511nr Form 2020

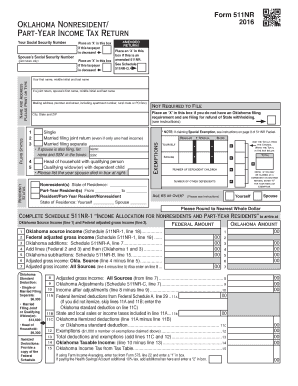

What is the 511nr Form

The 511nr Form is a tax document used by non-resident individuals in the United States to report their income and calculate their tax liability. This form is particularly important for those who earn income in the U.S. but do not qualify as residents for tax purposes. By completing the 511nr Form, individuals can ensure compliance with federal tax regulations while accurately reporting their earnings. It is essential for non-residents to understand their obligations to avoid penalties and ensure proper tax treatment.

Steps to complete the 511nr Form

Completing the 511nr Form involves several key steps to ensure accuracy and compliance with tax laws. Begin by gathering all necessary documentation, including income statements, tax identification numbers, and any relevant deductions. Next, fill out the form by entering your personal information, such as name, address, and social security number. Report your income from U.S. sources and calculate your tax liability based on the applicable rates. Finally, review the form for accuracy before submitting it to the appropriate tax authority.

Legal use of the 511nr Form

The legal use of the 511nr Form is governed by U.S. tax laws that require non-resident individuals to report their income accurately. This form serves as a declaration of income earned within the United States and is essential for fulfilling tax obligations. To ensure the form is legally valid, it must be completed accurately and submitted by the designated deadlines. Compliance with these regulations helps individuals avoid legal issues and potential penalties associated with underreporting or failing to file.

How to obtain the 511nr Form

The 511nr Form can be obtained through the official state tax authority's website or office. Many states provide downloadable versions of the form, which can be filled out electronically or printed for manual completion. Additionally, tax preparation services may offer assistance in obtaining and completing the form. It is important to ensure that you are using the most current version of the 511nr Form to comply with the latest tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 511nr Form vary by state, but it is generally due on the same date as the federal tax return for individuals. Non-residents should be aware of these deadlines to avoid late fees or penalties. It is advisable to check with the specific state tax authority for any state-specific deadlines or extensions that may apply. Keeping track of these important dates ensures timely submission and compliance with tax obligations.

Required Documents

When completing the 511nr Form, several documents are typically required to support your income claims and deductions. These may include W-2 forms, 1099 forms, and any other documentation that verifies income earned in the U.S. Additionally, you may need receipts or records for any deductions you plan to claim. Having these documents organized and readily available will facilitate a smoother completion process and help ensure accurate reporting.

Quick guide on how to complete 511nr 2016 form

Complete 511nr Form easily on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage 511nr Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign 511nr Form effortlessly

- Find 511nr Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to retain your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or misplaced files, cumbersome form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign 511nr Form and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 511nr 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 511nr 2016 form

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 511nr Form and who needs it?

The 511nr Form is a tax form used for non-residents in New York to report income earned within the state. This form is essential for anyone who does business or has income in New York but doesn’t live there, ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the 511nr Form?

airSlate SignNow simplifies the process of completing and eSigning the 511nr Form. With our platform, you can quickly fill out, send, and securely sign your documents, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 511nr Form?

Yes, airSlate SignNow offers various pricing plans to cater to your needs, including options specifically for businesses needing to manage forms like the 511nr Form. Our plans are designed to be cost-effective, giving you access to powerful document management tools.

-

What features does airSlate SignNow offer for managing the 511nr Form?

Our platform includes features like customizable templates, audit trails, and automatic reminders, ensuring your 511nr Form is completed accurately and efficiently. You can easily manage your documents from anywhere, streamlining your workflow.

-

Can I integrate airSlate SignNow with other software for the 511nr Form?

Yes, airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and more, allowing you to seamlessly manage your 511nr Form alongside your other business applications. This enhances your productivity and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for the 511nr Form?

Using airSlate SignNow for your 511nr Form offers benefits like faster turnaround times, enhanced security, and improved collaboration. Our platform ensures that your documents are handled with care and in compliance with legal requirements.

-

Is eSigning the 511nr Form legally binding?

Yes, eSigning the 511nr Form through airSlate SignNow is legally binding under federal and state laws, including the ESIGN Act. This means you can confidently send your signed documents without concern for their validity.

Get more for 511nr Form

- Volunteer information form smyth county public schools scsb

- Highline christian church youth group permission and release highlinechristian form

- Order of the eastern star petition for membership form

- Rodeo sponsorship form

- Sports bet contract template form

- Sports coach contract template form

- Sports contract template 787755879 form

- Sports event contract template form

Find out other 511nr Form

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template