Tax Alaska 2020

What is the Tax Alaska

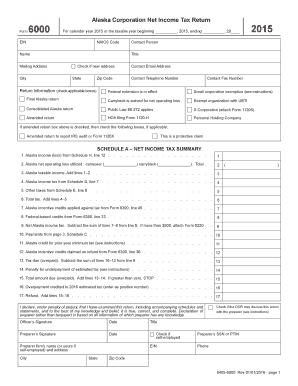

The Tax Alaska refers to specific tax forms and regulations applicable to residents and businesses operating in Alaska. These forms are essential for reporting income, claiming deductions, and ensuring compliance with state tax laws. Understanding the Tax Alaska helps individuals and entities navigate their tax responsibilities effectively.

How to use the Tax Alaska

Using the Tax Alaska involves filling out the appropriate forms accurately and submitting them to the relevant tax authorities. Taxpayers should gather necessary financial documents, such as W-2s and 1099s, to ensure all income is reported. Utilizing digital tools can streamline the process, making it easier to fill out and eSign documents securely.

Steps to complete the Tax Alaska

Completing the Tax Alaska typically involves several key steps:

- Gather all necessary financial documentation, including income statements and deduction records.

- Select the correct tax form based on your filing status and income type.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, as per the guidelines provided by the state tax authority.

Legal use of the Tax Alaska

The legal use of the Tax Alaska requires adherence to state tax laws and regulations. This includes using the correct forms, providing accurate information, and meeting submission deadlines. Failure to comply with these legal requirements can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska may vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 each year. It is crucial to stay informed about any changes in deadlines or extensions that may apply.

Required Documents

To complete the Tax Alaska, taxpayers typically need the following documents:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Tax Alaska through various methods. The most common methods include:

- Online submission via the state tax authority's website, which is often the quickest option.

- Mailing the completed forms to the designated tax office address.

- In-person submission at local tax offices, which may provide assistance if needed.

Quick guide on how to complete tax alaska 6967193

Complete Tax Alaska effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to draft, modify, and electronically sign your documents quickly without any hold-ups. Handle Tax Alaska on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Tax Alaska with ease

- Obtain Tax Alaska and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Tax Alaska and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967193

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967193

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Tax Alaska and how does it relate to airSlate SignNow?

Tax Alaska refers to the specific tax regulations and compliance requirements for businesses operating in Alaska. airSlate SignNow facilitates the eSigning and sending of essential tax documents, ensuring that your business stays compliant with Tax Alaska requirements efficiently.

-

How does airSlate SignNow help with managing Tax Alaska documents?

airSlate SignNow simplifies the management of Tax Alaska documents by providing a secure platform for eSigning and document sharing. You can easily send tax forms, receive signatures, and store records, ensuring all your Tax Alaska documentation is organized and easily accessible.

-

Is airSlate SignNow cost-effective for managing Tax Alaska documentation?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage their Tax Alaska paperwork. With various pricing plans, you can choose an option that fits your budget while gaining access to powerful features that streamline document management.

-

What features does airSlate SignNow offer for Tax Alaska compliance?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking of document status. These tools are essential for ensuring compliance with Tax Alaska processes and save your team valuable time.

-

Can I integrate airSlate SignNow with other applications for Tax Alaska processes?

Absolutely! airSlate SignNow allows seamless integrations with various applications such as CRM systems and accounting software, making it easy to manage your Tax Alaska documentation alongside other business operations. This ensures a unified approach to your tax compliance efforts.

-

How secure is airSlate SignNow for handling Tax Alaska documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Tax Alaska documents. The platform uses advanced encryption methods and secure cloud storage to protect your information from unauthorized access.

-

Can I access airSlate SignNow from multiple devices when managing Tax Alaska?

Yes, airSlate SignNow is designed for multi-device access, allowing you to manage your Tax Alaska documents from desktops, tablets, or smartphones. This flexibility ensures that you can handle important tax tasks on the go.

Get more for Tax Alaska

- For paperwork reduction act notice see page 3 fdic form

- Delaware form 200 c delaware composite personal income tax

- Illinois enhanced skills driving school insurance certificate form

- Calpers long term care form fill out and sign printable

- Delaware form 200 es declaration of estimated tax for

- Form 13 55 application for 100 disabled veteran household member exemption card

- On your behalf via pawtal our form

- Selene formfill out printable pdf forms online

Find out other Tax Alaska

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe