Tax Alaska 2019

What is the Tax Alaska

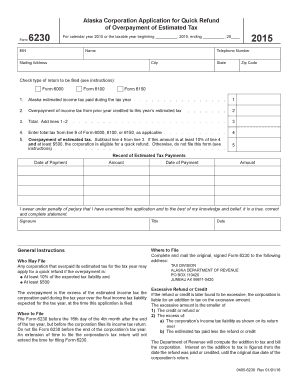

The Tax Alaska form is a specific document used by residents and businesses in Alaska to report income and calculate tax liabilities. This form is essential for ensuring compliance with state tax laws and regulations. It captures various financial details, including income sources, deductions, and credits applicable to Alaskan taxpayers. Understanding its purpose helps individuals and entities fulfill their tax obligations accurately and timely.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Next, carefully fill out the form, ensuring all income and deductions are reported correctly. Once completed, review the form for accuracy before submitting it to the appropriate state tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form securely.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including income statements and expense receipts.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include wages, self-employment income, and any other earnings.

- List applicable deductions and credits, which can reduce your overall tax liability.

- Double-check all calculations and information for accuracy.

- Sign and date the form before submission.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws that outline the requirements for filing. It is crucial to ensure that the form is filled out truthfully and submitted on time to avoid penalties. The form serves as a legal declaration of income and tax liability, and any inaccuracies could lead to legal repercussions. Compliance with all state regulations is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. Staying informed about these dates is crucial to avoid late fees and ensure timely processing of your tax return.

Required Documents

To complete the Tax Alaska form, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any deductions, such as mortgage interest statements or medical expense receipts

- Records of any other income sources

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the state tax authority's website, which often allows for quicker processing.

- Mailing the completed form to the designated tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, which may provide assistance with any questions or issues.

Choosing the right submission method can enhance the efficiency of your filing experience.

Quick guide on how to complete tax alaska 6967201

Complete Tax Alaska effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Tax Alaska on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Tax Alaska without any hassle

- Locate Tax Alaska and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Disregard missing or lost files, time-consuming form searches, or mistakes that require producing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Alter and eSign Tax Alaska and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967201

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967201

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is Tax Alaska and how does airSlate SignNow relate to it?

Tax Alaska refers to the tax regulations and requirements specific to the state of Alaska. airSlate SignNow can simplify the process of managing tax-related documents by providing a secure platform for eSigning and sharing necessary forms, making it easier for businesses to comply with Tax Alaska regulations.

-

How does airSlate SignNow help with Tax Alaska filing?

With airSlate SignNow, you can streamline the preparation and signing of your Tax Alaska documents electronically. This digital solution allows you to gather necessary signatures quickly, ensuring that all your paperwork is completed accurately and on time, which can signNowly reduce the stress of tax filing.

-

What features does airSlate SignNow offer for managing Tax Alaska documents?

airSlate SignNow offers features such as templates, reminders, and integrations with popular cloud storage services, all designed to simplify the management of your Tax Alaska documentation. These tools help ensure that all forms are properly filled out and signed, minimizing the risk of errors.

-

Is airSlate SignNow cost-effective for managing Tax Alaska requirements?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing their Tax Alaska needs. With various pricing plans available, users can choose an option that best fits their budget, while still benefiting from a comprehensive eSigning solution that saves time and resources.

-

Can airSlate SignNow integrate with other software for Tax Alaska management?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms such as CRMs and accounting tools, making it an ideal solution for managing your Tax Alaska documents. These integrations help streamline workflows and ensure that all necessary information is readily accessible.

-

What benefits does eSigning through airSlate SignNow provide for Tax Alaska documents?

eSigning through airSlate SignNow offers several benefits for Tax Alaska documents, including enhanced security, reduced processing time, and the ability to sign from anywhere. This flexibility allows businesses to avoid delays in their tax filing processes, which can be crucial for compliance.

-

How secure is airSlate SignNow for handling Tax Alaska documents?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Tax Alaska documents. Users can confidently sign and share sensitive tax information without the fear of data bsignNowes or unauthorized access.

Get more for Tax Alaska

- Philhealth konsulta registration form

- Tenant lease verification form nj211 org

- Brake inspection checklist napa brakes form

- Download cbse class 5 evs worksheets 21 session in pdfkseeb solutions for class 5 evs chapter 6 airevskendriya vidyalaya form

- Paper checker instant plagiarism checker tool citation form

- Tnb tutup akaun fill online printable fillable blank form

- Form it 203 s group return for nonresident shareholders of new york s corporations tax year

- Business termination email contract template form

Find out other Tax Alaska

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT