing plans that cater to different business needs, starting from affordable options for small businesses to comprehensive plans for larger enterprises. These plans include features specifically designed for managing documents like the Ir330 Form. Evaluating the pricing structure can help determine the best option for effortless eSigning of the Ir330 Form.

-

Can I customize the Ir330 Form using airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Ir330 Form to suit their specific requirements. You can add your company logo, adjust fields, and include custom messages. This level of customization enhances professionalism and ensures that your Ir330 Form meets your business needs.

-

What integrations does airSlate SignNow offer for managing the Ir330 Form?

airSlate SignNow seamlessly integrates with various third-party applications, such as CRM systems and accounting software, to enhance document management capabilities. These integrations allow you to automate workflows and ensure that the Ir330 Form is processed efficiently within your existing systems. This connectivity streamlines your document handling and reduces manual effort.

-

How does airSlate SignNow enhance the security of the Ir330 Form?

Security is a top priority for airSlate SignNow, particularly when handling sensitive documents like the Ir330 Form. The platform utilizes advanced encryption protocols and secure cloud storage to protect your documents. Additionally, audit trails and user authentication features help ensure that only authorized individuals can access and sign the Ir330 Form.

-

What benefits does airSlate SignNow offer for electronic signature on the Ir330 Form?

Using airSlate SignNow for electronic signatures on the Ir330 Form provides a range of benefits, including improved turnaround times and enhanced convenience. Users can eSign documents from anywhere, reducing the need for physical meetings. Moreover, the digital signature is legally binding and compliant, adding an extra layer of assurance for your documentation processes.

Get more for Ir330 Form

- Lvn refresher course online form

- Indiana forms 103 short 104

- Imnovid pomalidomide prescription authorisation form paf

- Nhti registrar form

- Equipment demonstration and test agreement form

- Tempus unlimited application form

- Independent caregiver caregiver contract template form

- Independent consultants contract template form

Find out other Ir330 Form

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease