Income Tax Tables Ok 2020

What is the Income Tax Tables Ok

The Income Tax Tables Ok refer to a standardized set of tables used by taxpayers in the United States to determine their federal income tax liability. These tables provide a clear breakdown of income ranges and corresponding tax rates, allowing individuals to calculate the amount they owe based on their taxable income. The tables are updated annually to reflect changes in tax laws and inflation, ensuring that taxpayers have access to the most accurate information for their filings.

How to use the Income Tax Tables Ok

To use the Income Tax Tables Ok effectively, taxpayers should first identify their filing status, such as single, married filing jointly, or head of household. Once the filing status is determined, individuals can locate their taxable income within the relevant table. The corresponding tax amount will indicate how much federal income tax is owed. It is essential to ensure that all income sources are included when calculating taxable income to avoid underreporting.

Steps to complete the Income Tax Tables Ok

Completing the Income Tax Tables Ok involves several straightforward steps:

- Gather all necessary financial documents, including W-2s and 1099s, to determine total income.

- Calculate your taxable income by subtracting any deductions or exemptions from your total income.

- Refer to the appropriate Income Tax Table based on your filing status.

- Locate your taxable income in the table to find the corresponding tax amount.

- Record the calculated tax amount on your tax return form.

Legal use of the Income Tax Tables Ok

The legal use of the Income Tax Tables Ok is governed by the Internal Revenue Service (IRS) guidelines. Taxpayers must adhere to the instructions provided by the IRS to ensure compliance with federal tax laws. Using these tables correctly is crucial for accurately reporting income and calculating tax liabilities. Failure to use the tables appropriately can result in penalties or audits by the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Income Tax Tables Ok, including updates on tax rates and filing requirements. Taxpayers should consult the IRS website or publications for the most current information. These guidelines outline how to properly use the tables, including any changes in tax brackets or deductions that may affect an individual's tax situation. Staying informed about IRS updates is essential for accurate tax preparation.

Filing Deadlines / Important Dates

Filing deadlines for income tax returns are critical for compliance. Typically, the deadline for individual taxpayers to file their federal tax returns is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available and the deadlines for estimated tax payments to avoid penalties. Keeping track of these important dates ensures timely filing and payment of taxes.

Penalties for Non-Compliance

Non-compliance with tax regulations, including improper use of the Income Tax Tables Ok, can lead to significant penalties. These may include fines for late filing, underpayment of taxes, or failure to pay taxes owed. The IRS may also impose interest on unpaid taxes, which can accumulate over time. Understanding the potential penalties associated with non-compliance emphasizes the importance of accurate tax reporting and timely submissions.

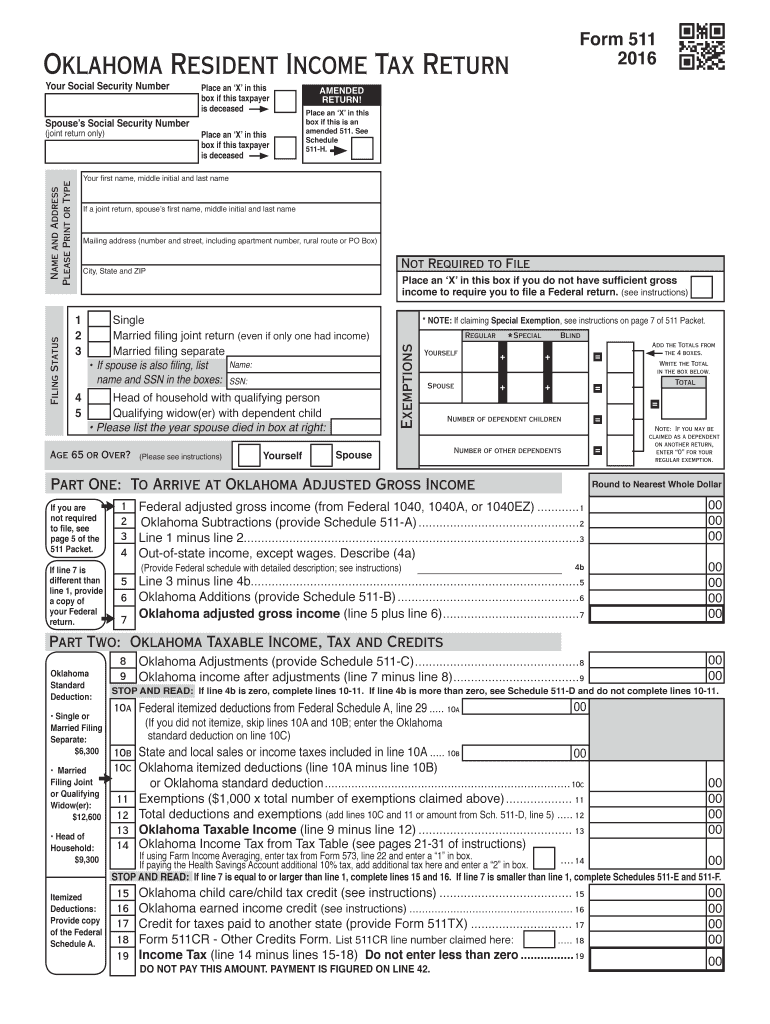

Quick guide on how to complete 2016 income tax tables ok

Effortlessly Prepare Income Tax Tables Ok on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Income Tax Tables Ok on any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

A Simple Method to Edit and Electronically Sign Income Tax Tables Ok

- Obtain Income Tax Tables Ok and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Income Tax Tables Ok to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 income tax tables ok

Create this form in 5 minutes!

How to create an eSignature for the 2016 income tax tables ok

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What are the Income Tax Tables Ok used for?

The Income Tax Tables Ok provide essential information for individuals and businesses to calculate their income tax obligations. By using these tables, you can determine your tax liability based on your earnings. Understanding how to apply these tables is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with the Income Tax Tables Ok?

airSlate SignNow offers businesses a streamlined way to manage documents related to Income Tax Tables Ok. You can easily eSign forms and agreements needed to report income, ensuring that your tax filing is processed without delays. Our solution not only simplifies document management but also enhances compliance.

-

Is airSlate SignNow cost-effective for small businesses dealing with Income Tax Tables Ok?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage documents related to Income Tax Tables Ok. With flexible pricing plans, you can find an option that fits your budget while still benefiting from secure eSigning capabilities. This can help save time and resources during tax season.

-

What features does airSlate SignNow offer for managing Income Tax Tables Ok documentation?

airSlate SignNow includes features such as templates, automated workflows, and secure cloud storage, all essential for managing Income Tax Tables Ok documents. These tools enable you to create, send, and eSign tax-related documents effortlessly. Furthermore, our platform provides real-time tracking of document statuses.

-

Can I integrate airSlate SignNow with other tax software while using Income Tax Tables Ok?

Absolutely, airSlate SignNow can be easily integrated with popular tax software, enhancing the way you manage Income Tax Tables Ok documents. This integration allows for seamless data transfer and efficient document handling, enabling you to maintain organized records for tax purposes. You can focus more on your tax strategy rather than administrative tasks.

-

How does airSlate SignNow ensure the security of documents related to Income Tax Tables Ok?

airSlate SignNow prioritizes the security of your documents with industry-standard encryption and secure data storage solutions. When dealing with sensitive information like Income Tax Tables Ok, our platform ensures that all files are protected against unauthorized access. You can eSign and manage your tax-related documents with peace of mind.

-

What benefits does using airSlate SignNow offer for handling Income Tax Tables Ok?

Using airSlate SignNow to manage Income Tax Tables Ok offers numerous benefits, including expedited document turnaround times and improved accuracy in tax filing. Our user-friendly interface simplifies the eSigning process, enabling you to focus on growing your business instead of getting bogged down by paperwork. Additionally, the availability of 24/7 support ensures assistance whenever you need it.

Get more for Income Tax Tables Ok

- Receptacle testing form 1 in gov

- Heart failure daily weight log form

- Itc telecom and dean e anderson scholarship clarkschooldistrict form

- Consultation contract template form

- Software as a service contract template form

- Software consultant contract template form

- Software developer contract template form

- Software contract template form

Find out other Income Tax Tables Ok

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed