St 125 Tax Form 2018

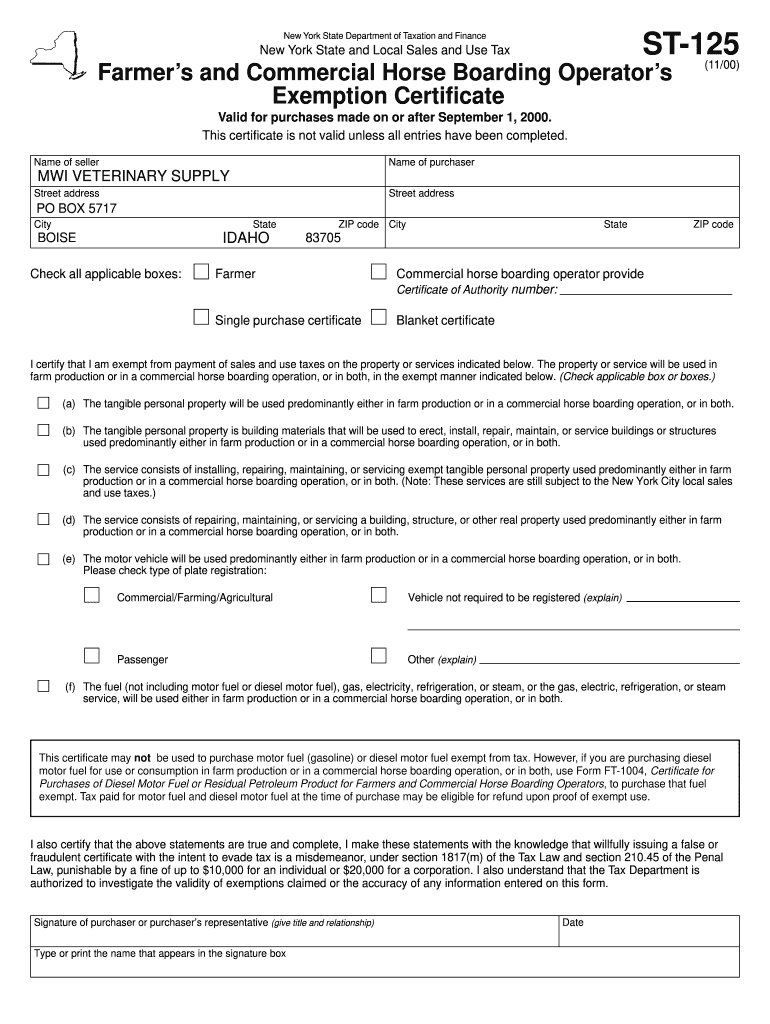

What is the St 125 Tax Form

The St 125 Tax Form is a document used primarily for reporting certain tax-related information in the United States. It is often utilized by businesses and individuals to provide necessary details about income, deductions, and other financial activities. This form plays a crucial role in ensuring compliance with federal and state tax regulations.

How to use the St 125 Tax Form

Using the St 125 Tax Form involves several key steps. First, gather all relevant financial documents, such as income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. The form can be submitted electronically or by mail, depending on the specific requirements of your state or the IRS.

Steps to complete the St 125 Tax Form

Completing the St 125 Tax Form involves a systematic approach:

- Collect necessary financial documents, including W-2s, 1099s, and receipts.

- Enter personal information, such as your name, address, and Social Security number.

- Report your income accurately, including all sources of revenue.

- Detail any deductions you are eligible for, providing supporting documentation as needed.

- Review the entire form for accuracy and completeness.

- Submit the form according to the guidelines provided by the IRS or your state tax authority.

Legal use of the St 125 Tax Form

The St 125 Tax Form must be used in accordance with IRS regulations and state laws. It is essential to ensure that all information reported is truthful and accurate to avoid penalties. Misuse of the form or providing false information can lead to legal consequences, including fines or audits. Therefore, understanding the legal implications of the form is crucial for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the St 125 Tax Form can vary based on your specific circumstances, such as whether you are self-employed or filing jointly. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, extensions may be available in certain situations. It is important to stay informed about any changes in deadlines to ensure timely submission.

Required Documents

To complete the St 125 Tax Form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the process and help ensure accuracy in reporting.

Form Submission Methods

The St 125 Tax Form can be submitted through various methods. Options typically include:

- Online submission via the IRS e-file system or state tax websites

- Mailing a paper copy to the appropriate tax authority

- In-person submission at designated tax offices

Choosing the right submission method can depend on personal preference and the specific requirements of your state.

Quick guide on how to complete st 125 tax form 2000

Effortlessly Prepare St 125 Tax Form on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage St 125 Tax Form on any gadget with the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

How to Modify and Electronically Sign St 125 Tax Form with Ease

- Find St 125 Tax Form and select Get Form to commence.

- Utilize the tools we provide to complete your document.

- Mark signNow sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or missing documents, frustrating form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you select. Modify and electronically sign St 125 Tax Form and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 125 tax form 2000

Create this form in 5 minutes!

How to create an eSignature for the st 125 tax form 2000

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the St 125 Tax Form and why is it important?

The St 125 Tax Form is a critical document used for tax purposes and outlines tax exemptions for certain buyers. Understanding this form is essential for businesses to avoid tax penalties and ensure compliance with local regulations. Properly filling out the St 125 Tax Form can lead to signNow savings and streamlined auditing processes.

-

How can airSlate SignNow simplify the process of filling out the St 125 Tax Form?

airSlate SignNow offers an intuitive eSignature platform that simplifies the completion and submission of the St 125 Tax Form. With our user-friendly interface, you can fill out, sign, and send the form electronically in just a few clicks. This saves time and reduces errors associated with manual form submission.

-

Is there a cost associated with using airSlate SignNow for the St 125 Tax Form?

Yes, there is a subscription fee for using airSlate SignNow, which offers several pricing plans based on your business size and needs. However, the investment is cost-effective, especially considering the time saved and efficiency gained in handling the St 125 Tax Form and other documents. Our plans cater to businesses of all sizes, ensuring you find a suitable option.

-

What features does airSlate SignNow provide for handling the St 125 Tax Form?

AirSlate SignNow includes features like customizable templates, automated workflows, and secure storage to effectively manage the St 125 Tax Form. These tools help businesses automate their document processes, ensure compliance, and retain a complete history of document actions. The platform's reliability means your forms are always secure and accessible.

-

Can airSlate SignNow integrate with other systems for managing the St 125 Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and accounting systems, enhancing the management of the St 125 Tax Form. This allows for streamlined workflows and minimizes data entry errors by automating the flow of information between platforms. Many businesses benefit from these integrations for better efficiency.

-

What are the benefits of eSigning the St 125 Tax Form with airSlate SignNow?

eSigning the St 125 Tax Form with airSlate SignNow provides signNow benefits such as faster turnaround times, increased security, and enhanced tracking capabilities. Document signing is made simple, allowing multiple parties to sign from anywhere, at any time. This not only saves time but also improves the overall compliance process for your business.

-

Is it easy to use airSlate SignNow for someone unfamiliar with the St 125 Tax Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, even for those unfamiliar with the St 125 Tax Form. Our platform provides step-by-step guidance, ensuring you can easily navigate document management and signing processes. Plus, our customer support is available to help you with any questions along the way.

Get more for St 125 Tax Form

- Dental assistant application 249601486 form

- Military pay order no military pay orderthis info form

- 009 74 fy 24 navsea standard item fy 24 item no form

- Transition center checklist u s army garrisons form

- Node js i am getting error in console ampquotyou need to enable form

- Dd form 2625

- Af form 624

- Regulations for officer development rod fo form

Find out other St 125 Tax Form

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now