Tax Alaska 2013

What is the Tax Alaska

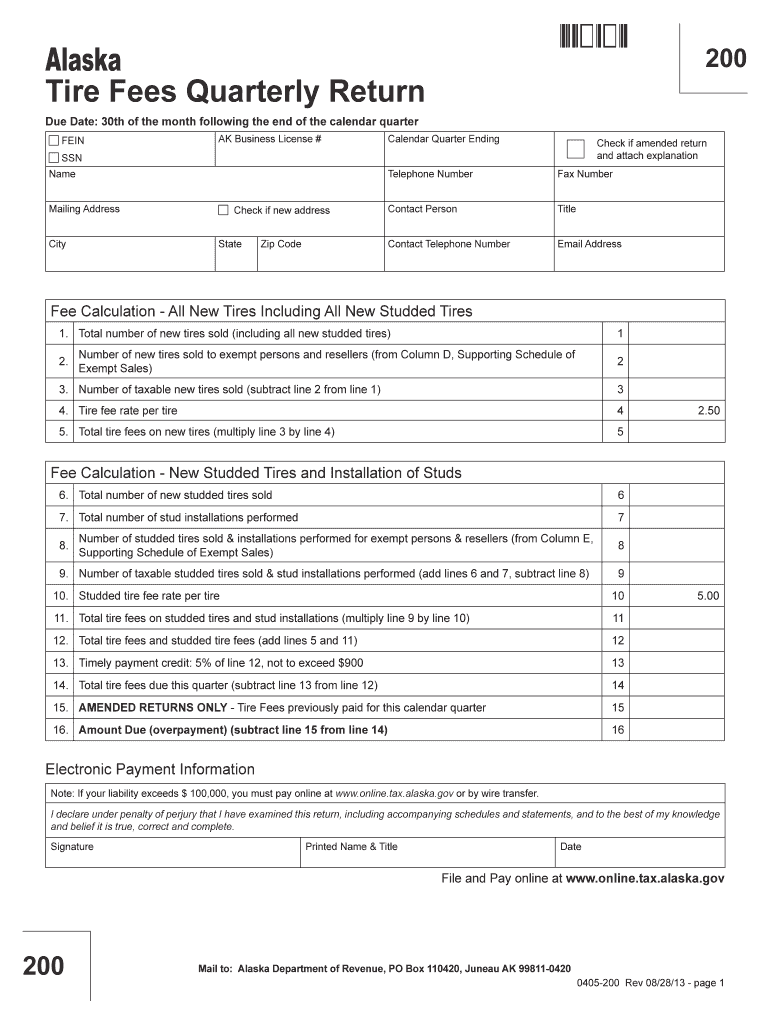

The Tax Alaska form is a specific document required for tax purposes in the state of Alaska. It is used by individuals and businesses to report income, claim deductions, and calculate taxes owed to the state. Understanding the purpose and requirements of this form is essential for compliance with state tax laws. The form ensures that taxpayers accurately report their financial activities and fulfill their obligations under Alaska's tax regulations.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense receipts, and any relevant tax records. Next, fill out the form carefully, ensuring that all personal information and financial details are correct. It is crucial to double-check calculations to avoid errors that could lead to penalties. Once completed, review the form for completeness before submitting it through the appropriate channels.

Legal use of the Tax Alaska

The Tax Alaska form is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Alaska Department of Revenue. This includes using the most current version of the form and providing accurate information. Electronic submission of the form is permissible, provided that it meets the legal requirements for eSignatures and data security, ensuring that the document is recognized as a legitimate tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial for taxpayers to meet to avoid penalties. Typically, the deadline for submitting the form is aligned with the federal tax filing date, which is usually April fifteenth. However, it is important to check for any specific state extensions or changes to deadlines that may occur. Marking these dates on a calendar can help ensure timely submission and compliance with tax obligations.

Required Documents

To complete the Tax Alaska form, several documents are required. These typically include W-2 forms for employees, 1099 forms for independent contractors, and any documentation related to deductions or credits being claimed. Additionally, taxpayers should have records of any other income sources, such as rental income or investment earnings. Having these documents organized and accessible will facilitate a smoother completion process.

Examples of using the Tax Alaska

Examples of using the Tax Alaska form include various scenarios where individuals or businesses report their income. For instance, a self-employed individual would use the form to report earnings from their business activities, while a corporation would file it to declare its profits and pay any applicable state taxes. Each example highlights the importance of accurately reporting financial activities to ensure compliance with state tax laws.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms, guidelines, and resources to assist individuals and businesses in fulfilling their tax obligations. Taxpayers can access the form directly from the department's website or through authorized distribution channels.

Quick guide on how to complete tax alaska 6967316

Complete Tax Alaska effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Handle Tax Alaska on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and electronically sign Tax Alaska without difficulty

- Obtain Tax Alaska and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Tax Alaska and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967316

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967316

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska?

airSlate SignNow is a user-friendly eSignature solution designed to streamline document management. For businesses dealing with Tax Alaska, it simplifies the process of signing and sending tax-related documents, ensuring compliance and efficiency. This helps reduce delays and enhances productivity.

-

How does airSlate SignNow ensure security for Tax Alaska documents?

Security is a top priority for airSlate SignNow, especially for sensitive Tax Alaska documents. The platform uses advanced encryption technology and complies with industry regulations, ensuring that your information remains secure. This gives users peace of mind when handling confidential tax documents.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit various business needs, making it an ideal choice for managing Tax Alaska documents. Plans are tailored for individuals, small businesses, and enterprises, providing cost-effective solutions that scale with your requirements. Users can choose the best option that fits their budget and usage.

-

Can airSlate SignNow integrate with other software for Tax Alaska processing?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing your ability to manage Tax Alaska efficiently. This includes popular CRM systems, cloud storage services, and more. These integrations allow for a smooth flow of information and reduce the need for manual data entry.

-

What features does airSlate SignNow offer for handling Tax Alaska documents?

airSlate SignNow provides a range of features tailored for efficient document handling, including templates, custom workflows, and real-time tracking of document status. These tools specifically cater to managing Tax Alaska documents, allowing users to streamline their processes and improve compliance. This ensures that all tax-related tasks are completed promptly and accurately.

-

Is airSlate SignNow suitable for small businesses dealing with Tax Alaska?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an excellent choice for small businesses managing Tax Alaska. The platform simplifies the signing process, allowing small businesses to efficiently handle their tax documents without overwhelming costs or complex setups.

-

How can airSlate SignNow improve my workflow for Tax Alaska?

By using airSlate SignNow, you can signNowly enhance your workflow for Tax Alaska with features like bulk sending, reminders, and automated follow-ups. These functionalities streamline the document signing process, reducing turnaround time and improving overall efficiency. This allows businesses to focus on core operations rather than get bogged down in paperwork.

Get more for Tax Alaska

- U s senator tammy baldwin service academy nomination form

- City of gainesville public utilities department residential application gainesville form

- Pdf students rights responsibilities and resources handbook form

- Verification of opioid education pa gov form

- Lowermac com31our residentsour residentslower macungie township pa form

- Hudson county surrogates court information sheet

- Enrollment application lenape technical school form

- Instructions for completing the authorization agreement form

Find out other Tax Alaska

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form