Am I Required to File a State Tax Return in Oklahoma, Even If I Ok 2020

What is the Am I Required To File A State Tax Return In Oklahoma, Even If I Ok

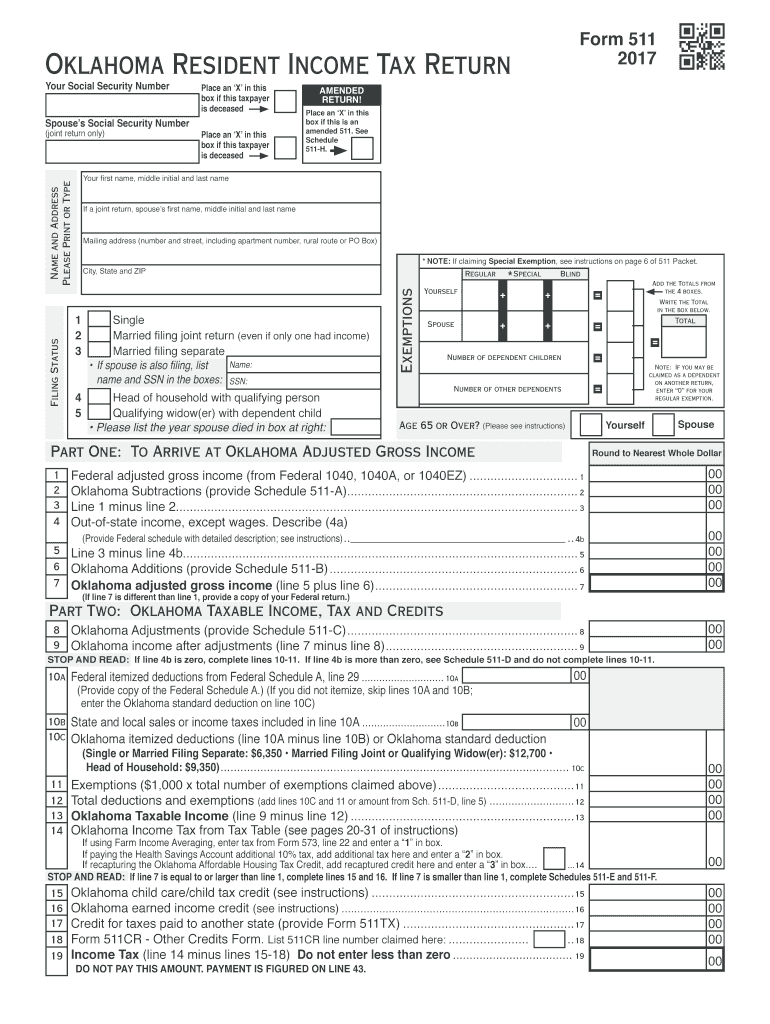

The form "Am I Required To File A State Tax Return In Oklahoma, Even If I Ok" serves as a guide for individuals determining their obligation to file a state tax return in Oklahoma. This form is particularly useful for residents who may have questions about their filing requirements based on their income level, residency status, or specific circumstances such as being a student or retired. Understanding whether you need to file can help avoid potential penalties and ensure compliance with state tax laws.

Steps to complete the Am I Required To File A State Tax Return In Oklahoma, Even If I Ok

Completing the form involves a few straightforward steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, review the criteria outlined in the form to assess your filing requirements based on your income and residency status. After determining your obligation, fill out the form accurately, ensuring that all information is complete and truthful. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on your preference and the options available.

Legal use of the Am I Required To File A State Tax Return In Oklahoma, Even If I Ok

This form is legally recognized as a tool for assessing tax filing obligations in Oklahoma. It is crucial to ensure that the information provided is accurate, as misrepresentation can lead to penalties. The form must comply with state regulations regarding tax filings, and using a reliable platform for submission can enhance the legal standing of your documentation. Utilizing electronic signatures through a trusted service can also ensure that your submission meets legal requirements.

State-specific rules for the Am I Required To File A State Tax Return In Oklahoma, Even If I Ok

Oklahoma has specific rules regarding who is required to file a state tax return. Generally, residents must file if their income exceeds a certain threshold, which can vary based on filing status, such as single, married, or head of household. Additionally, specific exemptions may apply for students or individuals with limited income. It is essential to review these state-specific guidelines to understand your obligations fully.

Required Documents

To complete the "Am I Required To File A State Tax Return In Oklahoma, Even If I Ok" form, you will need several documents. Key documents include your W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation related to deductions or credits you may qualify for can be beneficial. Having these documents ready will streamline the process and help ensure accuracy in your filing.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial to avoid penalties. In Oklahoma, the deadline for filing state tax returns typically aligns with the federal deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Oklahoma Tax Commission's official website for any updates or changes to these important dates.

Penalties for Non-Compliance

Failing to file a required state tax return in Oklahoma can result in significant penalties. These may include fines based on the amount of tax owed and interest on unpaid taxes. Additionally, non-compliance may lead to further legal action by the state. Understanding these potential consequences underscores the importance of accurately assessing your filing requirements and adhering to deadlines.

Quick guide on how to complete am i required to file a state tax return in oklahoma even if i ok

Prepare Am I Required To File A State Tax Return In Oklahoma, Even If I Ok seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides all the tools you need to create, alter, and electronically sign your documents quickly and efficiently. Manage Am I Required To File A State Tax Return In Oklahoma, Even If I Ok on any device with airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign Am I Required To File A State Tax Return In Oklahoma, Even If I Ok effortlessly

- Obtain Am I Required To File A State Tax Return In Oklahoma, Even If I Ok and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you would like to submit your form, whether by email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Am I Required To File A State Tax Return In Oklahoma, Even If I Ok and guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct am i required to file a state tax return in oklahoma even if i ok

Create this form in 5 minutes!

How to create an eSignature for the am i required to file a state tax return in oklahoma even if i ok

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

Am I Required To File A State Tax Return In Oklahoma, Even If I Have No Income?

Yes, you may still be required to file a state tax return in Oklahoma, even if you have no income. It's important to understand the specific thresholds set by the state to ensure compliance. Filing a return can also help you maintain your eligibility for certain tax credits or refunds.

-

What Are the Consequences of Not Filing a State Tax Return in Oklahoma?

Failing to file a state tax return in Oklahoma can lead to penalties and interest on any unpaid taxes. Additionally, it may complicate future tax filings and could potentially affect your credit score. To avoid issues, it's vital to determine if you must file based on your situation.

-

How Can airSlate SignNow Help Me File My State Tax Return?

airSlate SignNow streamlines the document signing process, making it easier to collect signatures for your tax forms. With our user-friendly interface, you can securely send and eSign necessary documents related to your state tax return. This ensures that you meet deadlines comfortably and efficiently.

-

What Features Does airSlate SignNow Offer for Tax Document Management?

airSlate SignNow offers features like document templates, in-person signing, and secure cloud storage, which simplify tax document management. These features allow you to efficiently gather signatures and organize your paperwork. An easy-to-use platform ensures you stay focused on your tax filing requirements.

-

Is airSlate SignNow a Cost-Effective Solution for Filing State Tax Returns?

Yes, airSlate SignNow provides a cost-effective solution for managing tax-related documents. With competitive pricing plans, businesses of all sizes can benefit from our eSigning capabilities while saving time and reducing overhead costs. Efficient document handling leads to smoother tax filing processes.

-

Can I Integrate airSlate SignNow with Other Tax Software for Oklahoma State Filing?

Absolutely! airSlate SignNow can integrate with various tax preparation software, enhancing your filing experience. This integration capability allows you to streamline your workflow, ensuring that all your tax documents are easily accessible and compliant with Oklahoma tax laws.

-

What Benefits Can I Expect from Using airSlate SignNow for My Tax Needs?

Using airSlate SignNow provides numerous benefits, including increased efficiency in collecting signatures and reduced paper usage. Our platform helps you maintain compliance with Oklahoma tax regulations while ensuring secure document handling. You'll experience less stress during tax season, knowing everything is organized.

Get more for Am I Required To File A State Tax Return In Oklahoma, Even If I Ok

- Oswego hospital lifeline application oswego health oswegohealth form

- Directory of mental hygiene related service partners form

- Patient pain drawing form

- Mychart authorization proxy access form ohiohealth

- Sports photography contract template form

- Sports management contract template form

- Sports player contract template form

- Sports sponsorship contract template form

Find out other Am I Required To File A State Tax Return In Oklahoma, Even If I Ok

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word